James B. Francis, CFA

Managing Director of Publicly Traded Securities Research, CRB Monitor

CRB Monitor tracks nearly 1,300 publicly-traded, Cannabis-Related Businesses (CRBs) globally, which have 1,500+ traded securities. We categorize CRBs into our proprietary cannabis risk tier framework and cannabis-based sectors. CRB Monitor also unravels and maintains complex corporate structures, linking publicly-traded parent companies to their underlying operational plant-touching subsidiaries. Custodian banks, broker/dealers, and asset managers find our data essential for pre-trade compliance, risk management, index construction, and portfolio analytics.

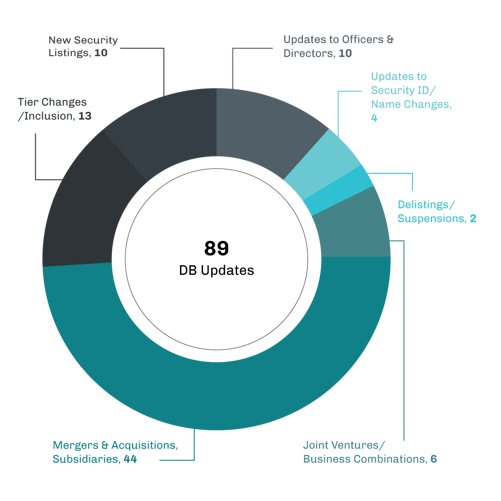

CRB Monitor Securities Updates – May 2021

Source: CRB Monitor

Cannabis Securities News Highlights

M&A Updates

The cannabis news cycle never seems to sleep, and in May 2021 investors were treated to a new crop of stories that continue to tell the evolving story of this emerging industry. There was a continuation of the M&A activity that started in Q1, with the closing of two significant Tier 1 CRB deals: Jazz Pharmaceuticals' acquisition of GW Pharmaceuticals plc and Tilray’s completion of its acquisition of Aphria Inc. Both transactions were blockbuster events for the cannabis industry, and during May, two new, impactful M&A deals hit the news cycle. First, Hexo Corp. (TSX: HEXO) announced its second major acquisition of 2021 with its proposed purchase of 100% of 48North Cannabis Corp. 48North (TSXV: NRTH) is a Tier 1B small cap ($50mm) CRB that holds licenses in Canada for both cultivation and sale of medical and recreational cannabis. This follows HEXO’s $235mm purchase of Zenabis Global Inc. (TSX: ZENA) a few months ago, which is a clear indication of HEXO’s strategy of maintaining its position in both medical and adult use cannabis markets. The other significant M&A deal in May in the publicly-listed space was the proposed acquisition of Inner Spirit Holdings Ltd. (CSE: ISH) by Sundial Growers Inc. (NASDAQ: SNDL). The Inner Spirit deal, valued at approximately $130 million, will further solidify Sundial’s status as a significant player in the legal cannabis space, lifting its market capitalization to approximately $2 billion, which further solidifies its position in the “Top 10” of pure play Tier 1 CRBs.

Regulatory Updates

In US regulatory news, the train kept rolling with the introduction late in May by Congressman Jerry Nadler (D.- NY) of a new legalization/decriminalization bill called the Marijuana Opportunity Reinvestment and Expungement Act of 2021, also known as H.R. 3884, or the MORE Act. If passed and signed into law, the MORE Act effectively would federally legalize cannabis by removing it from the Federal Controlled Substances Act. Additionally, the MORE Act, if passed and signed into law, would do the following:

- Replace statutory references to marijuana and marihuana with cannabis,

- Require the Bureau of Labor Statistics to regularly publish demographic data on cannabis business owners and employees,

- Establish a trust fund to support various programs and services for individuals and businesses in communities impacted by the war on drugs,

- Impose a 5% tax on cannabis products and require revenues to be deposited into the trust fund,

- Make Small Business Administration loans and services available to entities that are cannabis-related legitimate businesses or service providers,

- Prohibit the denial of federal public benefits to a person on the basis of certain cannabis-related conduct or convictions,

- Prohibit the denial of benefits and protections under immigration laws on the basis of a cannabis-related event (e.g., conduct or a conviction),

- Establish a process to expunge convictions and conduct sentencing review hearings related to federal cannabis offenses, and

- Direct the Government Accountability Office to study the societal impact of cannabis legalization.

