CRB Monitor Cannabis-Linked Securities 2nd Quarter 2021 Update

James B. Francis, CFA

Managing Director of Publicly Traded Securities Research, CRB Monitor

CRB Monitor tracks roughly 1,400 publicly-traded, Cannabis-Related Businesses (CRBs) globally, which have 1,500+ traded securities. We categorize CRBs into our proprietary cannabis risk tier framework and cannabis-based sectors. CRB Monitor also unravels and maintains complex corporate structures, linking publicly-traded parent companies to their underlying operational plant-touching subsidiaries. Custodian banks, broker/dealers, and asset managers find our data essential for pre-trade compliance, risk management, index construction, and portfolio analytics.

CRB Monitor Securities Database

As of June 30, 2021, the breakdown of publicly-traded, cannabis-linked securities was as follows:

| Security Type | Tier 1A | Tier 1B | Tier 2 | Tier 3 | Totals |

| Common Stock | 87 | 415 | 311 | 521 | 1,334 |

| Preferred Stock | 6 | 2 | 2 | 10 | |

| Convertible Debt | 2 | 21 | 1 | 1 | 25 |

| Debentures | 9 | 1 | 2 | 12 | |

| Rights | 5 | 2 | 7 | ||

| Units | 4 | 8 | 1 | 13 | |

| Warrants | 12 | 92 | 22 | 13 | 139 |

| Exchange-Traded Funds | 74 | 1 | 75 | ||

| Market Indexes | 34 | 34 | |||

| Totals | 101 | 660 | 348 | 540 | 1,649 |

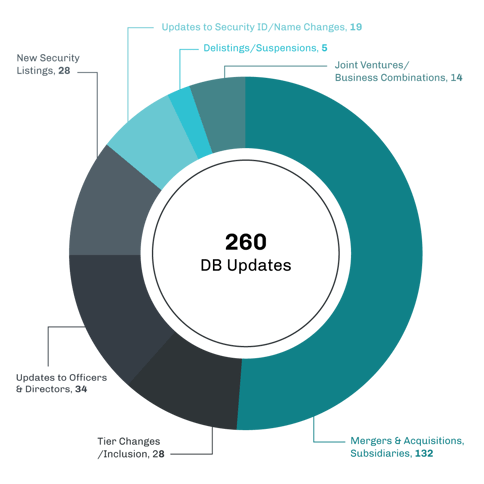

Of the thousands of announcements and filings reviewed during Q2 2021, our research resulted in a total of 1,023 updates to the CRB Monitor database (260 updates to issuers’ records, 763 news releases added). The complete list of securities and detail for these updates can be found in the CRB Monitor database. And for plenty of detail on our updates to the CRB Monitor database, please refer to our monthly newsletters: CRB Monitor April 2021 newsletter, CRB Monitor May 2021 newsletter, and the CRB Monitor June 2021 newsletter.

CRB Monitor Expands ETF Coverage & Adds Cannabis-Linked Sectors

CRB Monitor is pleased to announce that we have expanded the CRB Monitor securities database to include coverage of all ETFs that hold at least one "Pure Play" Tier 1A or Tier 1B cannabis-related security. [We define "pure play" as a company that earns, or intends to earn, at least 50% of its revenue from cannabis-related activities.] Our research has uncovered 51 non-cannabis-themed ETFs to the CRB Monitor database; we add these to the existing list of 23 listed cannabis-themed ETFs, to bring our ETF coverage to 73 funds. This expansion is great news for financial institutions who need to monitor all cannabis exposure, with no exceptions, across their investment and custody platforms.

Also during the second quarter of 2021, CRB Monitor announced the creation and addition of our Cannabis-Linked Sector Classification System (CLS) to our global universe of roughly 1,400 publicly-traded cannabis companies issuers and their 1,500+ securities listed on six continents. A complete summary and description of the methodology can be found on the CRB Monitor website.

CRB Monitor Securities Database Updates

Source: CRB Monitor

CRBs In the News

The cannabis news cycle remained active in the second quarter of 2021, at the regulatory level and with companies’ M&A activity as well. The following is a sampling of highlights, with links to the articles, from the cannabis-linked security news cycle, as tracked by CRB Monitor throughout the period. Included are CRB Monitor’s proprietary Risk Tiers.

In April, The Governor of New Mexico signed an adult-use legalization bill into law while the Minnesota’s House of Representatives prepared to vote on adult-use marijuana as well. Also in the month of April, Canopy Growth Corporation (TSX: WEED) announced its acquisition of The Supreme Cannabis Company, Inc. (TSXV: FIRE). While this is not as large as the blockbuster deals we have witnessed in Q1 – this deal is valued at approximately $435 million – it represents, nonetheless, further consolidation in the cannabis industry.

