James B. Francis, CFA

Chief Research Officer, CRB Monitor

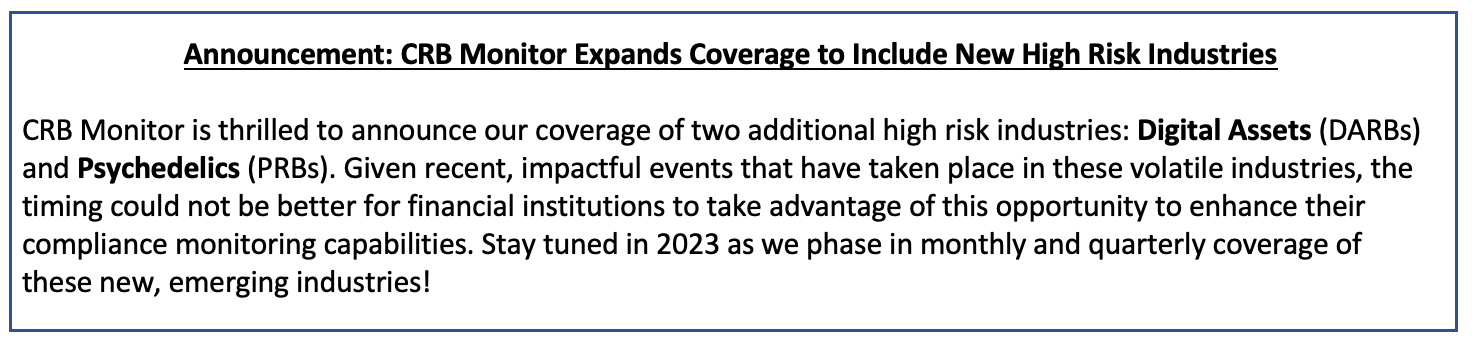

Cannabis-linked Equity Performance

Source: CRB Monitor, Sentieo, Nasdaq

Source: CRB Monitor, Sentieo, Nasdaq

Cannabis Index Returns

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), is a mix of Pure Play Tier 1 and Tier 2 cannabis related equities, weighted by both investability and strength of theme (SOT). A full description of HERBAL’s strengths and benefits can be found here: Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

The HERBAL index gave back some of its positive performance in November 2022, posting a -6.4% return. HERBAL outperformed its most similar competitor in the thematic space, the Global X Cannabis ETF (Nasdaq: POTX) (-7.6%). Similar to HERBAL, POTX is a pure play cannabis ETF and any deviations from the return of the HERBAL index will generally be due to security weightings. HERBAL underperformed the ETFMG Alternative Harvest ETF (NYSE Arca: MJ) (+3.6%) and the Advisorshares Pure US Cannabis ETF (NYSE: MSOS) (+7.1%). MJ’s performance is likely to deviate from HERBAL’s due to a significant percentage of non-Pure Play cannabis holdings, particularly tobacco stocks with either very small or even no cannabis exposure at all. MSOS’s performance can deviate from HERBAL as well, largely due to its holdings of CRBs with US Marijuana touch-points, which dominate that fund’s CRB exposure. [MJ, POTX and HERBAL cannot hold any securities with direct US touch points.]

The CRB Monitor equally-weighted basket of Pure Play Tier 1 CRBs with $500mm+ market cap had its second positive month in a row, posting a +4.1% return in November 2022. Looking at the table below, we see that Tier 1 Pure Play CRBs were mixed but we saw some impressive returns from the largest companies, particularly those in the MSO group. We’ll take a closer look below.

The CRB Monitor equally-weighted basket of Tier 2 CRBs with $150mm+ market cap slightly outperformed the Tier 1 CRB basket in November, posting a positive 4.6% return. As a reminder, we expect Pure Play Tier 1 and Tier 2 CRBs to display high correlation (~0.8) in the long term; however, their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact (positive or negative) of market forces that affect their sources of revenue that are derived from the Tier 1 group.

