James B. Francis, CFA

Chief Research Officer, CRB Monitor

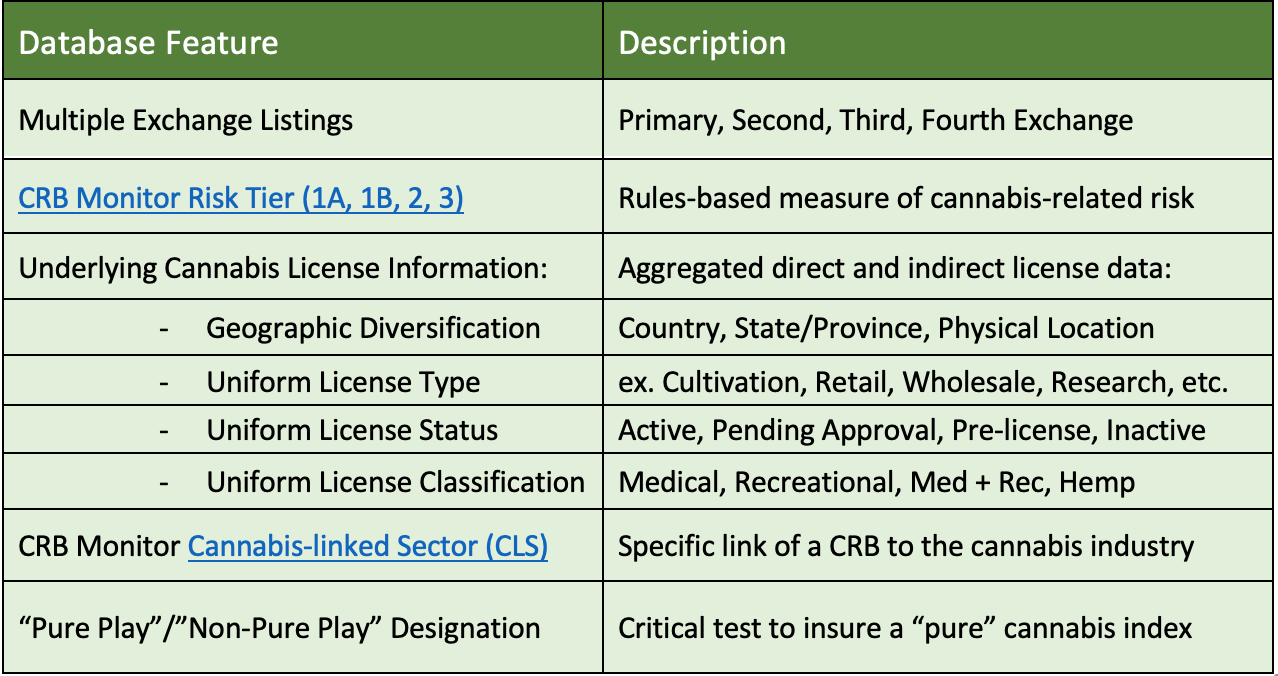

The CRB Monitor database maintains detailed profiles of more than 1,800 publicly-traded securities which underlie more than 1,400 Cannabis-Related Businesses globally. We categorize CRBs into our proprietary Cannabis Risk Tier Framework and Cannabis-Linked Sectors (CLS). In addition, CRB Monitor unravels and maintains complex corporate structures, linking publicly-traded parent companies to their underlying operational plant-touching subsidiaries. Several of the world’s largest custodian banks, broker/dealers, and asset managers find our data essential for pre-trade compliance, risk management, index construction, and portfolio analytics.

CRB Monitor, the leading provider of global market intelligence in the cannabis industry, is pleased to announce, in collaboration with Nasdaq Equity Indexes, the launch of the Nasdaq CRB Monitor Global Cannabis Index (trading symbol HERBAL).The HERBAL index, which was developed first as a benchmark solution for a soon-to-be-launched cannabis-themed exchange traded fund (ETF), is a complete and highly-researched representation of the global legal cannabis ecosystem. This index and its components have been thoroughly reviewed and vetted not only by Nasdaq, but also the ASX and the ETF manager’s custodian for complete “legality” and tradability.