The greatest challenge faced by proponents of the MORE Act (assuming it passes the US House of Representatives) is for it to pass the Senate, which is a long shot based on the current political divide there. In other words, for proponents of cannabis legalization/decriminalization, there isn’t a wealth of optimism here given the history of weak Republican support for cannabis reform. Stay tuned for updates!

Select M&A/Corporate Structure Updates:

|

Name |

Ticker Symbol |

CRBM Tier |

Event |

|

Tier 1B |

Jazz Pharmaceuticals Completes Acquisition of GW Pharmaceuticals plc |

||

|

Tier 1B |

Jushi Holdings Inc. Completes Acquisition of Two California Retail Dispensaries |

||

|

Tier 1B |

|||

|

Tier 1B |

|||

|

Tier 1A |

Sundial Growers to Acquire Inner Spirit Holdings and Spiritleaf Retail Cannabis Network |

||

|

Tier 1B |

|||

|

Tier 1B |

|||

|

Tier 1B |

Kiaro enters Ontario, US and Australia through Strategic Acquisition of Cozy Cannabis |

||

|

Tier 1B |

Mercer Park Brand Acquisition Corp. Announces $50 Million Equity Investment from The Parent Company |

Select Security/Exchange Updates:

|

Name/Ticker Symbol |

Ticker Symbol |

EVENT Type |

Result |

|

Name Change |

|||

|

Name Change |

|||

|

New Listing |

|||

|

Name Change |

|||

|

Name Change |

Golden Leaf Announces Timing of Corporate Name Change to Chalice Brands Ltd. and Share Consolidation |

||

|

New Listing |

|||

|

New Listing |

IntelGenx Announces Noteholder Approval of Proposed Amendments to Convertible Notes |

||

|

Name Change |

Select Risk Tier/Inclusion Updates in CRB Monitor:

|

Name |

Ticker Symbol |

Action |

Reason |

|

Upgrade –Tier 2 to Tier 1A |

Bod records highest ever monthly sales of medicinal cannabis products |

||

|

Upgrade –Tier 3 to Tier 1B |

Select New Additions to CRB Monitor:

|

Name |

Ticker Symbol |

CRBM Tier |

CRBM Cannabis Sector |

|

Tier 3 |

Financial Services |

||

|

Tier 1B |

Owner/Investor |

||

|

Tier 1B |

ETF – Cannabis-Themed |

||

|

N/A |

Tier 1B |

Index |

|

|

Tier 3 |

Food, Beverage & Tobacco |

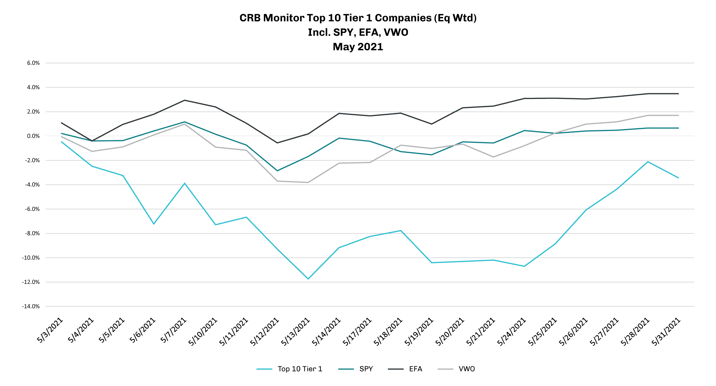

Cannabis-Linked Equity Performance

In a continuation from April’s weak performance, cannabis-linked equities were mixed but were generally lower for most of the month of May 2021. A rebound in the final week of May was of little consolation, as CRBs (with a few notable exceptions) finished in negative territory for the month.

Tier 1A multi-state operator (MSO) Columbia Care (NEO: CCHW)’s stock lost more than 13% during the month of May in spite of strong quarterly earnings that were reported in the middle of the month. In fact, according to Columbia Care’s CEO, Nicholas Vita, “in Q1 we generated $92.5 million in combined revenue, up 13% sequentially and 220% year-over-year.” Investors welcomed this news, pushing CCHW’s stock up 15% between May 21 and May 27, before it collapsed once again over the last few trading days of the month.

Tier 1A CRB Tilray, Inc. (Nasdaq: TLRY), now the largest pure play CRB by market cap and revenue, fell by more than 25% in the first two weeks of May before buyers jumped back in and pushed the stock higher and it finally closed down 9% for the month. With an average daily volume of more than 33 million shares (~$600mm) Tilray is, by far, the most actively-traded CRB and sadly one of the most volatile. As we wrote in an earlier newsletter, “TLRY has famously been one of those vulnerable companies, with a volatile performance history and a reputation as sometimes impossible to borrow (and therefore a settlement challenge).”