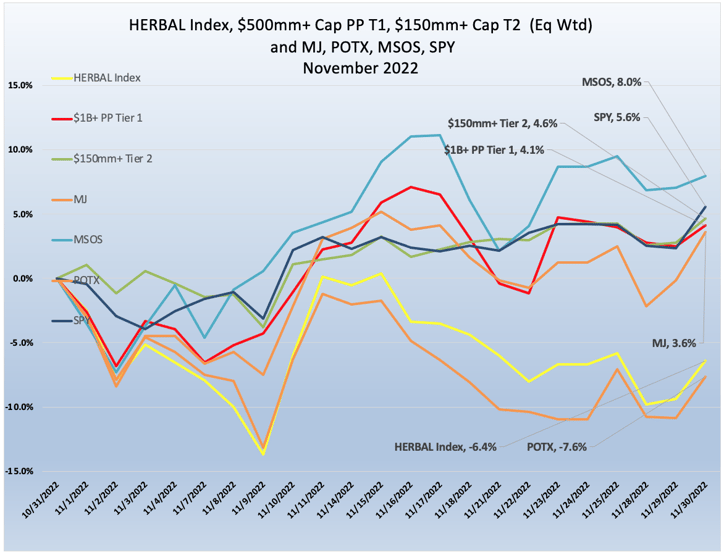

Tier 1 Pure Play CRBs w/Mkt Cap Over $500mm – November 2022 Returns

Source: CRB Monitor, Sentieo

CRB Monitor Tier 1

The positive return (+4.1%) of the Tier 1 basket was attributable to CRB’s in the MSO group, which continued on its upward trajectory from October (October featured mostly double-digit positive returns across the board). MSOs were still riding high from President Joe Biden’s October announcement regarding his intent to pardon and vacate the sentences of those who were previously convicted of cannabis possession-related offenses.

Curaleaf Holdings, Inc. (CSE: CURA) (+22.2%), Trulieve Cannabis Corp. (CSE: TRUL) (+10.6%), TerrAscend Corp. (CSE: TER) (+14.3%), and Green Thumb Industries Inc. (CSE: GTII) (+9.3%) once again surged, apparently from the tailwinds generated by the Biden announcement and perhaps with a small spark from a few states that had positive legalization results from the November 9th elections. Columbia Care Inc. (CSE: CCHW) (+2.7%) closed ahead but generally in line with its future parent company Cresco Labs Inc. (CSE: CL) (+0.7%). Verano Holdings Corp. (CSE: VRNO) (-5.0%) had been on a somewhat upward trajectory since Q3 but apparently investors cooled off to the rapidly-growing MSO in November.

It is notable that this was also an optimistic month for US equities, as investors responded positively to data showing inflation had somewhat subsided combined with expectations that we are out of the inflationary woods and headed for relative tranquility, due to ongoing Fed tightening.

Conversely, Tier 1 Canadian CRBs (no US touch-points) such as Tilray Brands, Inc. (Nasdaq: TLRY) (-4.9%), Canopy Growth Corporation (TSX: WEED) (-4.5%), Cronos Group Inc. (TSX: CRON) (-8.6%), and Sundial Growers, now called SNDL, Inc.(Nasdaq: SNDL) (-10.2%) had an across-the-board reversal in November. It is possible that investors are seeing that the growth of the Canadian cannabis market is “maxed out” (see our October 2022 securities newsletter for additional commentary on US vs. Canadian CRB revenue).

It’s clear that any steps toward US legalization will have a positive impact on the industry not only here, but globally. That is because US legalization suggests that Canadian (and other) operators would presumably be legally cleared to transact with MSO’s and even acquire US-based CRBs. Stay tuned!

Chart of the Month: CRB EV/EBITDA

Investors use the ratio of Enterprise Value (EV) to Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) as an essential measure of a company’s value, and there are some insights to be gained from it in the cannabis industry.

The numerator, EV, is a measure of the total current value of a company. EV is calculated as the market capitalization of a company plus total debt less cash. The denominator, EBITDA, is a measure of a company’s overall financial performance and profitability and a rough approximation for "cash flow". Therefore EV/EBITDA can be a proxy for Return on Investment (ROI) and bigger is better. As a point of reference, the average EV/EBITDA for the S&P 500 in 2021 was 17.2.