During May 2021 US Congressman Jerry Nadler (D-NY) introduced a new legalization/decriminalization bill called the Marijuana Opportunity Reinvestment and Expungement Act of 2021, also known as H.R. 3884, or the MORE Act. If passed and signed into law, the MORE Act effectively would federally legalize cannabis by removing it from the Federal Controlled Substances Act. Also in May we witnessed the closing of two blockbuster Tier 1 CRB deals: Jazz Pharmaceuticals' acquisition of GW Pharmaceuticals plc and Tilray’s completion of its acquisition of Aphria Inc.. And Hexo Corp. (TSX: HEXO) announced its second major acquisition of 2021 with its proposed purchase of 100% of 48North Cannabis Corp. 48North (TSXV: NRTH) is a Tier 1B small cap ($50mm) CRB that holds licenses in Canada for both cultivation and sale of medical and recreational cannabis. This follows HEXO’s $235mm purchase of Zenabis Global Inc. (TSX: ZENA) earlier this year.

In June, Connecticut’s governor Ned Lamont signed into law Senate Bill 1201, aka “AN ACT CONCERNING RESPONSIBLE AND EQUITABLE REGULATION OF ADULT-USE CANNABIS.” With his signature, Connecticut became the 19th state (plus the District of Columbia) where cannabis is legal for adult use. This law was designed to be comprehensive, covering essentially every aspect of life as it is touched by the cannabis industry. Also in June, The Valens Company Inc. (TSX: VLNS), a diversified, Canada-based Tier 1B CRB, completed its $40 million acquisition of Green Roads, a leading US-based hemp-derived CBD manufacturer. With this purchase, it is clear that Valens is looking to be a dominant player in the production and distribution of both THC- and CBD-based products. Valens also signed an agreement in late June to manufacture beverages and edibles for Gallery Brands, a premier Canadian distributor.

Cannabis-Linked Equity Performance

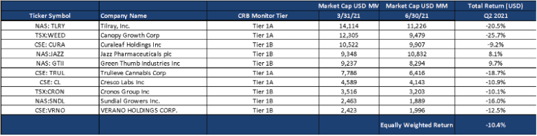

Cannabis-linked equities struggled in the second quarter of 2021, giving back a portion of the staggering returns investors enjoyed in Q1. The markets were not kind to Tier 1B CRB Tilray, Inc. (Nasdaq: TLRY), as it’s price fell more than 20% in Q2 in the face of new challenges following its acquisition of Aphria Inc. (TSX: APHA) earlier in 2021. Still up more than 90% for the year, TLRY’s return seems to be based on something other than fundamentals, as the acquisition of Aphria resulted in balance sheet debt of more than $300 million.

Tier 1A CRB Canopy Growth Corporation (TSX: WEED), the number two pure play CRB by market cap, gave up more than 25% in Q2 2021. WEED has fallen a breathtaking 60% from its high in early February, when CEO David Klein announced better-than-expected quarterly earnings numbers. However, since mid-February it appears as though the wind has been knocked out of Canopy’s sails. Investors in Canopy Growth must be wondering where the bottom is, and when it’s safe to jump back in. Investors also witnessed sharp drops in “marquee” Tier 1 CRBs Cresco Labs (CSE: CL), Cronos Group Inc. (TSX: CRON), Trulieve Cannabis Corp. (CSE: TRUL), and Sundial Growers Inc. (NASDAQ: SNDL), as the sector generally recoiled in early April and did not fully recover.

One positive note for the quarter was Tier 1B Jazz Pharmaceuticals plc (NASDAQ: JAZZ), which was up 8% for Q2 following the completion of its $7.5 billion acquisition of 100% of GW Pharmaceuticals in early May.

As always we continue to monitor the cannabis space as cannabis companies respond to impact from significant ongoing forces - new legalization/decriminalization measures emerging at the state level; the economic and financial impact brought about by the COVID-19 pandemic; and, perhaps the most interesting, are the latest developments coming out of the US Federal Government.

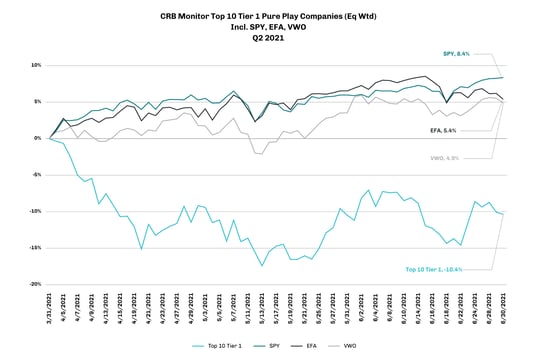

The CRB Monitor Top 10 Tier 1 Pure Play cannabis-linked equities retuned a negative 10.4% in Q2 2021 on an equally-weighted basis. Our Top 10 underperformed major equity indexes (US large cap, International, Emerging Markets) for the period.

Source: CRB Monitor, Sentieo

CRB Monitor “Top 10” Tier 1 Cannabis Companies – Performance

Source: CRB Monitor, Sentieo

Source: CRB Monitor, Sentieo

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"