James B. Francis, CFA

Chief Research Officer, CRB Monitor

The CRB Monitor Securities Research team covers all aspects of the publicly-traded cannabis ecosystem, including the regulatory environment, operational expansion/M&A activity, updates on officers/directors, and investment performance. With our monthly and quarterly newsletters, we keep our readership informed while we highlight the multi-faceted importance of CRB Monitor’s data to all types of users at financial institutions worldwide.

For additional detail on our updates to the CRB Monitor database, please refer to our monthly newsletters: CRB Monitor October 2023 newsletter, CRB Monitor November 2023 newsletter, and the CRB Monitor December 2023 newsletter.

Cannabis-Related Equity Performance

Cannabis Equity Index Returns - Tragedy Averted? Guess again.

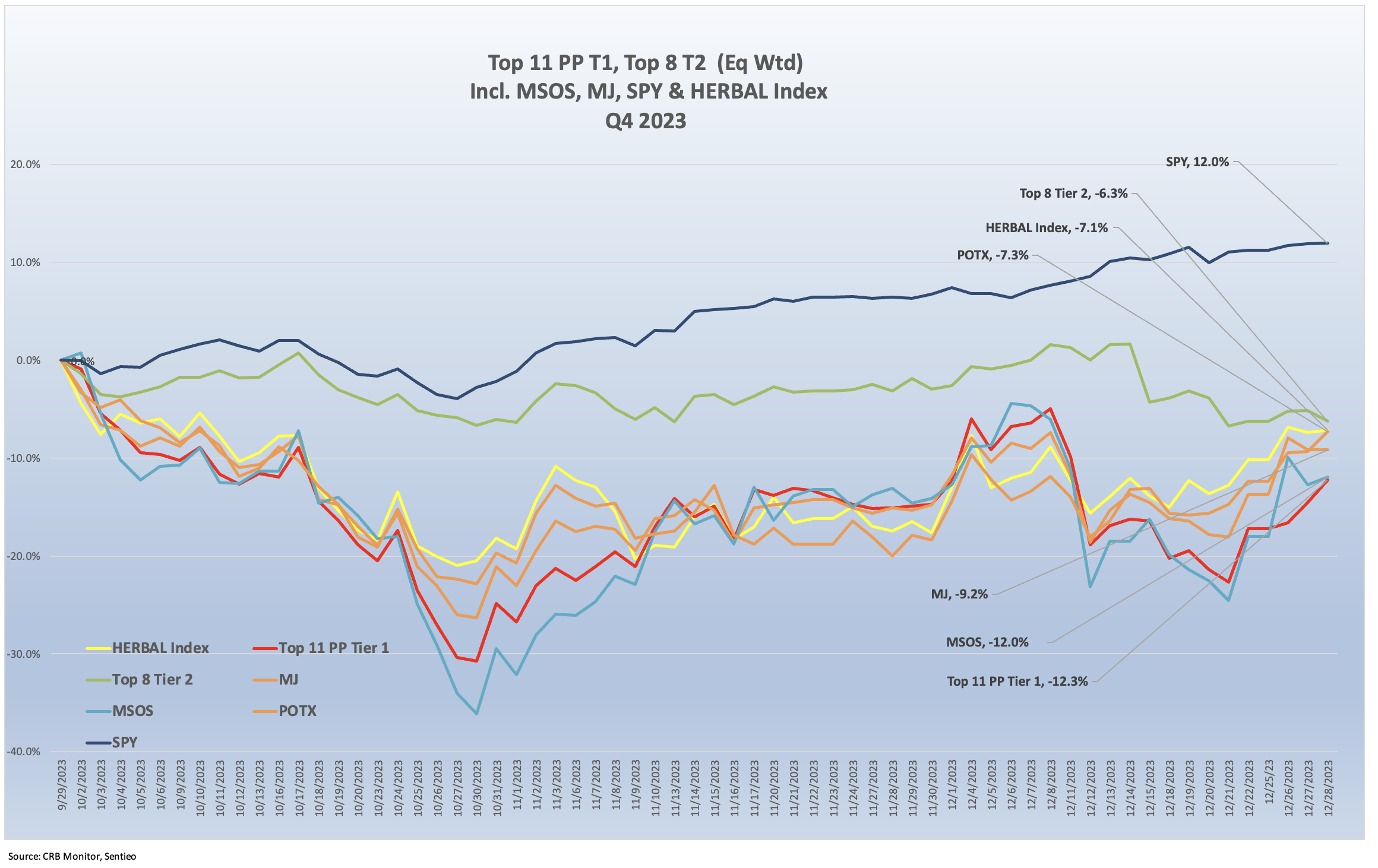

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL) is a mix of Pure Play Tier 1 and Tier 2 cannabis related equities, weighted by both investability and strength of theme (SOT). A well-conceived representation of the universe of legal, pure play Tier 1 and Tier 2 cannabis equities, HERBAL had a negative 7.1% return for the 3rd quarter of 2023. HERBAL’s Q4 performance finished slightly ahead of its closest non-US plant-touching competitor, the Global X Cannabis ETF (Nasdaq: POTX) (-7.3%). A full description of HERBAL’s strengths and benefits can be found here: Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

The ETFMG Alternative Harvest ETF (NYSE Arca: MJ) (-9.2%), given its significant exposure to US marijuana, got a lift in Q3 from the positive HHS news but was also caught up in the significant MSO recoil in October. MJ’s benchmark’s latest material change in index methodology has the fund holding more than 50% of the fund in US MSO’s (via swap contracts), as well as a ~20% holding in non-pure play CRBs, which tend to have low correlation with Pure Play cannabis. These features can be a deal-breaker for institutions that have restrictive policies regarding holdings which violate the US Controlled Substances Act.

Also in the US plant-touching category is the MSO-heavy Advisorshares Pure Us Cannabis ETF (NYSE: MSOS), which posted a return of -12.0% in Q4. MSOS’s performance has a tendency to deviate (but not always) from both HERBAL and POTX largely due to its holdings of CRBs with US Marijuana touch-points (largely MSOs), which dominate in that fund. [HERBAL and POTX cannot hold any securities with direct US touch points.]