Tier 1A CRB Canopy Growth Corporation (TSX: WEED), the number two pure play CRB by market cap, suffered a similar fate, losing nearly 9% as many CRB stocks pulled back in May. WEED has fallen a breathtaking 60% from its high in early February, when CEO David Klein announced better-than-expected quarterly earnings numbers. However, since mid-February it appears as though the wind has been knocked out of Canopy’s sails. Investors in Canopy Growth must be wondering where the bottom is, and when it’s safe to jump back in.

On a positive note, Sundial Growers Inc. (NASDAQ: SNDL)‘s shares soared on two announcements that made investors optimistic: first, SNDL announced in early May its acquisition of Inner Spirit Holdings and Spiritleaf Retail Cannabis Network; and second, SNDL’s announcement of Q1 earnings, which sent is stock skyward once again. The gist of the announcement, from CEO Zach George, was that SNDL was happy to announce “Sundial's first-ever quarter with positive earnings from operations and adjusted EBITDA”. Investors responded in kind, and SNDL shares closed out May more than 12% higher.

In spite of their extreme volatility during the month, the CRB Monitor Top 10 Tier 1 cannabis-linked equities basket fell by just 3.5% in May 2021, on an equally-weighted basis, underperforming major equity indexes (US large cap, International, Emerging Markets).

CRB Monitor “Top 10” Tier 1 Cannabis Companies

Source: CRB Monitor, Sentieo

Source: CRB Monitor, Sentieo

CRBs In the News – May 2021

May 2021 was a continuation of a busy news cycle for publicly-traded cannabis-linked companies. The following is a sampling of highlights from the May 2021 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

- Affinor Growers Prepares for Vertical Farming in Aruba (Tier 1B)

- HempFusion Signs Definitive Agreement to Acquire Pioneering CBD Brand Apothecanna (Tier 2)

- The Valens Company Continues Domestic Expansion with Entry into New Brunswick Cannabis Market (Tier 1B)

- BevCanna Signs Agreement to Infuse Vertosa's Emulsions into Its Cannabis Beverages (Tier 1A)

- Vext Science Receives Approval from the State of Arizona to Begin Operations in Newly Built-Out Manufacturing Facility (Tier 1B)

- Glass House Group Awarded Two Additional Santa Barbara Retail Licenses (Tier 1B)

- THC Farmaceuticals, Inc. Acquires Controlling Interest in G.K. Manufacturing from Cannabis Sativa, Inc. (Tier 2)

- CBD of Denver Expands its Swiss Production with New Company-Owned Extraction and Washdown Facility (Tier 1B)

- Blackhawk's Subsidiary Spaced Food Ramps Up Production of Cannabis Infused Edibles (Tier 1B)

- Grapefruit USA, Inc. Issues Further Update Concerning Formation of Joint Venture with Canadian Partner to Distribute Hourglass Products; Possible Acquisition (Tier 1B)

- New You, Inc. Merges with ST Brands to Create Holding Company for Global Cannabis-Related Products and Services (Tier 2)

- Flora Growth Forms Flora Lab Manufacturing Division Around Recently Acquired GMP-Certified Laboratory (Tier 1A)

- WeedMD Launches New Product Collaboration with CannTx Life Sciences for Release of Limited Edition Cultivars to Starseed Medicinal (Tier 1B)

- SPAC Stable Road Dealt Fresh Setback as Merger Partner Backs Away From Revenue Guidance (Tier 2)

- Global Hemp Group Acquires Strategic Property for its Colorado Hemp Agro-Industrial Zone (Tier 1B)

- High Tide Closes Acquisition of Leading CBD E-Commerce Retailer FABCBD (Tier 1B)

- IONIC Brands to Produce CBD Vape Products in Japan, Its First International Licensing Agreement (Tier 1B)

- Here To Serve Holding Corp. Announces Further Increase in the Value of its Equity Portfolio (Tier 1B)

- Sweet Earth Acquires Rights for Pure America Hemp Brand and Enters Into Manufacturing Agreement With Pure Products LLC (Tier 1A)

- Can B Corp. Enters the Industrial Hemp Business (Tier 1B)

- Item 9 Labs Corp.'s Dispensary Franchise, Unity Rd., Signs New Multi-Unit Franchise Agreement (Tier 1B)

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"