Back in June 2022 we looked at EV/EBITDA for a list of CRBs and in retrospect we found that the chart was distorted by the inclusion of the Canadian CRBs, some of which have negative earnings. And so this time we look at the 2-year EV/EBITDA trend of a group of MSOs only, which is a more meaningful representation of the success of the cannabis industry.

The 2-year chart below shows a degree of optimism for investors, which is also reflected in the companies’ stock returns (see above). We are seeing return on investment, while not at early 2021 levels, in a recovery, with Tier 1 MSOs making that steep hike back toward levels that we witnessed in early 2022. We can relate some of this to investor sentiment as Washington continues to take its baby steps toward some version of cannabis reform.

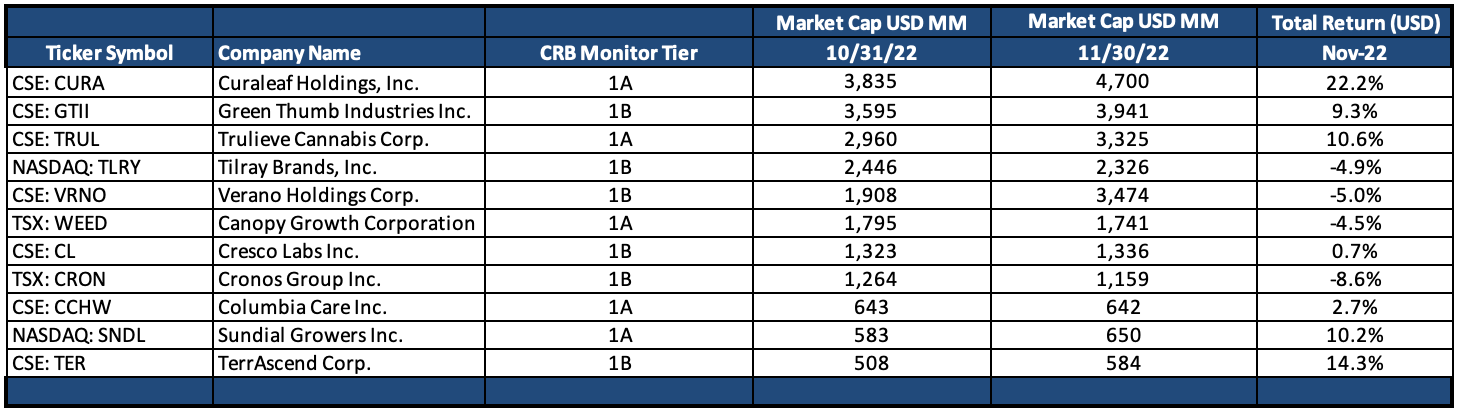

Tier 2 CRBs w/Mkt Cap Over $150mm – November 2022 Returns  Source: CRB Monitor, Sentieo

Source: CRB Monitor, Sentieo

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies had a +4.6% return for November 2022, which was essentially in line with the equally-weighted Tier 1 basket. The sometimes wide spread between the top two tiers can be unsettling on a month-to-month basis; however, investors would be wise to invest in these two baskets with an eye toward the long term. And while they are highly correlated, there is no need to try to play the mean reversion game with them. With that said, when these two portfolios deviate it could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given the direct revenue relationship, but the time it takes to mean revert is not so easy to predict.

Performance across the Tier 2 basket was mixed in November, with the best performing Tier 2 CRB being NewLake Capital Partners, Inc. (OTCQX: NLCP) (+17.2%). Per CRB Monitor, NewLake Capital is “an internally managed triple-net lease REIT that purchases properties leased to state-licensed U.S. cannabis operators. NewLake currently owns a geographically diversified portfolio of 27 properties across 10 states with 8 tenants, comprised of 17 dispensaries and 10 cultivation facilities. The Company's tenants include what the Company believes to be some of the leading and most well-capitalized companies in the cannabis industry, such as Curaleaf, Cresco Labs, Trulieve and Columbia Care.” NewLake currently pays investors an 8% dividend yield and boasted Q3 earnings growth of 50% in a mid-November earnings call.