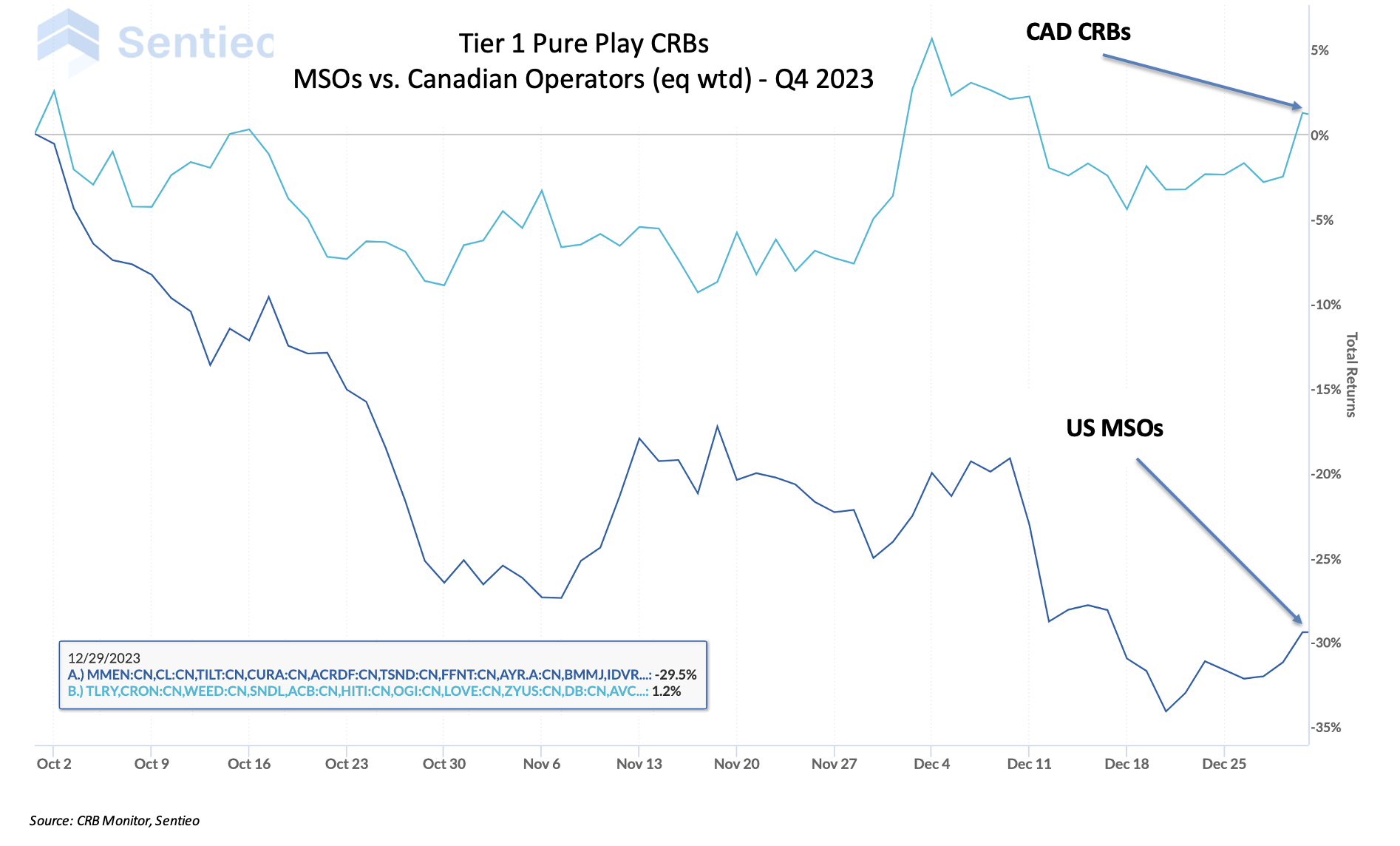

The CRB Monitor equally-weighted basket of the largest Pure Play Tier 1 CRBs got hit by the October volatility and didn’t fully recover, returning -12.3% in Q4 2023. This basket is essentially a hybrid of CRBs without US touchpoints and US multistate operators (MSO’s). Their equal weighting will cause their returns to deviate from the other indexes, which all employ some variation of market cap weighting. We take a look at the comparative performance of CAD’s vs. MSO’s on a chart below.

The CRB Monitor equally-weighted basket of the largest Tier 2 CRBs outperformed the Tier 1 basket significantly, losing 4.3% in Q4. As we have indicated in the past, Pure Play Tier 1 and Tier 2 CRBs tend to display high (~0.8) correlation in the long term (see our section on correlation in the CRB Monitor September 2022 newsletter which is due for an update in 2024), but their respective performance has a tendency to diverge in the short term, given the occasional lag from the impact (positive or negative) of market forces. In general, Tier 2 CRBs share in the overall success or failure of the Tier 1 universe and ultimately are expected to converge with the Tier 1 equity basket.

October 2023 saw precious little support for cannabis equities (see the chart above), and many CRBs returned to their pre-HHS rescheduling announcement lows. We are all old enough to remember the euphoria of August month end that continued its honeymoon into mid-September, only to level off and enter into a veritable free fall by mid-October. This market for publicly-traded cannabis has the emotional stability of a kid in middle school and we are somewhat dumfounded at the complete lack of confidence that investors seem to have in it just a few weeks after some game-changing news.

What happened? While there might be several factors at play, one reasonable explanation would be that the recent chaos in the US House of Representatives did not help. With (possible) THC rescheduling most likely a year away, the only other piece of good news for cannabis investors to cling to is the latest iteration of the SAFE Banking Act, now called the SAFER Banking Act. While SAFER has bipartisan support, the margins are razor thin and it is unclear if there are enough congresspeople from both chambers to get it through particularly in these contentious times. [For an excellent summary of SAFER Banking, please check out CRB Monitor’s article “With Bipartisan Support, Cannabis Banking Bill Heads to Senate Floor” on crbmonitor.com.]

Now enter Mike Johnson (R-Louisiana), the new Speaker of the House, who is about as conservative as we have seen in a leadership role in that body. While we do not know how Mr. Johnson will lean going forward (we can only imagine), we do know that his voting record as it relates to cannabis shows an extreme lack of support for reforms of any kind. And so it was no surprise when Johnson’s ascent to his new job was accompanied by a wholesale cannabis selloff in October.

November 2023 had cannabis investors saying, “Well, at least it didn’t tank again”. In fact, they were treated to returns that reflected either 1) optimism about federal cannabis reforms or 2) we were witnessing one of those bounces of the “expired cat” nature (we might choose the latter). Recent months notwithstanding, it is safe to say that the long-term trajectory of cannabis equities has been down, down, down, as every rally has been followed by an equally-dramatic correction. However, as we have said periodically, hope springs eternal.

And what about earnings season? While returns for plant-touching CRB equities were positive in November, in the eyes of analysts, the recent earnings season was a mixed bag, with a variety of results across the larger CRBs. With that said, results trended toward very small surprises, including Green Thumb Industries (slight positive), Verano Holdings (slight negative), Curaleaf (slight negative), Trulieve (slight positive) and Cresco Labs (positive). In other words, the positive stock performance could have been in part due to the presence of few major negative surprises...and the dead cat bounce.

December 2023 provided, if nothing else, a ray of hope for those investors that have stuck around for the duration of this performance history that boasts all the excitement of a Henrik Ibsen play. And if we are to look at December as a beginning, as opposed to an end, then people who care about these companies still have a few things to look forward to as this election year starts in earnest.

Truth be told, it is hard to believe that cannabis reform will be a priority in Washington this year, as politicians can scarcely agree on which allies to provide aid to or, even more important, how to keep the US government open. As we get closer to the middle of 2024, the economy will be front and center as a key driver for independent voters. And it will be uncertain whether politicians will want to place cannabis legalization higher on the agenda than the border or Israel/Ukraine aid.

So where does that leave cannabis? Surely, the hot-button issues like SAFE banking and DEA rescheduling will be on Americans’ minds as they pull the lever next fall, but hold on. SAFE banking has been tried and has failed to become a law a half dozen times. And the rescheduling of THC from a Schedule I narcotic to a Schedule III medication is far from a done deal. To that end, we suspect that the idea of rescheduling is more complicated than people have considered, given the persistent push-back from a considerable number of politicians at the federal level. And on that note, we will have to stay tuned this year, and hope that cannabis reform is not pushed aside to make room for bigger fish in 2024.