Cannabis Equities – Why Now?

Why should investors care about a new cannabis-themed index product, given the recent downward spiral performance of cannabis-related equities? As providers of the most comprehensive global universe of cannabis market intelligence, CRB Monitor feels your pain.

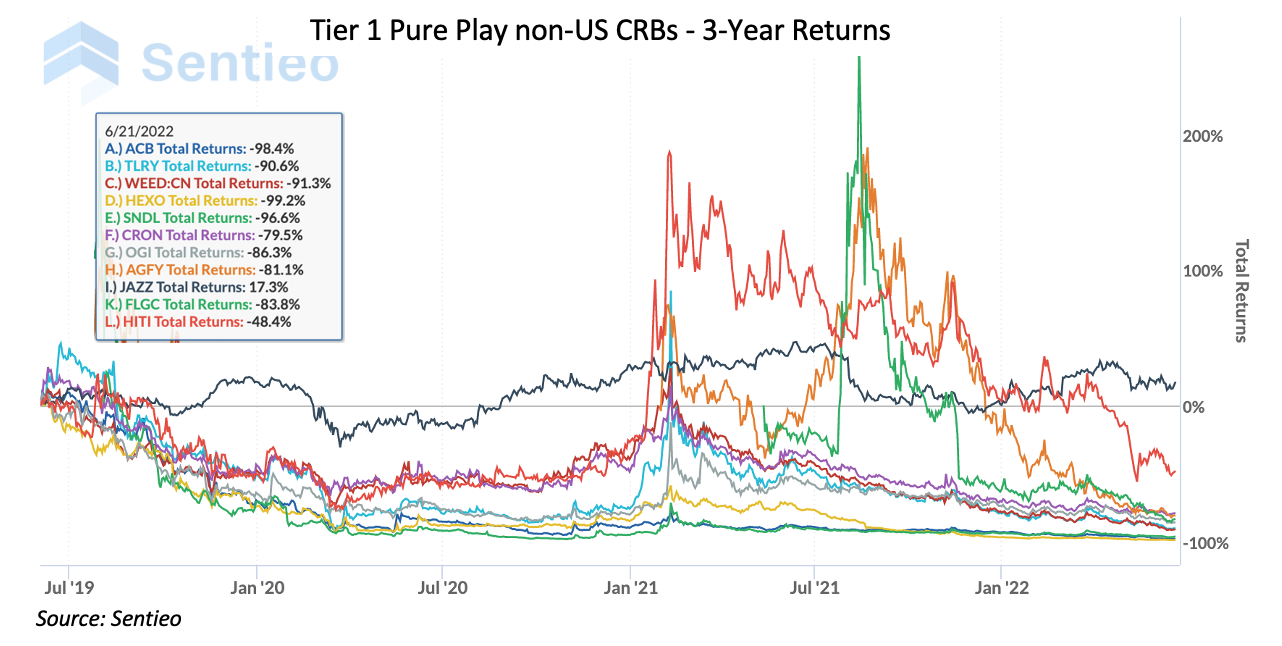

Cannabis equities have, by and large, produced negative returns over the last 18 months (see chart below). And with the exception of a handful of CRBs that are closely connected to US cannabis (and therefore restricted from most cannabis-themed investment vehicles) the broad basket of cannabis equities has had it pretty rough for the better part of the last 3 years. In other words, investors that have stayed away from cannabis historically have benefitted from that decision. But we digress.

There are reasons for investor optimism, beyond the obvious sentiment that equity prices “cannot possibly go much lower from here.” Cannabis legalization, at the state level, continues to move ahead, albeit slowly. And cannabis legislation/decriminalization by the US federal government appears to be imminent, most likely beginning with the SAFE Banking Act. [We cover the latest in cannabis regulatory news in our May 2022 cannabis securities newsletter.]

With each of these incremental victories, as well as positive developments related to the global pandemic and the war on black market cannabis, we feel optimistic about the prospect of a near-term increase in cannabis-related revenues and higher CRB stock prices.

