Request More Info

We'd love to hear from you! Let us know how we can help.

We'd love to hear from you! Let us know how we can help.

Uncover and explore connections to the universe of publicly traded digital asset-related businesses (DARBs) and ETP's with CRB Monitor’s exhaustive database of digital asset-linked securities and associated risk classifications.

CRB Monitor’s research team performs a daily global search of publicly traded DARBs and their traded securities. We exhaustively identify, classify, and bring all relevant information together - so you don’t have to.

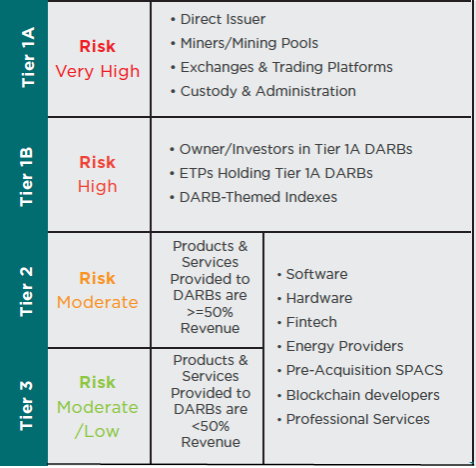

Tier 1A: Digital Asset-Touching Businesses

Companies directly handling digital assets

Example: TradeStation Group, Inc. (Nasdaq: TRAD)

Tier 1B: Digital Asset Ecosystem Investors

Owners and investors of Tier 1A DARBs, digital asset-themed ETPs, and market indexes

Example: BIGG Digital Assets Inc (CSE: BIGG)

Tier 2: Primary Service Providers

Companies providing services to Tier 1 DARBs as a primary revenue source

Example: Northern Data AG (XETRA: NB2)

Tier 3: Incidental Service Providers

Companies providing services to Tier 1 DARBs as an incidental revenue source

Example: Otter Tail Corporation (Nasdaq: OTTR)

This new frontier for investors represents new risks for financial institutions of all sizes. As this asset class evolves institutions need a reliable source of intelligence to use to protect their investor base

CRB Monitor’s rules-based methodology provides institutions with an essential tool that can be easily integrated into any risk and compliance platform.