US equities had a robust Q4, with the SPDR S&P 500 ETF Trust (NYSE Arca: SPY) returning a record-setting 12.0% return. Consistently favorable economic data suggest that inflation is under control while the threat of a recession is in the rear view mirror. And historically-low unemployment data combined with some administration-supported election year optimism should make for a few more record-setting days in the coming months.

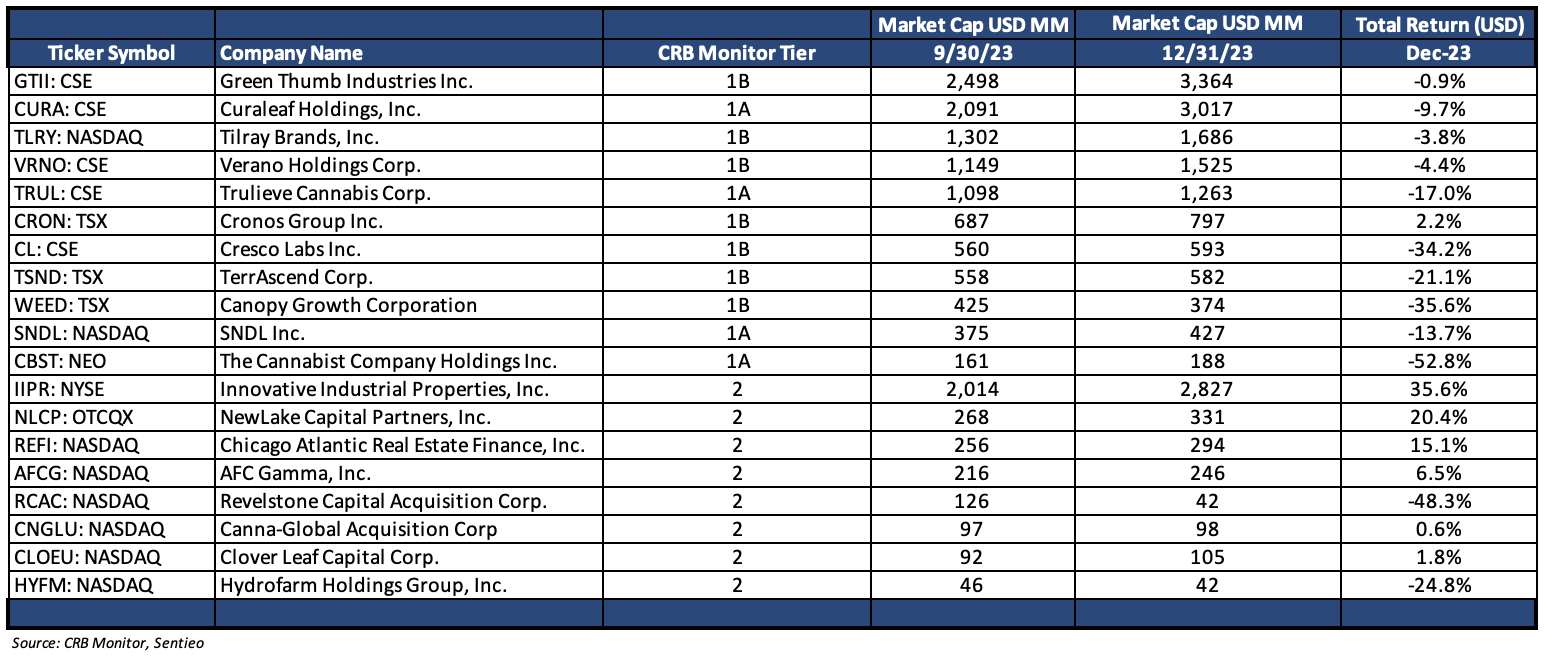

Largest Tier 1 Pure Play & Tier 2 CRBs by Mkt Cap – Q4 2023 Returns

CRB Monitor Tier 1

For those who believe that all companies in this highly-concentrated industry move in lockstep, the above table shows just how wide the spread was between the best and worst performing CRBs (from our basket) in Q4 2023. From this data one would think that these companies are in different industries, but truth be told, each CRB is fighting its own battle and while they all feel impact from the daily news out of Washington, each has been built to withstand that impact differently and hence the diverse performance numbers. In addition, the fact that they are all forced by statute to operate within their chosen regions will result in different operational challenges for each CRB.

Looking at the MSO basket vs. the CAD basket, what cannabis investors got in Q4 was a sharp reversal from the prior period. The MSO group suffered a hangover following the revelations from the HHS announcement, with negative returns from Green Thumb Industries Inc. (CSE: GTII) (-0.9%), Cresco Labs Inc. (CSE: CL) (-34.2%) and its now ex-fiancé The Cannabist Company Holdings, Inc. (CBOE CAD: CBST) (-52.8%), Curaleaf Holdings, Inc. (CSE: CURA) (-9.7%), and Trulieve Cannabis Corp. (CSE: TRUL) (-17.0%). The equally-weighted MSO basket returned -29.5% for the quarter.

The Canadian (non US plant-touching) operators outperformed the MSOs (although not spectacular in absolute terms), with Tier 1 Canadian CRBs Tilray Brands, Inc. (Nasdaq: TLRY) (-3.8%), Canopy Growth Corporation (TSX: WEED) (-35.6%), Sundial Growers, now called SNDL, Inc., (Nasdaq: SNDL) (-13.7%) and Cronos Group Inc. (TSX: CRON) (+2.2%) underwhelming investors but still outperforming the MSO basket significantly in the aggregate.

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies gained -6.3% for the third quarter of 2023, which outperformed the equally-weighted Tier 1 basket by 6.0%. Pure Play Tier 1 and Tier 2 CRBs tend to display high correlation in the long term (see our analysis of CRB correlations in the CRB Monitor September 2022 newsletter), but their respective performance has a tendency to diverge in the short term, as it did in Q4, given the occasional lag from the impact (positive or negative) of market forces.

Given its relative size and direct relationship to plant-touching cannabis operations, we tend to follow Innovative Industrial Properties, Inc. (NYSE: IIPR) (+35.6%) closely. IIPR is an internally-managed real estate investment trust (CLS sector - REIT) focused on “the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators for their regulated state-licensed cannabis facilities.” IIPR is of particular interest to financial institutions largely due to the fact that its stock historically defied the volatile price patterns of the cannabis space and up to November 2021 consistently outperformed its peers as well as the CRBs that leased its properties. It is also, by far, the largest Tier 2 CRB by market capitalization. But a third and even more important consideration related to IIPR is the source of its revenue, which is essentially 100% derived from US plant-touching activities. As a Tier 2 CRB, IIPR is granted an NYSE listing, but a number of financial institutions continue to find the company in violation of internal cannabis policies. These institutions will restrict custody and transacting in IIPR.

IIPR’s stock price did not get the lift in Q3 from the August HHS announcement that its Tier 1 MSO customers did; the company’s stock rallied in Q4 with a return of more than 35%.

