James B. Francis, CFA

Chief Research Officer, CRB Monitor

CRB Monitor tracks ~ 1,400 publicly-traded, Cannabis-Related Businesses (CRBs) globally, which have 1,500+ traded securities. We categorize CRBs into our proprietary cannabis risk tier framework and cannabis-linked (CLS) sectors. In addition, CRB Monitor unravels and maintains complex corporate structures, linking publicly-traded parent companies to their underlying operational plant-touching subsidiaries. Custodian banks, broker/dealers, and asset managers find our data essential for pre-trade compliance, risk management, cannabis related business stocks, index construction, and portfolio analytics.

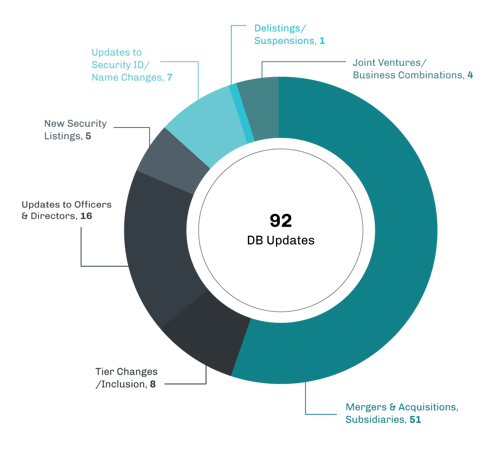

CRB Monitor Securities Database Updates

Source: CRB Monitor

CRB Monitor Expands ETF Coverage & Adds Cannabis-Linked Sectors

CRB Monitor is pleased to announce that we have expanded the CRB Monitor securities database to include coverage of all ETFs that hold at least one "pure play" Tier 1A or Tier 1B cannabis-related security. [We define "pure play" as a company that earns, or intends to earn, at least 50% of its revenue from cannabis-related activities.] Our research has uncovered 51 non-cannabis-themed ETFs to the CRB Monitor database; we add these to the existing list of 23 listed cannabis-themed ETFs, to bring our ETF coverage to 73 funds. This expansion is great news for financial institutions who need to monitor all cannabis exposure, with no exceptions, across their investment and custody platforms.

Also during the second quarter of 2021, CRB Monitor announced the creation and addition of our Cannabis-Linked Sector Classification System (CLS) to our global universe of ~1,400 publicly-traded issuers and their 1,500+ securities listed on six continents. A complete summary and description of the methodology can be found on the CRB Monitor website.

Cannabis M&A Updates

Given the magnitude of the M&A activity completed in Q1 2021, June seemed tranquil in comparison. With that said, investors were treated to plenty of notable corporate activity in the cannabis industry. Some highlights:

The Valens Company Inc. (TSX: VLNS), a diversified, Canada-based Tier 1B CRB, completed its $40 million acquisition of Green Roads, a leading US-based hemp-derived CBD manufacturer. With this purchase, it is clear that Valens is looking to be a dominant player in the production and distribution of both THC- and CBD-based products. Valens also signed an agreement in late June to manufacture beverages and edibles for Gallery Brands, a premier Canadian distributor. In spite of this positive news, Valens’ shares fell significantly in June, closing more than 11% lower for the month.

TPCO Holding Corp. (NEO: GRAM.U), aka The Parent Company, has been making its presence known, having recently acquired several cannabis businesses in California, the latest of which is called Calma, a dispensary located in the West Hollywood area. TPCO, originally launched as a SPAC, is widely known as the pet project of entertainment magnate Shown “Jay-Z” Carter and his record company, Roc Nation.

Australian Tier 1B CRB Creso Pharma Ltd. (ASX: CPH) and Ontario-based Tier 1B magic truffle manufacturer Red Light Holland Corp. (CSE: TRIP) have agreed to merge their businesses to form The HighBrid Lab, a new entity that will specialize in both cannabis products and psychedelics. According to a mid-June press release, “The Combined Company is expected to have a cash balance of approximately C$45 million, providing considerable financial flexibility to progress its growth strategy.” One familiar face on the new company’s board will be Bruce Linton, who has held senior positions at several cannabis-related entities including former CEO of Canopy Growth (TSX:WEED).

And the acquisition train keeps rolling for Tier 1B Verano Holdings Corp. (CSE: VRNO). Verano added its 34th medical cannabis dispensary, called MUV, during the month of June 2021. Per the CRB Monitor database, this brings Verano’s active and pending license count to 98 across 18 states in the US.

Select M&A/Subsidiary Highlights:

Regulatory Updates

On June 22nd Connecticut’s governor, Ned Lamont, signed into law Senate Bill 1201, aka “AN ACT CONCERNING RESPONSIBLE AND EQUITABLE REGULATION OF ADULT-USE CANNABIS.” With his signature, Connecticut became the 19th state (plus the District of Columbia) where cannabis is legal for adult use.

