Coming in January 2025: BIS Prudential Treatment of Cryptoasset Exposures

and Mandatory Capital Reporting for Financial Institutions

James B. Francis, CFA, Chief Research Officer, CRB Monitor

Peter Simcox, Senior Analyst, CRB Monitor

The heightened interest in cryptocurrencies, particularly brought on by a new wave of recently-launched spot Bitcoin ETFs in the US, has emphasized the need for a comprehensive understanding of evolving regulations. And these regulations will have broad implications for several types of institutional users of cryptocurrencies, whether they are (among others) banks, asset managers, custodians, and trading desks.

New Basel Classification Standards

In December 2022 the Basel Committee on Banking Supervision (BCBS) issued its latest publication regarding cryptoassets - the Prudential Treatment of Cryptoasset Exposures - a document that has sent a shockwave through the financial community. The 36-page guide, which targets, among others, banks, broker/dealers, and asset managers, provides a comprehensive framework for the treatment of cryptoasset exposures by institutions. The requirements outlined in the publication include a regulatory, supervisory review and disclosures in a three-pillar system, as outlined in the Executive Summary.

CRB Monitor has reviewed the full BIS publication in detail and believes that it will be incumbent upon financial institutions to, starting in January 2025, provide specifics related to cryptoasset holdings as they will have a direct impact on banks’ capital requirements and risk management.

What is This About?

The Basel standards are all about (what else?) risk management. This exercise in balance sheet compliance exists largely because financial institutions now and going forward will need to exercise discipline in order to save themselves from the sometimes unforeseeable pitfalls of crypto investing. Given frequent bouts of volatility, illiquidity, and questionable investor behavior, crypto investing has the ability to throw a bank’s financials into disarray and (in extreme cases) potential financial peril (see FTX, Silvergate Capital, Signature Bank). In 2025 when these standards are in effect, financial institutions will presumably have the guardrails they will need to protect their shareholders from potential, crypto-themed future disasters.

How does the Basel Framework Classify Cryptoassets?

The Basel framework assists in establishing the Prudential Classification of cryptoassets through a two-tiered grouping system, which features complexities that we will seek to explain in this article. Beginning in January 2025, banks will be required to conduct regular reviews and classify cryptoassets into these two main groups, initially determined by the banks but subject to supervisory review:

Basel Prudential Classification Methodology for Digital Assets

Group 1 Cryptoassets: Group 1 Cryptoassets must meet specific classification conditions outlined in sections SCO 60.8–19 of the standard. Conditions include a redemption risk test for cryptoassets with a stabilizing mechanism, ensuring reserve assets are sufficient for redeemability even in extreme stress. Those that meet in full a set of classification conditions. Group 1 cryptoassets are subject to capital requirements based on the risk weights of underlying exposures as set out in the existing Basel Framework.

- BIS Group 1A: Certain Tokenized Traditional Assets – These are digital assets which are backed by real assets that meet minimum standards. In this hierarchy, Group 1A assets have the lowest level of perceived risk.

- BIS Group 1B: Certain Stablecoins - A stablecoin can only qualify for Group 1B if it is issued by supervised and regulated entities and is not an algorithm-based stablecoin. Group 1 is subdivided into tokenized traditional assets (Group 1a) and cryptoassets with effective stabilizing mechanisms (Group 1b).

Group 2 Cryptoassets: This group encompasses “unbacked” cryptoassets as well as tokenized traditional assets and stablecoins that fail to meet Group 1 classification conditions. As a result, they pose additional and higher risks compared with Group 1 cryptoassets and consequently are subject to a newly prescribed conservative capital treatment. In addition to any tokenized traditional assets and stablecoins that fail the classification conditions, Group 2 includes all unbacked cryptoassets. A set of hedging recognition criteria is used to identify those Group 2 cryptoassets where a limited degree of hedging is permitted to be recognized (Group 2a) and those where hedging is not recognized (Group 2b).

- BIS Group 2A: Certain Stablecoins and Certain Cryptocurrencies - Cryptoassets meeting hedging recognition criteria (as specified in SCO 60.55)7 fall into Group 2A, receiving limited hedge recognition.

- BIS Group 2B: Cryptoassets that fail to meet hedging recognition criteria. Group 2B represents the highest perceived level of risk in the digital space.