Perennial head-scratcher Innovative Industrial Properties, Inc. (NYSE: IIPR) (+17.2%) has now rallied for the second month in a row following an abysmal streak of underperformance. Investors will have to wait and see if this is either a “dead cat bounce” or if the stock is really in recovery.

Bakhu Holdings Corp. (OTC Pink: BKUH), a non-plant touching, development-stage company, which was up 67% in October on very little volume, came crashing some of the way back to earth in November (-25.0%). This is no surprise to us given the fact that BKUH is largely illiquid and trades by appointment. As we stated last month, BKUH rarely records a print two days in a row and this extreme illiquidity is likely to cause equally extreme performance swings.

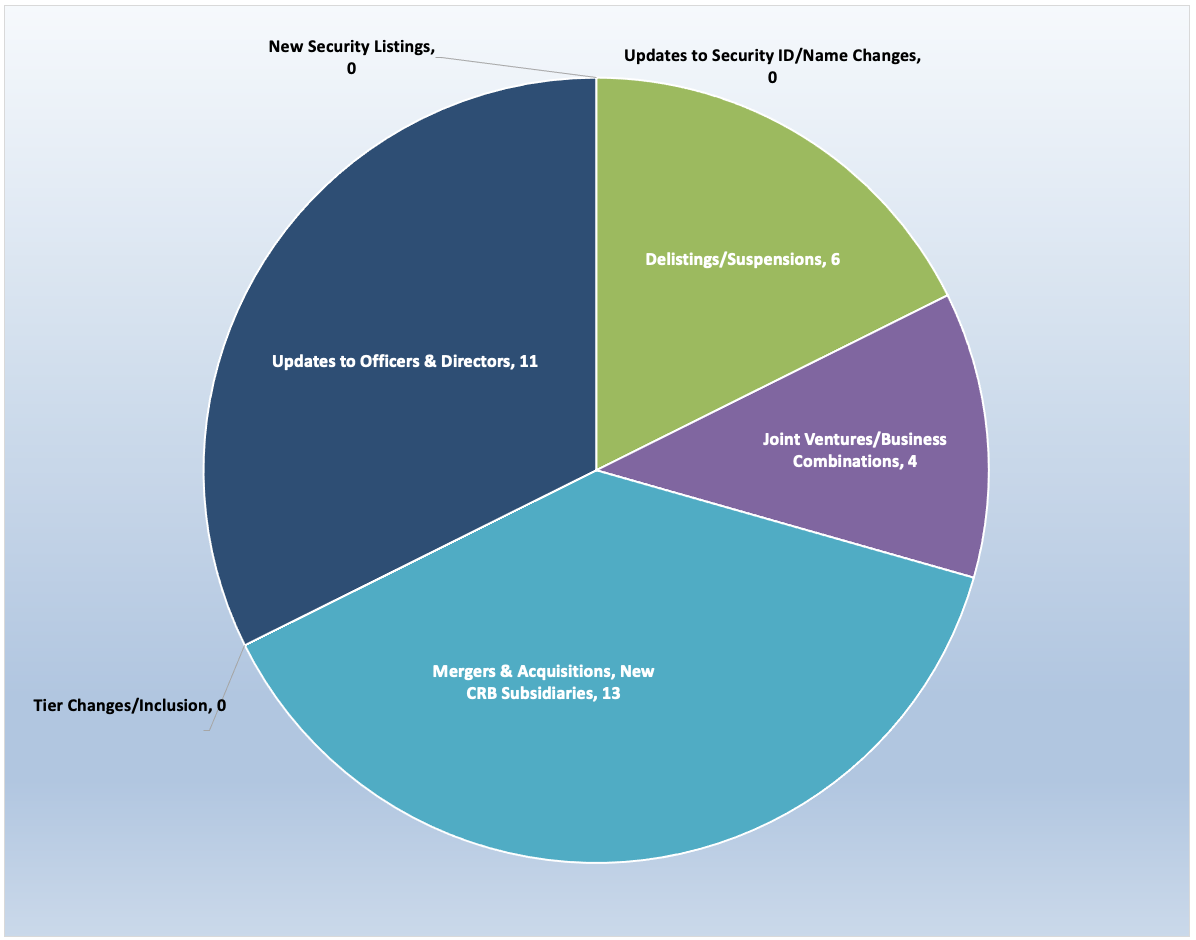

CRB Monitor Database Updates - November 2022

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for November 2022:

Source: CRB Monitor, Sentieo

Cannabis Business Transaction News - November 2022

Companies in the publicly-traded cannabis space continued to seek to expand local operations in November 2022. With that said, M&A activity has slowed considerably in 2022. But as we continue to observe, the market is still well-positioned for growth, particularly in the US and globally. We believe this given the fact that only approximately 10% of the active licenses in North America are ultimately held, either directly or indirectly, by publicly-traded CRBs. And with the recent (albeit perfunctory) revelations out of Washington we expect continued growth into the future, but stress patience as the critical investor virtue.

Here are some of the November highlights:

Tier 1A Canadian CRB SNDL, Inc. (NASDAQ: SNDL) announced on November 1 that it successfully closed its acquisition of a Zenabis subsidiary business, pursuant to an approval order of the Québec Superior Court. According to the press release, “SNDL will acquire an indoor cultivation facility with considerable capabilities and proven outcomes, significant monetizable cannabis inventory, and valuable non-core real estate assets." SNDL holds 145 licenses covering all major types, with expansion into Malta thanks to the Zenabis acquisition.

Also in November Tier 1B MSO Trees Corporation (Neo: TREE) announced the signing of a definitive agreement to acquire GMC LLC d/b/a Green Man Cannabis Dispensary, located in Denver. According to the press release, “Total consideration for the acquisition will consist of 4,494,382 shares of common stock, with an ascribed stock price of $0.89 per share, a meaningful premium to the current stock price, and cash. The acquisition is expected to close prior to the end of this calendar year, subject to obtaining Colorado Marijuana Enforcement Division and local licensing approval.” Following this acquisition, Trees Corporation holds 21 active cannabis licenses in Oregon and Colorado.

Canadian Tier 1B CRB Tilray Brands, Inc. (NASDAQ: TLRY) announced the acquisition of Montauk Brewing Company. According to the press release, “Montauk Brewing is well-known for its beloved product portfolio, premium price point, and distribution across over 6,400 points of distribution, including top national retailers such as Target, Whole Foods, Trader Joe’s, Stop & Shop, King Kullen, Walmart, 7-Eleven, Costco, BJ’s, and Speedway.”

At this time, Montauk Brewing Company is not a cannabis-related business; however the press release goes on to say: “Upon federal legalization in the U.S., Tilray plans to take full advantage of its strategic infrastructure, operations and consumer loyal brands across beer, spirits, and snack-food categories to parlay into THC-based products and further expand its commercial opportunities.” Currently Tilray has cannabis operations across nine countries and holds 262 cannabis licenses in either active or pending status.

Finally, Tier 1B MSO and cannabis superpower Cresco Labs Inc. (CSE: CL) and its future subsidiary business Columbia Care Inc. (CSE: CCHW) announced the signing of definitive agreements to divest certain New York, Illinois, and Massachusetts assets to an entity owned and controlled by Sean “Diddy” Combs. According to the November 9th press release, “The divestiture of the Assets is required for Cresco to close its previously announced acquisition of Columbia Care. The Transaction is expected to close concurrently with the closing of the Columbia Care Acquisition. Total consideration for the Transaction is an amount up to US$185,000,000.”

The press release goes on to say, “The Transaction is Combs’ first investment in cannabis, the fastest growing industry in the U.S., and upon closing, will create the country’s first minority-owned and operated, vertically integrated multi-state operator. This industry-changing transaction is rooted in Cresco’s vision to develop the most responsible, respectable and robust industry possible, and advances Combs’ mission to open new doors in emerging industries for Black entrepreneurs and other diverse founders who are underrepresented and underserved.”