Hydrofarm Holdings Group, Inc. (Nasdaq: HYFM) (CLS Sector Agricultural & Farm Machinery) (-24.8%). Hydrofarm is an independent distributor and manufacturer of hydroponics equipment and supplies, primarily to cannabis cultivators. Similar to IIPR (in fact, much worse), HYFM was in a free fall in 2022, posting a return of -95% for that year and its price has not improved materially since, even with this Q4 spike. As we have written in past newsletters, HYFM typically trades by appointment, and its illiquid nature (and accompanying wide bid/ask spread) can and will cause significant performance swings on any given day, as it has done essentially weekly for the last two years. With its price now oscillating around $1, HYFM is now in the midst of consolidation and restructuring, and we believe we have seen the exodus of most investors, who took their optimism with them.

Chart of the Quarter: MSO Business Trends and Performance

Multistate operators (MSOs) are CRBs that spread their revenue-generating, licensed cannabis operations (cultivation, manufacturing, distribution, etc.) across two or more states in the US. This model for doing business can be complicated and painful, but CRBs’ hands are tied while cannabis is still federally illegal and operating on a state-by-state basis (and internal to each state) is the only way to grow revenues within the US.

As such, MSOs face obstacles that can limit their ability to operate profitably in every state where they are licensed. Some notable hurdles include:

- Licensing requirements that seek to establish or restore social equity to CRB ownership

- Varying levels of state taxation

- Barriers to using mainstream banking services, such as payments, lending, and deposit accounts

- Varying degrees of participation by the illicit market which undermine the legal market

And so given these (and other) headwinds, several large, publicly-traded multistate operators have closed their operations in one or more states. And we thought it might be interesting to take a look at this trend in the cannabis industry as it could be a reflection of companies’ need to survive while the politicians figure things out.

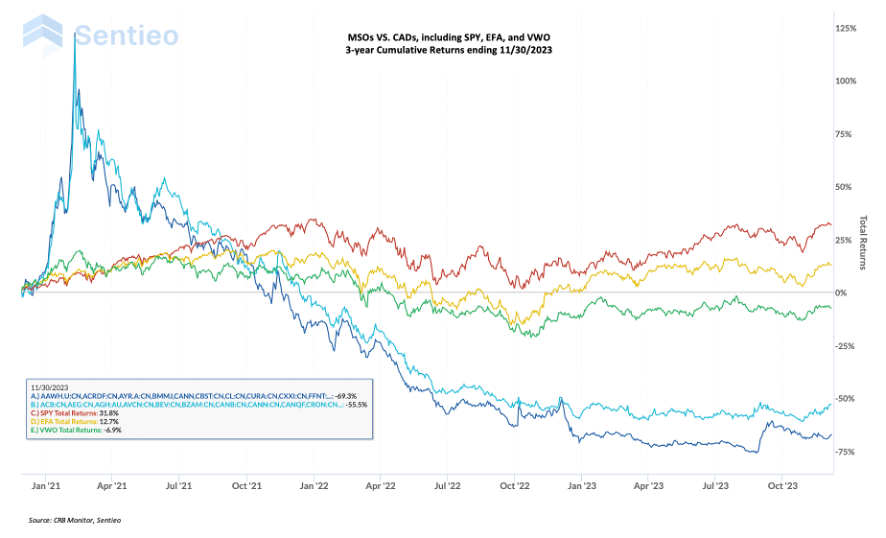

But first, and to provide some context, let’s take a look at market performance. It is an understatement to say that cannabis-related equities have been in a free fall for the better part of the last 3 years (see chart below).

The two lines at the bottom of this chart represent the performance of a basket of the largest 30 MSOs (dark blue) and the largest 30 Canadian-based CRBs (light blue). The remaining three series represent the performance of SPY (S&P 500 ETF), EFA (MSCI International ETF), and VWO (Vanguard Emerging Markets ETF). Not only have the cannabis baskets spent most of the last 3 years in a downward spiral, they are largely uncorrelated with the other broad market equity indexes.

Interestingly, the two equally-weighted CRB baskets were largely in lock-step until Q4 2022, when they started to diverge, with MSOs underperforming the CADs. Why the bottom fell for MSOs out can be traced to the progress, or lack thereof, of cannabis reforms by our leaders in the US Congress. It could be inferred from the data that the MSO group has taken a significant hit (following a major bubble) as our congressional leaders have dragged their feet; and whether or not the damage is reversable is anyone’s guess.

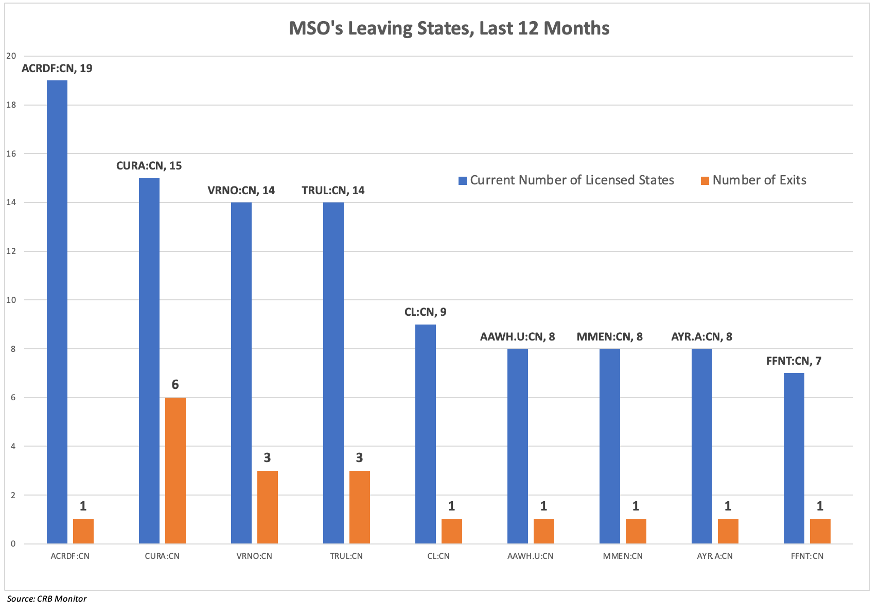

On that note, over the last year the MSO group has been forced into playing defense, and that is where CRB monitor’s research kicks in. What has interested us is the trend of the largest MSOs packing up and moving operations out of a number of states over the last 12 months and the data is eye-opening.