Source: Basel Committee on Banking Supervision

While the above information endeavors to summarize the entire publication, there is quite a bit more information to digest in order to be in a position to implement and follow the new Basel-mandated standards. That is because financial institutions will be left to perform this exercise themselves as well as be responsible for ongoing monitoring, as classifications could change over time.

Truth be told, the terminology is not difficult to follow (“tokenized assets”, “stablecoins”, “cryptocurrencies”) but the underlying policies will, by the end of 2024, require new procedures and calculations for banks to regularly monitor their balance sheets to ensure compliance with the new standards.

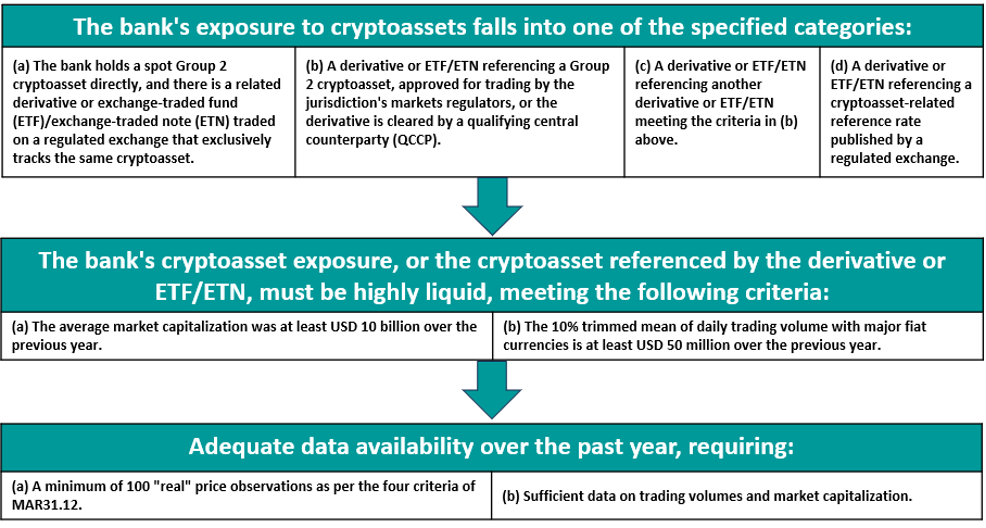

As such, the following graphic is a representation of the Basel hedging criteria requirements:

Source: Basel Committee on Banking Supervision

Source: Basel Committee on Banking Supervision

There are additional key elements of the standard, which include (directly from the BIS text):

- Infrastructure risk add-on: An add-on to risk-weighted assets (RWA) to cover infrastructure risk for all Group 1 cryptoassets that authorities can activate based on any observed weaknesses in the infrastructure on which cryptoassets are based.

- Redemption risk test and a supervision/regulation requirement: This test and requirement must be met for stablecoins to be eligible for inclusion in Group 1. They seek to ensure that only stablecoins issued by supervised and regulated entities that have robust redemption rights and governance are eligible for inclusion.

- Group 2 exposure limit: A bank’s total exposure to Group 2 cryptoassets must not exceed 2% of the bank’s Tier 1 capital and should generally be lower than 1%. Banks breaching the 1% limit. Banks breaching the 1% limit will apply the more conservative Group 2b capital treatment to the amount by which the limit is exceeded. Breaching the 2% limit will result in the whole of Group 2 exposures being subject to the Group 2b capital treatment.

[Needless to say, the rules are rather deep and detailed, and we recommend that all interested parties read the entire announcement, as the details are critical for successful implementation of the standards.]