Select CRB Business Transaction Highlights:

|

Company Name |

Ticker Symbol |

CRBM Tier |

Event |

|

Tier 1A |

|||

|

Tier 1B |

|||

|

Tier 1B |

|||

|

Tier 1B |

Charlotte's Web Announces US$56.8 Million Investment from BAT |

||

|

Tier 1B |

|||

|

Tier 1B |

|||

|

Tier 1B |

|||

|

Tier 1B |

|||

|

Tier 1B |

Security/Exchange Highlights:

|

Company Name |

Ticker Symbol |

EVENT Type |

Result |

|

Warrant expiry |

|||

|

Warrant expiry |

|||

|

Warrant expiry |

|||

|

Stock Suspension/Delisting |

CSE Bulletin: Delist - Emerald Health Therapeutics, Inc. (EMH) |

||

|

Stock Suspension/Delisting |

Select New Additions to CRB Monitor:

|

Name |

Ticker Symbol |

CRBM Tier |

CRBM Cannabis Sector (CLS) |

| (None to report in November) |

Regulatory Updates - November 2022

We continued to monitor the regulatory news cycle in November in real time, and in spite of some obvious distractions (global economic woes, Russia/Ukraine conflict, midterm election results) there is always cannabis-related regulatory news to report and here is a sample of some of the more significant stories:

In November Kyle Jaeger published a story in Marijuana Moment about a federal agency that is proposing to replace a series of job application forms for prospective workers in a way that would treat past marijuana use much more leniently than under current policy. According to the article, “The Office of Personnel Management (OPM) first announced in a Federal Register notice last week that it was proposing the changes, which are currently open to public comment for a two-month period, partly because of “changing societal norms” amid the state-level legalization movement and to widen the applicant pool for qualified federal workers.”

The article goes on to say: “The draft Personnel Vetting Questionnaire (PVQ) would replace the current SF85, SF85P, SF 85P-S and SF86 forms, which each cover positions of varying levels of sensitivity and security. Those forms require applicants to disclose use of illicit drugs by checking them off on a list.”

In early November the US Senate voted to send the new Cannabis research bill to President Joe Biden for his signature. As reported in an article in MJ Biz Daily, the Senate approved bipartisan legislation that would “ease restrictions on medical marijuana-related research, sending to President Joe Biden’s desk the first of what the cannabis industry hopes is a flurry of MJ-related bills over the next month. It’s also the first time Congress has passed a bill solely related to marijuana.” Some would argue that this bill does not amount to a ripple in the ocean that is legalization and decriminalization, or even SAFE Banking; however it is the first cannabis reform legislation that has passed and so it is historic.

Meanwhile Reps. Barbara Lee (D-CA) and Earl Blumenauer (D-OR) sent a letter asking the Treasury Department’s Financial Crimes Enforcement Network (FinCEN) to provide marijuana banking data—including a demographic breakdown that they say can “inform federal efforts around equitably ending the racist cannabis prohibition.”

Also in November Green Market Report reviewed an MJ Biz Con speech by Curaleaf Executive Chairman Boris Jordan, in which Jordan suggested that “The modern marijuana industry is headed toward massive consolidation that will eventually feature just a handful of companies atop a global supply chain.” In an excerpt from the article, Jordan is clear on his prediction regarding the progress toward legalization:

“Such a monumental shift may be closer than many think, (Jordan) said, given what he’s hearing out of Curaleaf’s lobbying team in Washington, D.C. They indicate that the SAFE Banking Act still has a chance of becoming law this year, and that the Biden administration is focused on rescheduling cannabis within the next two years.

“We’re hearing from our people in Washington (D.C.) that they’re targeting a 2024 rescheduling of cannabis, from Schedule 1 to 3, 4, or 5,” Jordan said, adding that “there’s genuine bipartisan going on with SAFE Banking.”