We also make the case for including cannabis equities in an overall asset allocation in our recent blog, "Cannabis Equities: Is This the Right Time To Invest?".

This brings us to the launch of the intelligently-constructed CRB Monitor Global Cannabis Index (HERBAL), which is long overdue and arriving just in time for the next cannabis boom.

Why Another Cannabis Index?

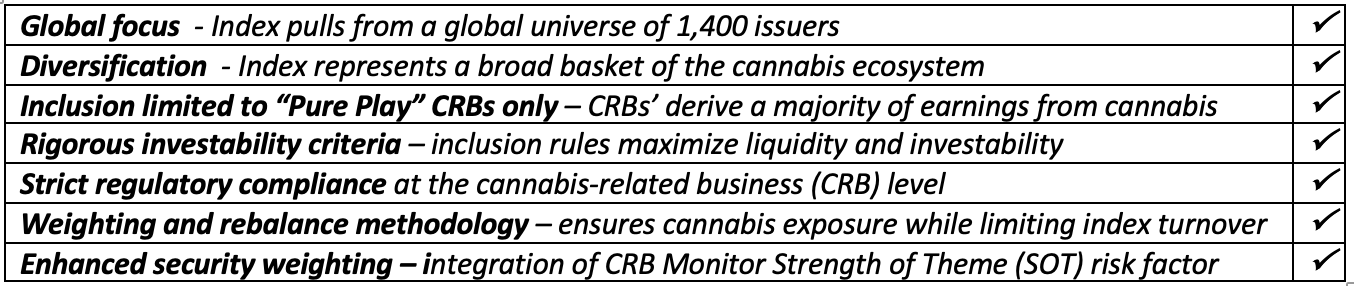

The Nasdaq CRB Monitor Global Cannabis Index sets a new standard for cannabis equity indexes, as it features the following well-researched, critical characteristics:

CRB Monitor’s Securities Research team has been instrumental in the development and implementation of the HERBAL index’s rules-based construction methodology, contributing significantly to security inclusion and index weighting. We have been involved in every step of the way, establishing the eligible global securities universe of Tier 1 and Tier 2 “Pure Play” CRBs, and calculating the proprietary Strength of Theme risk factor, which is calculated for every member of the eligible universe and is integrated into the final weighting of the HERBAL index.

Nasdaq CRB Monitor Global Cannabis Index - Eligible Universe

The basis for the HERBAL index’s eligible universe is the CRB Monitor global securities database of 1,400 publicly-traded companies, which are defined by a broad set of characteristics:

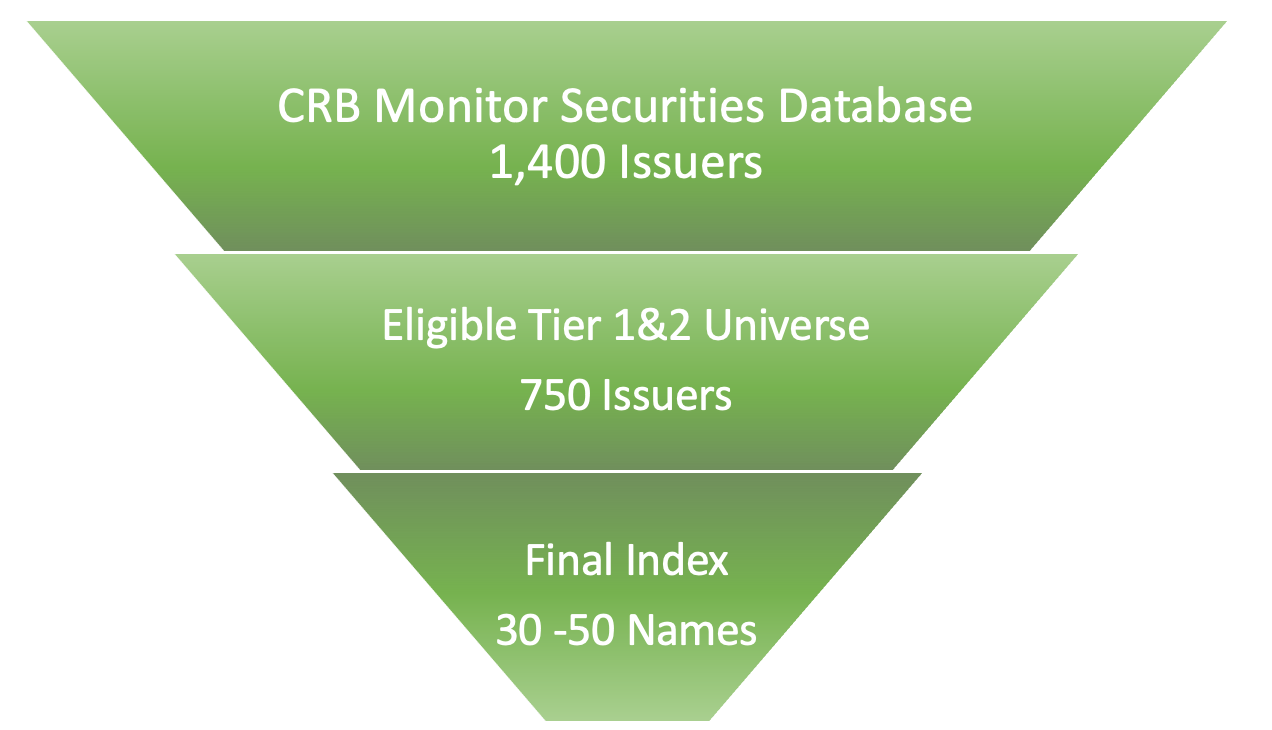

The eligible universe for the HERBAL index benefits from the ongoing work of the CRB Monitor Securities Research team, which monitors the global cannabis ecosystem daily. From the list of approximately 1,400 Tier 1, Tier 2, and Tier 3 issuers, we construct an Index-eligible universe of approximately 750 Tier 1 & 2 CRBs. The final index is the result of a rigorous, rules-based selection process detailed below.

Index Inclusion Methodology

The Nasdaq CRB Monitor Global Cannabis Index has the following rules of inclusion:

- Regulatory Compliance. Given that cannabis is classified as a Schedule 1 narcotic by the US Drug Enforcement Administration, any cannabis-related revenue generated in the US, by definition, is defined as an illegal activity. As such, cannabis-related indexes that are used by funds and ETFs must prohibit the inclusion of any companies with US plant-touching operations. This rule applies to CRB Monitor Tier 1 securities, and every CRB Monitor’s company profile provides the complete corporate structure and underlying license detail that makes it possible to identify (and filter out) US-plant touching CRBs.

A second “check” for regulatory compliance is the primary exchange listing. Companies that list on top tier exchanges like the NYSE, Nasdaq, TSX/TSXV, LSE, and ASX must meet standards directly related to illegal activity. As such, these indexes do not award listings to any companies with direct connections to US plant-touching cannabis operations. Companies with US operations are generally relegated to listing on second-tier exchanges such as the CSE or NEO, otherwise they can be found exclusively on the OTC Markets platform, which is technically not an exchange and has no apparent minimum listing standards. - Inclusion of CRB Monitor Tier 1 and Tier 2 Securities. The Nasdaq CRB Monitor Global Cannabis Index includes securities from Tier 1 (licensed CRBs & owner/investors in licensed CRBs) and Tier 2 (providers of goods and services to Tier 1 CRBs, pure play CBD sellers). A full explanation of CRB Monitor’s risk tier methodology can be found in the article Defining “Cannabis-Related Business” on the CRB Monitor website.

- “Pure Play-Only” Designation. In order to be included in the HERBAL index, a security issuer must be identified by CRB Monitor as a "Pure Play" cannabis related business. In order to meet this standard, CRB Monitor researches every company in the CRB Monitor universe, reviewing regulatory filings, press releases, news articles, investor presentations, etc., to determine whether or not each company derives (or intends to derive) at least 50% of its overall revenues from the Cannabis industry. If a company meets this standard, it is considered “Pure Play” and passes this inclusion test. This applies to both Tier 1 and Tier 2 CRBs.