Classifying Digital Assets

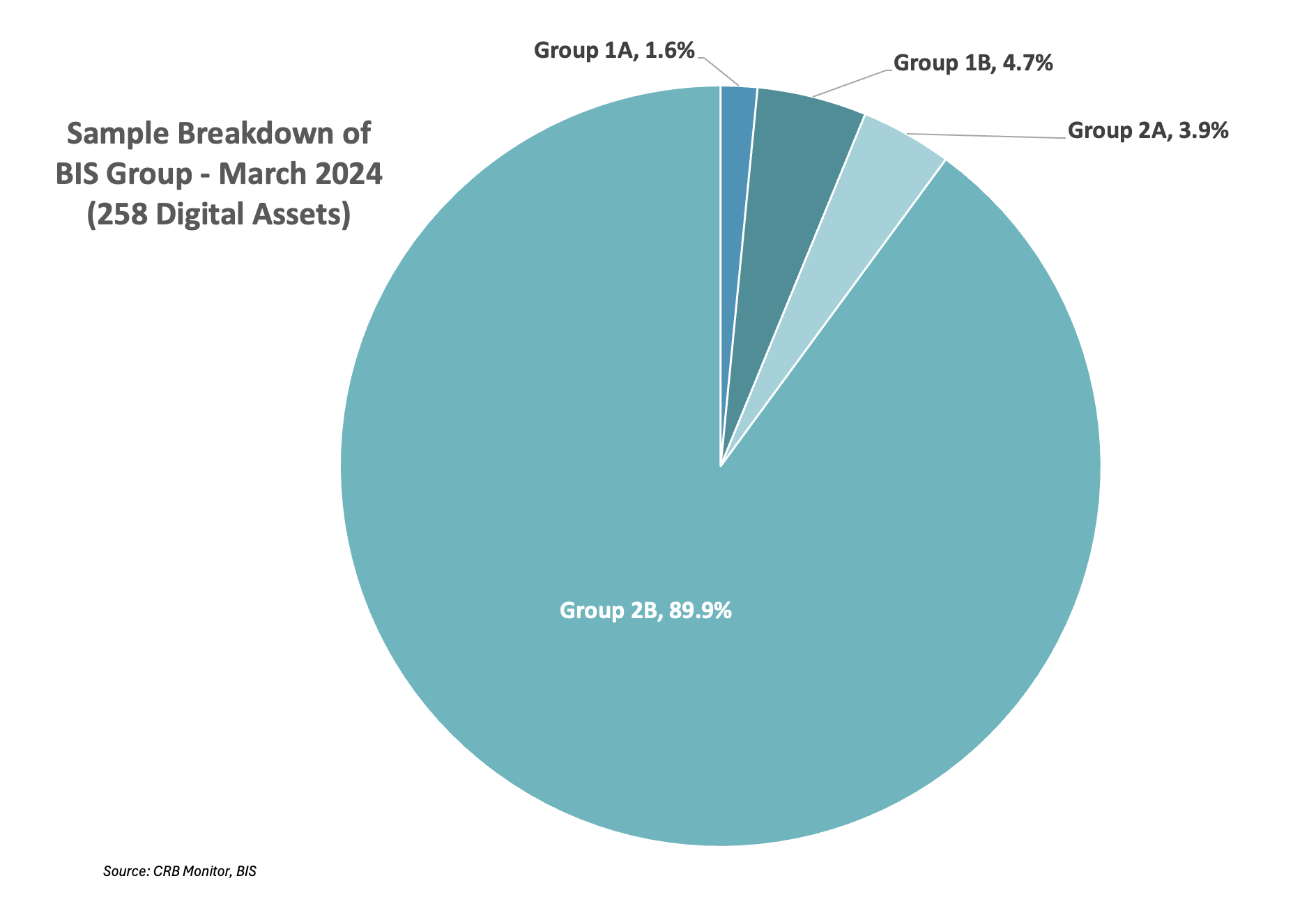

CRB Monitor has begun applying the BIS classification standards to a broad universe of digital assets, and as such here is the breakdown of the largest 258 in March 2024, which we believe is a good representation of the digital asset universe:

As is evident from this analysis, nearly 90% of the digital asset universe resides in Group 2B, the riskiest category. Why is this important? As Group 2B is generally made up of smaller, more thinly-traded, lesser-known cryptocurrencies, transacting in or holding these assets places banks and other financial institutions at risk and the degree of exposure to them will factor into their (and their clients’) disclosures going forward. When BIS goes into effect, the value of these as well as their Group 2A cryptocurrencies will be subjected to “a 100% capital charge (equivalent to a RW of 1,250%)”. Furthermore, according to Basel, the difference in treatment between Group 2A and 2B cryptoassets is that Group 2A has “some hedging recognition” while Group 2B has “no hedging recognition”. With that said, Group 2A only includes just the handful of cryptocurrencies that meet and maintain the most ambitious liquidity standards.