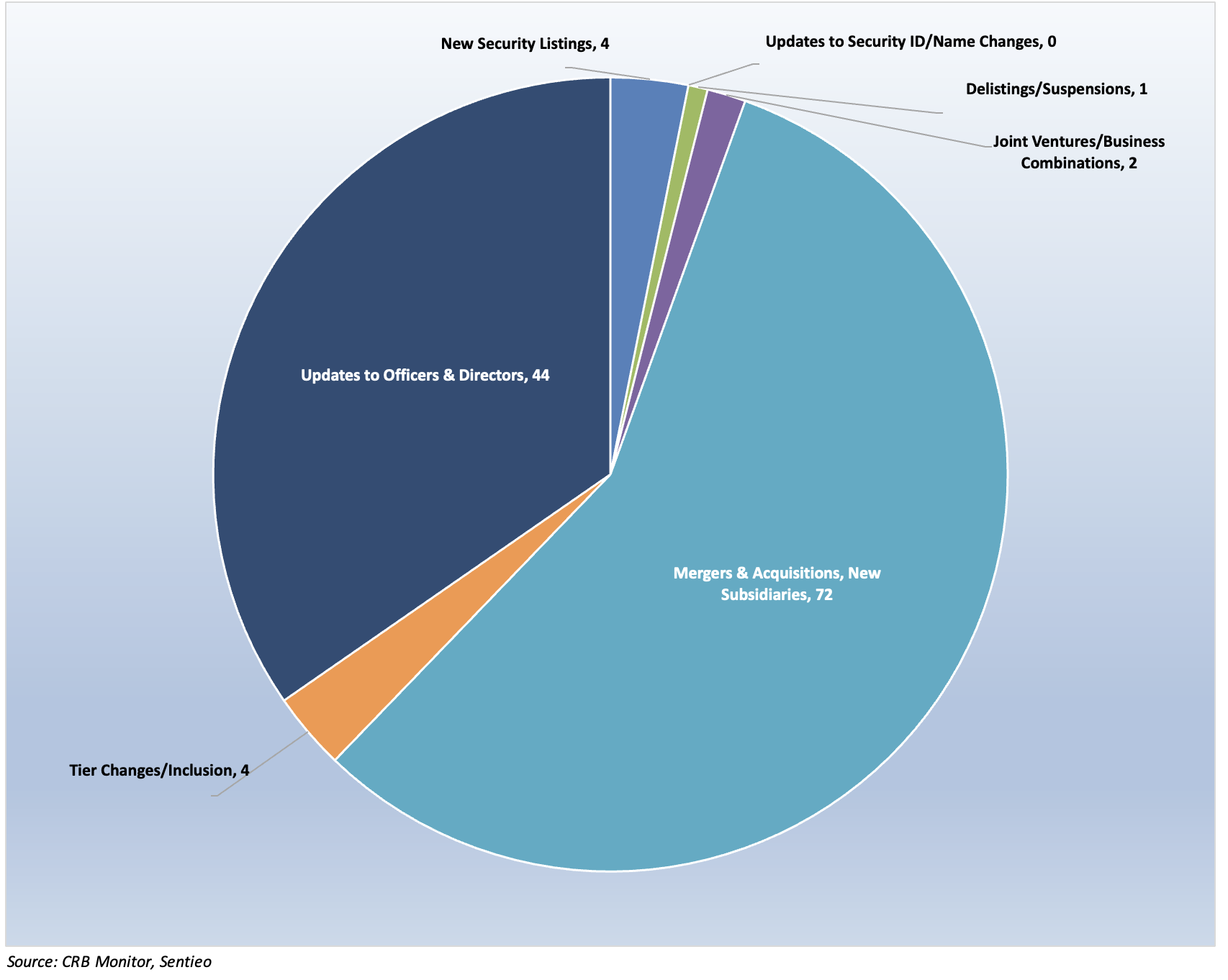

The above chart represents an interesting trend for nine of the largest CRBs which recently “picked up their ball and went home,” selling licensed operations in states where they had moved in not long ago. [We have provided more detail at the company level in the table below]. The process of moving into a state is complex and expensive, as an operator must secure one or more licenses from a state authority while navigating the twists and turns of doing business in local municipalities that have mixed levels of acceptance among residents.

*Trulieve closed three dispensary locations in California; however, one still remains active.

One significant example of this phenomenon is Tier 1A Curaleaf Holdings, Inc. (CSE: CURA), an MSO that has unwound operations in 6 states in the last 12 months. During 2023, Curaleaf Holdings, Inc. concluded its operations in multiple states including California, Colorado, Oregon, Vermont and Michigan. The company exited production and cultivation facilities in California, Colorado and Oregon and sold two dispensary locations and a cultivation/manufacturing facility in Vermont. Additionally, Curaleaf announced it has exited operations in Michigan and Kentucky. Per Curaleaf's Chairman: "Throughout 2023, the company’s been focused on improving efficiency metrics and dialing in operations to maximize its existing base."

Another Tier 1 MSO that has made its exit from multiple states is perennial acquirer and Tier 1B CRB Verano Holdings Corp. (CSE: VRNO). In Q1 2022, Verano Holdings Corp. entered into an agreement to acquire publicly-traded Tier 1B CRB "Goodness Growth Holdings Inc." Through this acquisition, Verano would have entered the states of New York, Minnesota and New Mexico. Goodness Growth, a Tier 1A private CRB, operates multiple cultivation facilities and dispensary locations across these three states. Goodness Growth also operates a manufacturing and processing facility in New York. However, in Q4 2022 Verano terminated this agreement. Per Verano's CEO: "We believe the decision to terminate this arrangement agreement was in the best interest of Verano and our shareholders."

A third Tier 1 MSO that has backed out of several states is Trulieve Cannabis Corp. (CSE: TRUL). In late Q2 2023, Trulieve announced its plans to wind down cannabis operations in Massachusetts and Nevada. At that time, Trulieve also announced the consolidation (not a total exit) of its California operations with the closure of select retail assets in Palm Springs and Venice.* Trulieve exited the Nevada wholesale market and expects to cease Massachusetts operations by the end of 2023. Per Trulieve's CEO: "These difficult but necessary measures are part of ongoing efforts to bolster business resilience and our commitment to cash preservation as we continue to focus on our business strategy of going deep in our core markets and jettisoning non-contributive assets."

The last 12 months have been a challenge for both the cannabis industry and its investors. With DEA re-scheduling, SAFER Banking, and legalization all in a holding pattern of sorts, CRBs have had to make difficult choices as they look to the future. And although this analysis might look a bit tame, we identified nine cannabis-related businesses that are effectively moving operations out of 14 different states. We will continue to report on this as the story unfolds.

CRB Monitor Securities Database

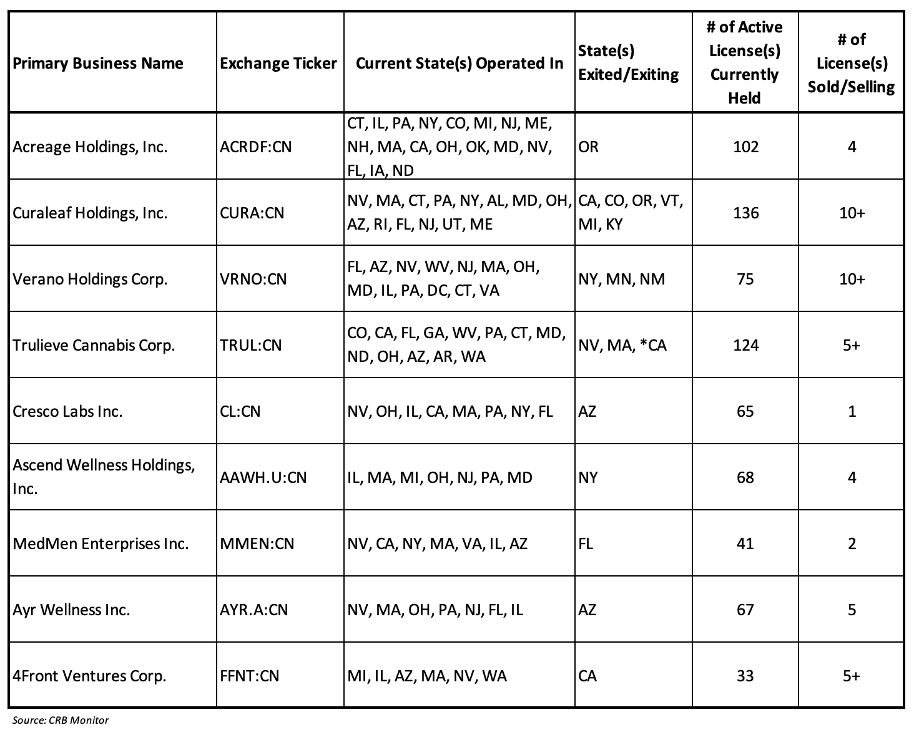

As of September 30, 2023, the breakdown of publicly-traded, cannabis-linked securities was as follows:

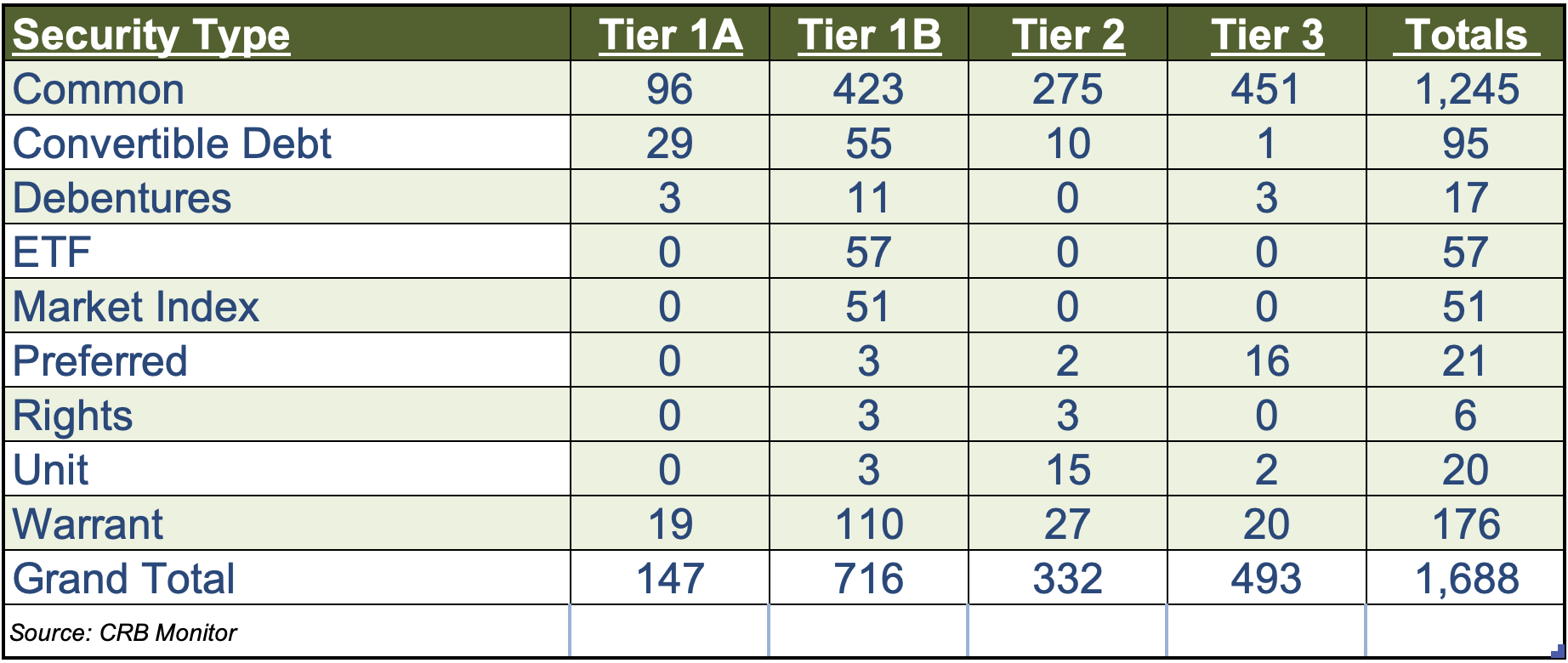

The level and frequency of M&A activity at the listed company level has not improved, but with that said Q4 2023 featured a wealth of daily updates to the CRB Monitor database. Of the thousands of announcements and filings reviewed during the full year, our daily research resulted in a total of 287 updates to CRB Monitor company profiles (127 updates to issuers’ records, 160 news articles added). The complete list of securities and detailed profiles for more than 1,300 cannabis-linked issuers can be found in the CRB Monitor database. And for more detail on our updates to the CRB Monitor database, please refer to our latest monthly newsletters: CRB Monitor October 2023 newsletter, CRB Monitor November 2023 newsletter, and the CRB Monitor December 2023 newsletter.

CRB Monitor Securities Database Updates - Q4 2023

Cannabis Business Transaction News - Q4 2023

We closely tracked the cannabis news cycle throughout the third quarter of 2023, making a total of 287 updates to the CRB Monitor database from daily securities alerts (127 profile updates, 160 articles added). Cannabis equity prices were generally mixed in Q4 2023, and we were there, standing by to capture all the critical information necessary to maintain the world’s best cannabis-linked securities database - CRB Monitor. The following is a sampling of some of the highlights from the Q4 cannabis news cycle.

In October, Canadian Tier 1B CRB Tilray Brands, Inc. (NASDAQ: TLRY) issued a press release announcing that they “closed their all-cash previously-announced acquisition of eight beer and beverage brands from Anheuser-Busch (NYSE: BUD), including the breweries and brewpubs associated with them.” The acquired businesses include Shock Top, Breckenridge Brewery, Blue Point Brewing Company, 10 Barrel Brewing Company, Redhook Brewery, Widmer Brothers Brewing, Square Mile Cider Company, and HiBall Energy.

The press release goes on to say: “Irwin D. Simon, Chairman and Chief Executive Officer, Tilray Brands, said, “...With this EBITDA accretive transaction, Tilray has acquired a stellar lineup of eight craft beer and beverage brands that both solidify our leadership in the craft beer industry and strengthen our business in the expansive beverage sector in which we see tremendous opportunity to reinvigorate innovation across many categories including non-alcoholic beverages, energy, and nutritional drinks.”” Tilray, which now holds, through its subsidiaries, 353 active cannabis licenses. The acquisition of these 8 beverage brands gives TLRY a runway to secure a foothold in the cannabis-infused beverage industry, which is set to take off in the years to come.

Also in October, Tier 1B MSO Cresco Labs Inc. (CSE: CL) announced in a press release the opening of its latest legal medical cannabis dispensary, Sunnyside Altoona in the Commonwealth of Pennsylvania. In the words of the announcement, “Sunnyside Altoona is dedicated to helping qualified patients unlock all the benefits that medical marijuana can provide. The new store will offer a wide assortment of accessories and medical marijuana products like flower, vape cartridges, disposable vape pens, concentrates, troches, topicals, tinctures and more from the Company’s branded portfolio that includes Cresco, Supply, FloraCal Farms, Wonder Wellness Co. and Remedi.” With the closing of this new purchase, Cresco’s active and pending-approval license count expands to 67 across 9 states.

Finally in October, Ever-expanding Tier 1B MSO Verano Holdings Corp. (CSE: VRNO) announced the opening of Zen Leaf Newington, the company’s second social equity joint venture location in Connecticut and fourth cannabis dispensary statewide. In the words of the October press release, “In opening Zen Leaf Newington, Verano received support for the company’s approved social equity plan by several local organizations, including Connecticut Foodshare, Connecticut Pardon Team, New Life II Ministries of New Britain, North Oak Neighborhood Revitalization Zone of New Britain, St. Mark’s Episcopal Church of New Britain and the New Britain Food & Resource Center.” With all of that said, Connecticut adult-use dispensary openings have been a slow crawl since legalization two years ago. Verano’s ongoing expansion has resulted in their ownership of 80 active cannabis licenses across 12 states plus the District of Columbia.