If those two reforms come to pass, he said, “the two biggest impediments for the industry are gone,” referring to the 280E provision in the federal tax code and banking restrictions.

Jordan tacked on a warning, with a nod to the financial difficulties in much of the industry: “If we don’t get SAFE, you’ll see swaths of companies go out of business next year.”

This speech is significant given the timing as well as Curaleaf’s position as the largest Tier 1 CRB by market capitalization. CRB Monitor recognizes that while the future of cannabis is far from being in jeopardy, any road blocks on the path to Federal legalization will place a number of CRBs at risk and are likely to result in further consolidation in the industry. They are also a danger to Tier 2 businesses, who derive significant revenue from Tier 1 businesses.

Finally, MJ Biz Daily reported in mid-November that Missouri (yes, Missouri) could begin recreational marijuana sales in early February or even sooner, according to a spokesperson for the state. Under Missouri’s new constitutional amendment legalizing recreational cannabis – approved by the voters on November 8th, existing medical marijuana companies can apply on Dec. 8 to switch their business to adult use.

According to the report, “Under the law, the state must take action on the applications within 60 days, which would be Feb. 6. However, Lisa Cox, spokesperson for Missouri’s health department, told the Post-Dispatch that the state expects to convert licenses before that deadline – as soon as the agency has rules in place.”

CRBs in the News - November 2022

The following is a sampling of highlights from the November 2022 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

- SNDL Acquires Zenabis Business (Tier 1A)

- The Green Organic Dutchman Completes Strategic Merger with BZAM Cannabis (Tier 1B)

- Cresco Labs & Columbia Care Announce Planned Divestiture in Three Markets to Sean "Diddy" Combs, Creating the First Minority-Owned, Vertically Integrated Multi-State Cannabis Operator (Tier 1B)

- IIROC Trading Halt - PLTH.WT.C (Tier 1B)

- Burcon Appoints Specialty Protein Executive Kip Underwood as Chief Executive Officer (Tier 1A)

- Branded Legacy, Inc. Acquires Total Refinement Solutions, LLC (Tier 1B)

- CADIZ INC. ANNOUNCES $10 MILLION DIRECT PLACEMENT LED BY LARGEST INVESTORS (Tier 1B)

- Skye Bioscience Closes Acquisition of Emerald Health Therapeutics (Tier 2)

- CSE Bulletin: Delist - Emerald Health Therapeutics, Inc. (EMH) (Tier 1A)

- Charlotte's Web Announces US$56.8 Million Investment from BAT (Tier 1B)

- iAnthus Announces Appointment of Philippe Faraut as CFO (Tier 1B)

- Lifeist Wellness Secures Equity Facility with Alumina Partners and Closes First Tranche (Tier 1B)

- Hempacco and High Sierra Technologies, Inc. Announce Joint Venture to Manufacture, Market, and Distribute Low Odor Hemp Smokables Based on HSTI's and Hempacco's Patented and Patent Pending Technologies (Tier 1B)

- IIROC Trading Halt - PCLO.WT (Tier 1B)

- IIROC Trading Halt - PILL (Tier 1A)

- Cansortium Announces Change in Chief Financial Officer (Tier 1B)

- Molson Coors exits CBD drinks (Tier 1B)

- IIROC Trading Halt - FFNT.WT (Tier 1B)

- Hempacco and Sonora Paper Company Disclose New Joint Venture to Manufacture and Market Hemp Paper Smoking Products Including Hemp Blunts, Hemp Cones, and Hemp Tubes (Tier 1B)

- Medical Marijuana, Inc. Subsidiary Kannaway Expands Leadership Team With Appointment of Industry Veterans to Roles of Executive Vice President and Vice President of Information Technology (Tier 1A)

- Item 9 Labs Corp. Appoints Mike Weinberger to CEO Ahead of Approaching Transformational Acquisition (Tier 1B)

- Arcadia Biosciences (RKDA) Announces CFO Transition (Tier 1A)

- CordovaCann Partners with Jackson BevCo to Open Cannabis Stores Within the Jackson BevCo Convenience Store Footprint (Tier 1B)

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"