Below is a sample list of the more than 1000 cryptocurrencies that CRB Monitor has classified according to their respective BIS Group which includes an analysis of hedging recognition criteria (as specified in SCO 60.55).

| Digital Asset |

Ticker |

BIS Group |

Meets All Hedging Criteria (Group 2 Only) |

Market Cap. |

|

Bitcoin |

BTC |

2A |

Yes |

$1,163,355,536,429 |

|

Ethereum |

ETH |

2A |

Yes |

$400,193,965,440 |

|

Tether |

USDT |

1B |

- |

$98,456,677,660 |

|

Binance Coin |

BNB |

2A |

Yes |

$63,193,834,345 |

|

Solana |

SOL |

2A |

Yes |

$50,343,852,173 |

|

Ripple |

XRP |

2A |

Yes |

$32,159,723,116 |

|

USDC |

USDC |

1B |

- |

$28,538,204,229 |

|

Cardano |

ADA |

2A |

Yes |

$22,574,412,577 |

|

Avalanche |

AVAX |

2B |

No |

$15,246,761,541 |

|

Dogecoin |

DOGE |

2A |

Yes |

$14,239,042,327 |

Source: CoinGecko

Applying Basel Classifications to Exchange Traded Products

CRB Monitor has identified more than 300 digital asset-themed exchange traded products (ETPs), which derive their digital asset exposure through either spot or futures-based cryptocurrencies. And we believe that a thoughtful application of the Basel standards to ETPs will be essential for asset managers, trading desks, and custodians to assess risk on behalf of their clients. [Furthermore, we would recommend a risk analysis which combines the Basel Group analysis with CRB Monitor’s Country of Regulation Score, which CRB Monitor produces as well.]

Given our expectations of its importance for asset owners going forward, CRB Monitor conducted a risk analysis to identify cryptocurrency ETPs that directly hold or invest in cryptocurrencies and their corresponding BIS Group:

|

Issuer Name |

Underlying cryptoasset |

BIS Group |

Market Cap (USD |

|

AVAX |

2B |

$16,791,042 |

|

|

DOT |

2B |

$31,563,423 |

|

|

ADA |

2A |

$69,221,861 |

|

|

SOL |

2A |

$779,551,744 |

|

|

ETH |

2A |

$ 8,848,822,005 |

|

|

BTC |

2A |

$10,660,409,020 |

|

|

MATIC; TRX; ADA; BNB; LTC; SOL; XRP; XRP; DOT |

- |

$4,183,260 |

|

|

BTC; ETH; DOT; SOL; XRP |

- |

$235,618,125 |

|

|

BTC; ETH; SOL; XRP; ADA; AVAX; DOT; MATIC; LINK; LTC |

- |

$597,339,856 |

|

|

BNB |

2A |

$422,586,195 |

Source: ETP Websites

Finally, Disclosure Requirements and Monitoring

The BIS publication goes into exhaustive detail regarding disclosure and monitoring of digital asset holdings, specifically for banks. And to ensure uniformity in disclosures, the Committee has created a series of standardized disclosure requirements which include the following:

- Overview of crypto activities, risks, and classification approach.

- Overview of cryptoasset exposures and capital requirements.

- Explanation of accounting for cryptoasset exposures.

- Liquidity risk classification of cryptoasset exposures.

In addition to reporting, banks are also responsible for monitoring the crypto assets they are exposed to, making sure that they are correctly classified within their groups (1A, 1B, 2A, 2B) and compliant with internationally accepted standards on an ongoing basis. And while these standards and requirements target banks specifically, CRB Monitor believes that the BIS classification methodology has implications for risk management that cover all types of companies that engage in financial services. As such, CRB Monitor’s risk analysis is performed for both layers – the digital asset and the digital asset-related business (DARB). [We will be issuing future publications that present this work in greater detail.]

The Basel Prudential Treatment of cryptoasset Exposures represents a significant upgrade in the regulatory landscape for banks and other financial institutions who invest in cryptoassets. CRB Monitor believes that a complete understanding of these standards will be essential to implement a program that will ensure compliance and maximize risk management in this volatile and ever-evolving space.

CRB Monitor’s Coverage of Digital Assets and DARBs

In recent years, CRB Monitor has been closely following the actions of global regulators worldwide and has compiled and curated relevant data to construct and maintain a database of more than 1,000 digital assets and 1,600 digital asset-related securities. Our work has resulted in an invaluable tool for financial practitioners who must assess global digital asset-related exposures in an ongoing basis.

Wondering what a Tier 1, Tier 2 or Tier 3 DARB is?

See our seminal ACAMS Today white paper Defining ‘Digital Asset-related Business’ and Digital-Asset Related Businesses - What Financial Institutions Need to Know