- Minimum Market Capitalization. Float-adjusted Market Capitalization is the value of a number of a company’s shares that are available for purchase on the open market; this has historically been used as one of the minimum thresholds for investability. Minimum market capitalization for inclusion in the HERBAL index is $100 million.

- Liquidity. The USD value of the average number of shares traded daily (ADV) over a specified period (in this case, 3-months) is another commonly-used measure of investability. For inclusion in the HERBAL index, minimum 3-month ADV is $1 million.

- Minimum Share Float. For inclusion, at least 20% of a security’s total shares outstanding must be publicly available for trading (float shares).

Index Weighting Methodology and Strength of Theme Factor

The Nasdaq CRB Monitor Global Cannabis Index has adopted a weighting methodology that maximizes Pure Play exposure to the cannabis ecosystem while limiting excessive turnover. The HERBAL index can be described as “a theme-adjusted market capitalization index.” In other words, each index security’s weight is calculated by multiplying it’s float-adjusted market capitalization by its Strength of Theme factor. To limit overall turnover due to the volatility of the cannabis space, initial constituent weights are capped at an 8% maximum and 0.3% minimum. We believe that this theme-adjusted market cap weighting is the best representation of global, pure play cannabis that is available to cannabis investors.

CRB Monitor Strength of Theme Factor

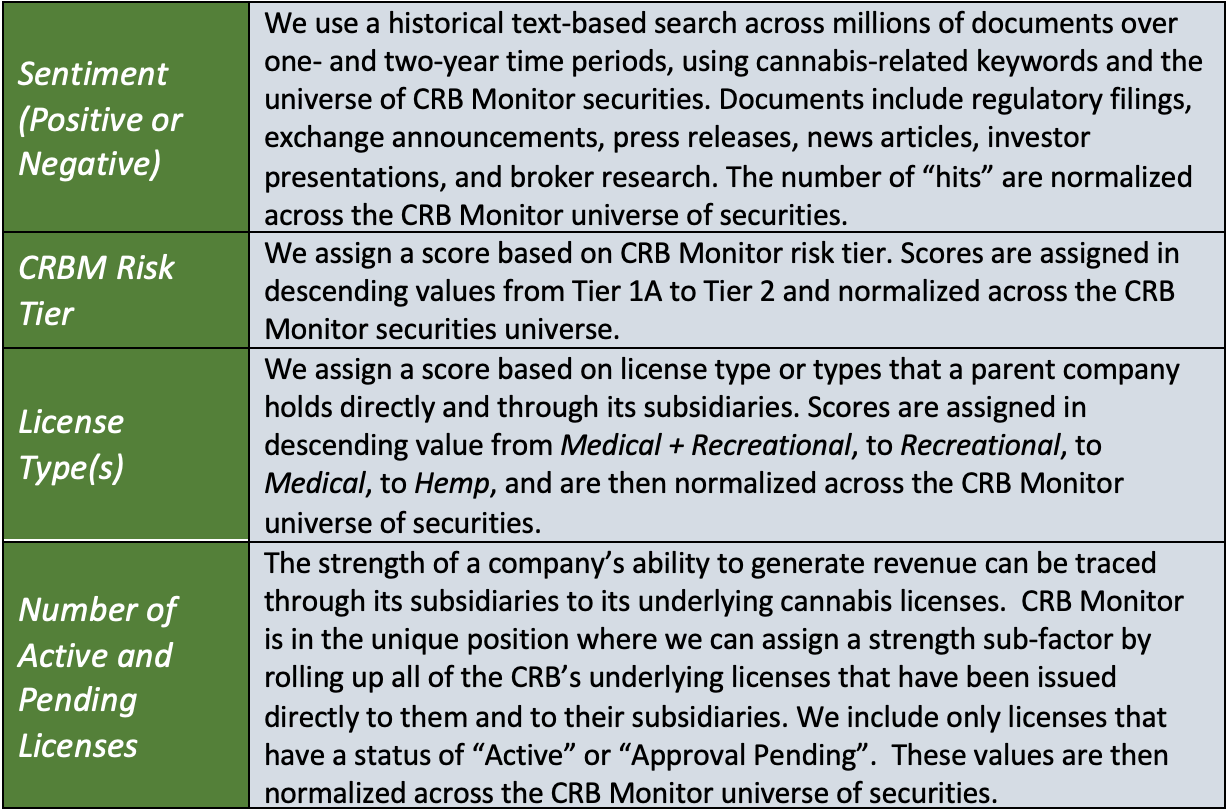

What makes the Nasdaq CRB Monitor Global Cannabis Index truly unique is our proprietary Strength of Theme (SOT) risk factor. Strength of Theme combines various sub-factors including sentiment, CRB Monitor tier strength, Pure Play designation, and universe members’ subsidiaries’ underlying license characteristics. The inputs to these factors are derived from