In November, Green Thumb Industries Inc. (CSE: GTII) and Incredibles, a cannabis edibles brand from Green Thumb, announced a partnership with Magnolia Bakery, New York City’s world-famous bakeshop. In the words of the November 1st announcement, “Starting today, fans of both brands can shop the collaboration featuring two limited-edition THC-infused chocolate bars at RISE Dispensaries in Illinois, Nevada and Massachusetts, with wider availability across the three states to follow.” Green thumb’s operation footprint stretches across 17 states plus British Columbia and through their subsidiaries GTII controls 94 licenses which are either active or pending approval.

Also in November, Tier 1B Canadian CRB RIV Capital Inc. (TSX: RIV) announced in a press release that the expansion of its cannabis cultivation and production facility located in Chestertown, New York is now operational. Introducing the new 75,000 square foot facility, CEO Mike Totzke said, "The completion of our Chestertown facility is a major milestone in our New York growth story as we near our anticipated and long-awaited entry into the adult-use cannabis market...This expansion, paired with our expertise and advanced knowledge of the state market, will accelerate the development of a robust wholesale program, and significantly increase product output in step with the expansion of New York's consumer base." Following this expansion, RIV Capital’s active and pre-license license total is 139 across 4 countries.

Finally in November, ever-expanding Tier 1B MSO Verano Holdings Corp. (CSE: VRNO) issued a press release announcing the opening of MÜV North Miami-Biscayne on Friday, November 17th, which is Verano’s 73rd Florida dispensary and 136th location nationwide. In the words of the press release, “MÜV North Miami-Biscayne – Verano’s second dispensary in Florida’s largest metropolitan area with more than 2.7 million residents1 – adds another complementary location to the Company’s existing MÜV Miami-Kendall dispensary situated on the city’s Southwest side.” Joel Noonan, EVP of Verano’s Southern Region, commented: “We are so excited to open MÜV North Miami on beautiful Biscayne Boulevard...Adding a second MÜV location in Florida’s largest market provides another convenient location for the Miami medical cannabis community to access our patient-centric service and wide variety of high quality products in a warm and welcoming environment.” By CRB Monitor’s count, Verano now holds, through its subsidiaries, 75 active cannabis licenses in the United States.

In December, Tier 1A MSO Curaleaf Holdings, Inc. (CSE: CURA) issued a press release announcing the opening of “its second dispensary location in Sarasota, Florida”. According to the announcement, “this is the company's 61st location in Florida...Curaleaf's second Sarasota dispensary will offer a curated menu of premium cannabis products, featuring an extensive selection of flower and pre-rolls, JAMS and Blue Kudu edibles, as well as the top-selling Select line, including Select Briq, Select Live Rosin, Select Live Rosin X Bites and the innovative vape hardware, Cliq by Select.” With this new opening, Curaleaf’s operational footprint has grown to 4 countries (19 states + DC) and 138 cannabis licenses that are either in active or pending status.

Also in December, and on a less happy note, Tier 1B household cannabis name MedMen Enterprises Inc. (CSE: MMEN) announced in a December press release that it has “entered into definitive agreements to sell its non-core business operations in Arizona and certain assets in Nevada to an affiliate of Mint Cannabis, a private multi-state cannabis operator headquartered in Arizona”. The announcement goes on to say, “The transactions consist of the sale of MedMen’s wholly-owned operating subsidiary in Arizona and its two operating dispensaries located in Clark County, Nevada. These sales are the result of MedMen’s previously announced strategic review and evaluation of divestiture opportunities of its non-core assets. The transactions are subject to customary closing conditions, including, among others, the receipt of applicable regulatory approvals.” In the words of Ellen Deutsch Harrison, MedMen’s CEO: “MedMen is pleased with the outcome of our strategic review and has made good progress in our restructuring efforts. These transactions will bolster liquidity in the short term, reduce liabilities, and enable the Company to focus on operating efficiencies and executing our long-term asset-light growth strategy in our core markets.” Following this consolidation of operations, Medmen holds 45 cannabis licenses in 7 states that are either in active or in pending status.

And finally, some December news out of Florida: Tier 1B Trulieve Cannabis Corp. (CSE: TRUL) continuing its domination of the medical cannabis landscape Sunshine State, announced in a December press release the opening of two new medical dispensaries in Crawfordville and Crestview, Florida. Grand opening celebrations were held in Crawfordville on Friday, December 29 and Crestview on Saturday, December 30. Both events begin at 9 a.m., featuring music, specials, discounts, and opportunities to register for upcoming patient education sessions. In the words of Trulieve's Chief Executive Officer Kim Rivers, "We are excited to open these dispensaries, providing high quality products and service for Florida patients in the Big Bend and Panhandle regions”. The announcement goes on to say that “Both locations will carry a wide variety of popular products including Trulieve's portfolio of in-house brands such as Alchemy, Co2lors, Cultivar Collection, Modern Flower, Momenta, Muse, Roll One, Sweet Talk and Trekkers. Customers will also have access to beloved partner brands such as Alien Labs, Binske, Black Tuna, Blue River, Connected Cannabis, DeLisioso, Khalifa Kush, Love's Oven, Miami Mango, O.pen, Seed Junky and Sunshine Cannabis, all available exclusively at Trulieve in Florida.”

Regulatory Updates

In October it was reported by our very own CRB Monitor journalists that the Oklahoma Medical Marijuana Authority (OMMA) and law enforcement are focusing attention on illegal activity at licensed cannabis businesses, resulting in arrests, fines and business shut downs.

According to the article, the step-up in enforcement began at the beginning of the year, but a lot of activity has occurred since this summer.

In June, OMMA Executive Director Adria Berry identified eight enforcement areas:

• Untagged Inventory

• Certificate of Analysis (testing) compliance

• Sales over legal limit

• Multiple licenses for one address

• Timely waste disposal

• Monitoring for unauthorized movement or diversion

• Plant destruction to prevent diversion

• Patient license reuse

The Oklahoma regulators expect to see a reduction of 30%-40% in the number of cannabis licenses, which is not great news for good actors in the industry but still a necessary move to clean things up.

Also in October, an article in MJ Biz Daily reported that Germany-based Sanity Group is teaming up with the Swiss Institute for Addiction and Health Research (ISGF) to open two legal recreational cannabis stores (the first legal dispensaries in Europe) in Switzerland as part of the country’s pilot study into dispensing marijuana. In the words of the article, “Overall, the Sanity Group-ISGF pilot project is the sixth that has been given the green light. ISGF and Sanity Group said they received final approval from the Federal Office of Public Health to conduct the cannabis pilot study. That followed approval from the Ethics Committee Northwest and Central Switzerland last year...The study will examine the regulated sale of cannabis for nonmedical purposes. It will be led by Michael Schaub, the ISGF’s scientific director.”