publicly-available information; however, without the CRB Monitor securities database this data would be very difficult, if not impossible, to accumulate effectively and efficiently. The CRB Monitor database, now eight years in its evolution, is in a unique position to provide the data necessary to calculate relative Strength of Theme across the entire HERBAL index universe.

The SOT risk factor and sub-factors can be used to construct indexes, risk models and portfolios. The breadth of the CRBM universe (now 1,400 companies) and the depth of the data (information on more than 150,000 cannabis licenses) that are used to calculate individual factors speak to the effectiveness of the SOT.

Strength of Theme Factor Construction

The Strength of Theme factor is not intended to be a measure alpha, or expected return, but rather a measure of a company’s risk and overall exposure to the cannabis industry. When combined with investability, Strength of Theme can be an effective tool in the construction of indexes and investment vehicles, particularly ETFs. [We will be measuring comparative Strength of Theme factors across the universe of cannabis-themed ETFs in a future blog post.]

Source: CRB Monitor, June 2022

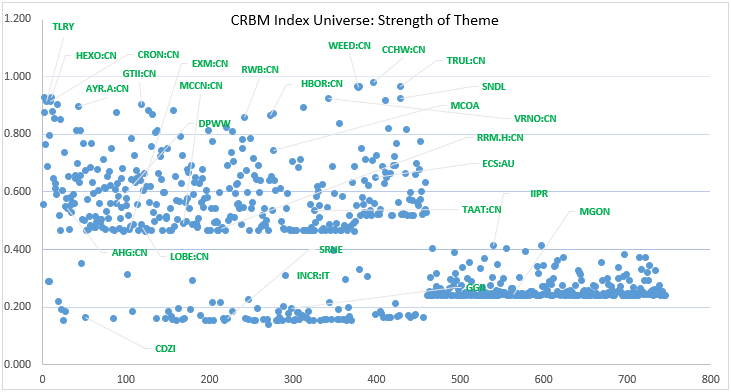

The dispersion of the Strength of Theme factor, as shown in the scatter plot above, highlights the differences in cannabis exposure across the broad universe of more than 750 Tier 1 and Tier 2 Cannabis-linked securities. We believe that this enhancement to the HERBAL index weighting methodology is a key differentiator from simple capitalization-weighted or equally-weighted index products. The higher “clusters” in the chart above largely represent Tier 1 pure play securities while the lower “clusters” of securities in the scatter plot are primarily made up of both non-pure play Tier 1 and Tier 2 universe members. We’ve highlighted the ticker symbols of some examples in green.

HERBAL Index Performance

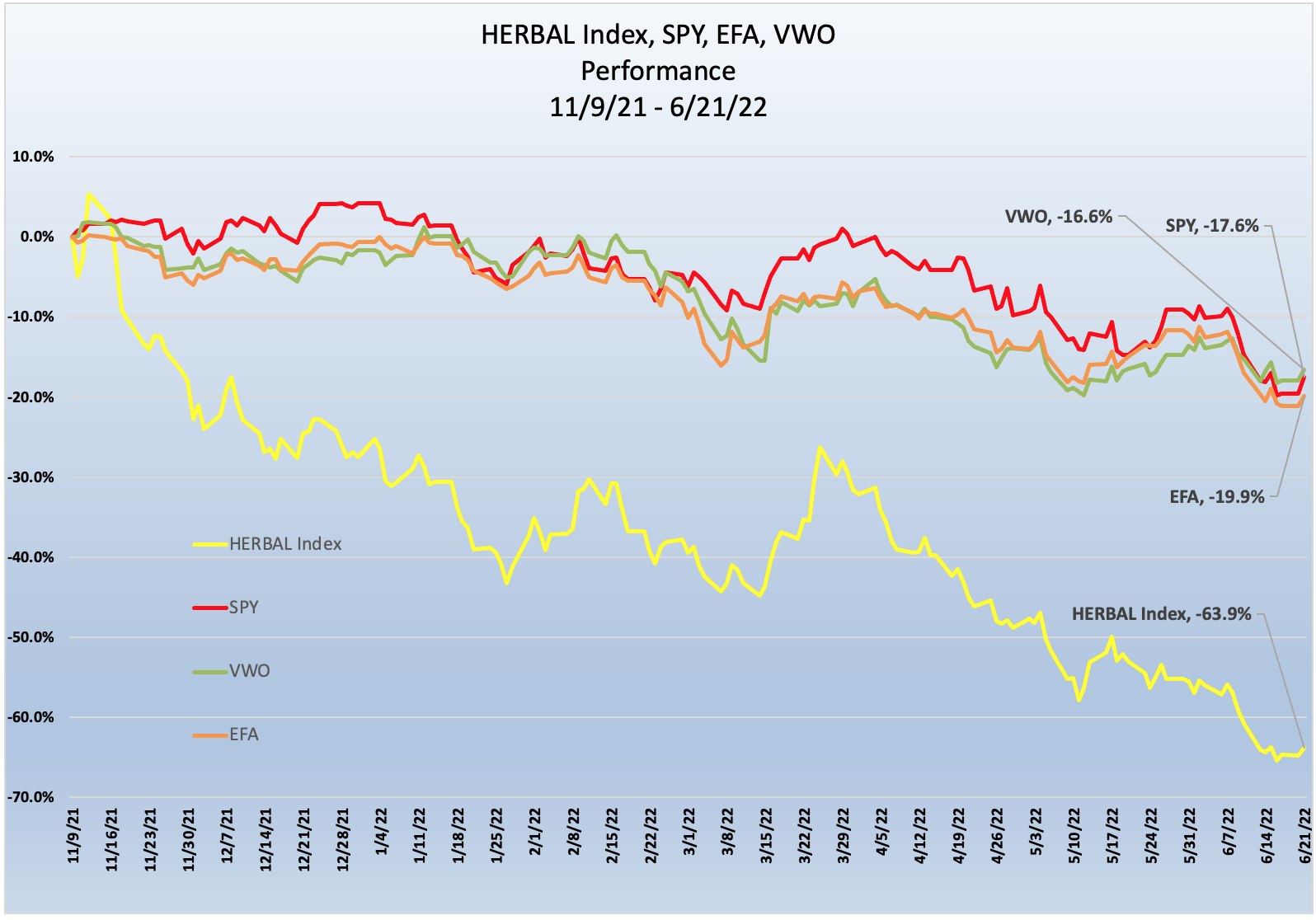

The above chart shows HERBAL index performance since its inception (11/9/21) compared with US equities (SPY), International equities (EFA), and Emerging Markets equities (VWO). It would be an understatement to say that this has been a challenging period for most equities, not just CRBs.

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL) is designed to track the performance of a selection of global companies engaged in Cannabis-related business that are legal under applicable national and local laws, including U.S. federal and state laws. HERBAL is the result of a collaborative effort by Nasdaq and CRB Monitor Securities Research. The HERBAL construction methodology uses current market data and proprietary CRB Monitor data to construct a global, pure play, investable cannabis index that is the “gold standard” benchmark for cannabis investors.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"