Finally in October , Bloomberg reported that New York State “will license five new marijuana dispensaries to open, part of an effort to keep up with growing demand and out-compete illicit sellers, according to the state’s cannabis regulator.” According to the article, “The new stores include locations in New York City’s Astoria, Harlem and the Lower East Side districts...that will bring the state’s total to 27.” As has been widely reported, New York’s legal cannabis program got off to a rocky start with many “pop-up” illegal dispensaries scattered throughout the five boroughs. The article goes on to say, “Sales from the stores have hit $83 million year-to-date, even with many closed for renovation, according to the agency.” We will take a wait-and-see approach when it comes to the illicit market, which seems to have been a challenge for regulators in New York to control.

In November, it was reported by our very own CRB Monitor journalists that the state of Ohio has become the 24th state to legalize adult-use cannabis. According CRB Monitor reporters, “Issue 2 handily passed 57% to 43%. Polls indicated that the measure would pass by such a margin, even as Republicans adopted a resolution opposing it and opponents were accused of releasing misleading ads. Supporters reportedly included U.S. Rep. Dave Joyce, co-chair of the Congressional Cannabis Caucus, and U.S. Senate Banking Committee Chairman Sherrod Brown.”

The article goes on to report: “The new law allows adults 21 and older to consume and possess up to 2.5 ounces of cannabis and cultivate up to six plants, 12 per household, for personal use. It would permit controlled and regulated commercial cultivation and sales by licensed businesses overseen by a new Division of Cannabis Control (DCC) under the Department of Commerce. It would also exempt financial institutions that provide services to licensed cannabis businesses from criminal liability.”

Also in November, our CRB Monitor team wrote an excellent report entitled Startup or Scam? Bogus Cannabis Unions Not Just a California Concern detailing the little-known existence of fraudulent unions that have infiltrated the cannabis industry. According to the article, “Shady unions and labor peace agreements (LPA) are not just a problem for California cannabis workers. The ProTech 33-related National Production Workers Union claims that it is organizing cannabis workers in states outside of California, while the upstart Cannabis Engineers, Extractors and Distributors (CEED) Union Local 420 has announced its first successful unionizing effort in the Northeast, the United Food and Commercial Workers International's (UFCW) traditional stomping grounds...The UFCW has accused CEED Local 420 of being a company union, but a spokesperson with CEED claims that the UFCW is threatened by an upstart union.”

On the topic of hunting down fake unions, the article reports, “With the need for an LPA comes the possibility that upstart organizations could swoop in, help companies fulfill the LPA obligation, and then put no further effort into actually organizing that company’s workers. Most of the country’s unionized cannabis workers are members of either the Teamsters or the UFCW. Both unions have been critical of upstart unions and what they allege are bad-faith efforts to fulfill LPAs.”

Finally in November, A November article in Marijuana Moment reported that a Colombian Senate committee has approved a bill to legalize marijuana, sending it to the full chamber for consideration. According to the article, “The legislation—which has already moved through committee and on the floor in the Chamber of Representatives in recent months—cleared the First Committee of the Senate on Wednesday. This marks the third of eight planned debates before the measure is potentially sent to the president next year. This is by no means a “done deal”, however. The MM story goes on to say, “Lawmakers nearly enacted a version of the reform into law earlier this year, but it stalled out in the final stage in the Senate last session, meaning the two-year legislative process needed to start over again. Rep. Juan Carlos Losada and Sen. María José Pizarro reintroduced the legislation in July.”

In December, it was reported by our very own CRB Monitor journalists that state regulators in Georgia have been left wondering if they will be able to continue their rollout of a medical cannabis program that includes existing licensed pharmacies, after the U.S. Drug Enforcement Agency sent a stern warning to would-be providers of low-THC medical cannabis products “that provide services to licensed cannabis businesses from criminal liability.” According to the article, “The DEA in late November reminded registered pharmacies that they must follow all federal laws and that cannabis remains an illegal Schedule 1 drug on the federal level. The warning came about a month after the state began authorizing pharmacies to serve medical cannabis patients...Neither marijuana nor THC can lawfully be possessed, handled, or dispensed by any DEA-registered pharmacy. Under federal law, products derived from the cannabis plant with delta-9-THC content above 0.3% are considered marijuana, a Schedule I controlled substance...Further, products that contain any amount of a synthetically produced THC are considered to be tetrahydrocannabinols, likewise a Schedule I controlled substance.”

Also in December, our CRB Monitor news team wrote an excellent report entitled Alabama Faces Another Lawsuit Following a Third Round of Licensing which gave us a detailed view into Alabama’s continuing woes as they launch their medical marijuana market. Specifically, the Crimson Tide hit the fan when a processor filed a lawsuit after being passed over in the Alabama Medical Cannabis Commission’s third attempt to issue business licenses. From the article: ““The AMCC’s actions of repeatedly changing rules, criteria, and parameters for applicants, their submissions, and the awarding of processor licenses was and is unconstitutional and cannot be permitted,” Enchanted Green LLC, a minority applicant that had won a license in the last two failed licensing rounds, said in its Dec. 4 complaint....On the Friday before the filing, the AMCC awarded 20 licenses to cultivators, processors, dispensaries, secure transport and a testing lab after two previous attempts to award licenses were scratched. The first round in June, which was scored by the University of South Alabama, was suspended after calculation errors were discovered. On Aug. 10, the commission approved another group of licenses, but then was sued by Verano Holdings, a vertically integrated MSO that was denied a license it had previously been awarded. Again, the commission suspended the licenses. Also, the commission chair, Dr. Steven Stokes, resigned because it was alleged in yet another lawsuit that he couldn’t serve on the commission because he was also a trustee for the University of South Alabama.” Stay tuned as this hot mess unfolds.

Finally in December: MJ Biz Daily reported in December that Cannabis multistate operators with medical marijuana licenses in New York received the green light from state regulators in December to enter the adult-use market on Dec. 29, exactly one year after the state launched recreational sales. According to this December 11th article , “The Cannabis Control Board’s approval had been anticipated for months, but the decision marks a controversial milestone in the rollout of the state’s recreational marijuana market. It follows the New York State Supreme Court’s Dec. 1 decision to lift an injunction that had prevented regulators from handing out new adult-use business licenses.” The Board issued approvals to the following multistate operators (these should sound familiar to experienced CRB Monitor newsletter readers):

- Columbia Care NY, whose parent is New York-based MSO The Cannabist Co.

- Curaleaf NY, part of New York-headquartered MSO Curaleaf Holdings.

- Etain, owned by RIV Capital, a Toronto-based investment firm.

- NYCanna, part of New York-headquartered MSO Acreage Holdings.

- PharmaCann of New York, whose parent is Chicago-based MSO PharmaCann.

- Valley Agriceuticals, whose parent is Chicago-headquartered MSO Cresco Labs.

In June, New York State’s Office of Cannabis Management proposed that MSOs could enter the recreational market by year-end, “effectively eliminating a three-year waiting period for the state’s 10 vertically integrated medical marijuana providers, or registered organizations (ROs).” The article goes on to say that “Regulators had adopted the waiting period to provide a first-to-market advantage for social equity retailers and smaller suppliers, but they shifted gears in an effort to expand retail channels and accelerate business as hundreds of unlicensed marijuana stores proliferated the market, particularly in New York City.” We will be standing by to see if New York ever gets legal cannabis right, but as one can see from the list of hall-of-famers above, the stakes are looking high this year.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"