This law was designed to be comprehensive, covering essentially every aspect of life as it is touched by the cannabis industry. Here is a complete list of the aspects of Connecticut’s newly-signed cannabis law.

|

Section of New Law |

Summary |

|

Possession |

Legal up to 1.5 oz. |

|

Licensed retail sales |

In effect by the end of 2022 |

|

Homegrown |

Maximum of 6 plants per adult, indoors only |

|

Erases prior convictions |

Erases cannabis convictions between 2000-2015 |

|

Equity and investments |

Supports social equity of applicants in the cannabis market |

|

Tax structure |

Creates new sources of revenue for communities |

|

Revenue (1) |

Directs revenue to underserved communities |

|

Revenue (2) |

Directs revenue to support substance misuse prevention |

|

Preventing underage use |

Strengthens laws governing underage cannabis use |

|

Safe driving laws |

Strengthens Connecticut’s impaired driving statutes |

|

Advertising |

Strict standards on advertising geared toward minors |

|

Safe products |

Imposes strong requirements for product safety |

|

Municipalities and zoning |

Controls number of local cannabis businesses through zoning |

|

Employment |

New workplace laws governing prior cannabis usage |

|

Medical marijuana |

Expands medical marijuana program for participants |

|

State parks and beaches |

Cannabis use prohibited in state parks, beaches, on state waters |

Per CRB Monitor, Connecticut currently has 274 active medical marijuana licenses that are held by 18 cannabis businesses (CRBs), of which several are subsidiaries of two publicly-traded CRBs, Curaleaf Holdings, Inc. (CSE: CURA), and Trulieve Cannabis Corp. (CSE: TRUL). Given that Connecticut’s expansion into legal adult-use cannabis sales will occur sometime in 2022, it is safe to anticipate new license issuance and new interest from Tier 1 publicly traded CRBs in the Q3 and Q4, so stay tuned!

Security/Exchange Highlights:

|

Company Name |

Ticker Symbol |

EVENT Type |

Result |

|

New Listing |

High Tide Begins Trading on Nasdaq Today Under Symbol "HITI" |

||

|

Name Change |

Clean Power Announces Name Change to PowerTap Hydrogen Capital Corp. |

||

|

New Listing |

Social Life Network Up Listing to the OTCQB - The Venture Market |

||

|

New Listing |

|||

|

Delisting/new listing |

|||

|

ID/Name Change |

|||

|

New Listing |

Cadiz Inc. Announces Offering of Depositary Shares and Series A Cumulative Perpetual Preferred Stock |

||

|

Name Change |

ParcelPal Technology, Inc. Announces Name Change to ParcelPal Logistics Inc. |

Select New Additions to CRB Monitor:

|

Name |

Ticker Symbol |

CRBM Tier |

CRBM Cannabis Sector (CLS) |

|

Tier 2 |

Personal Products |

||

|

Tier 2 |

Personal Products |

||

|

Tier 2 |

Financial Services |

||

|

Tier 1B |

Owner/Investor |

||

|

Tier 1B |

Owner/Investor |

Cannabis-linked Equity Performance

June 2021 was a somewhat mixed month for cannabis securities’ performance, as summer began in earnest and the world cautiously emerged from the COVID-19 pandemic. With that said, the cannabis industry continues to be a volatile space for investors and the largest CRBs do not fail to confirm that statement, regardless of the season.

Tier 1B CRB Green Thumb Industries Inc. (CSE: GTII), a manufacturer and distributor of cannabis brands such as Beboe, Dogwalkers, and Dr. Solomon’s, extended its gains in June, returning more than 13% for the month. Still on a veritable high following exceptional Q1 results, Green Thumb continued the expansion of its Massachusetts operations with the completion of its acquisition of Liberty Compassion, Inc., which includes both cultivation and retail.

Shares of Tier 1B multi-state operator Verano Holdings Corp. (CSE: VRNO) were 12.5% lower for the month amidst the news in mid-June that they were now DTC-eligible. Investors perceive this as a positive in the long-term, as it should bring in a broader shareholder base and increased trade volume.

Tilray, Inc. (Nasdaq: TLRY)’s shares once again provided a bit of drama for investors, soaring 26% between June 1st and June 9th, only to fall back to earth to the point where the stock was trading essentially flat by June 18th, before closing out the month up 6.5%. Still up more than 90% for the year, TLRY’s return seems to be based on something other than fundamentals, given that its blockbuster acquisition of Aphria earlier in 2021 has resulted in balance sheet debt of more than $300 million. But wise investors are aware of this volatility, which is largely driven by heavy stock borrow demand combined with a low free float. And with all this debt hanging in the balance, Irwin Simon, Tilray’s Chairman and CEO, issued a press release on June 29th, asking his shareholders for help:

“Tilray is seeking to increase the number of authorized shares of common stock, so that it may use its stock to acquire and finance attractive businesses that would help Tilray grow and create value for stockholders.”

Investors did not appear to love this announcement, given that Simon is asking for more than a 50% dilution with this issuance. Shares fell by about 5% on the 29th and stayed there on the 30th.

Cronos Group Inc. (TSX: CRON) delivered shareholders a return of 6.5% in June, as investors appeared to look favorably upon the mid-month announcement of Cronos’ subsidiary’s buy of a long-dated option on approximately 10.5% of vertically-integrated US CRB PharmaCann. While the purchase is contingent on US federal legalization, investors are seeing these types of strategic moves essential for Cronos’ competitiveness in the cannabis space, given the recent flurry of M&A activity that has left Cronos in 8th place in terms of market capitalization.

The CRB Monitor Top 10 Tier 1 Pure Play cannabis-linked equities added 1.0% in June on an equally-weighted basis, which landed it in the middle relative to major equity indexes (US large cap, International, Emerging Markets).

CRB Monitor “Top 10” Tier 1 Cannabis Companies

Source: CRB Monitor, Sentieo

Source: CRB Monitor, Sentieo

CRBs In the News

June 2021 was a continuation of a busy news cycle for publicly-traded cannabis-linked companies. The following is a sampling of highlights from the June 2021 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

- Green Thumb Closes on Acquisition of Massachusetts Cannabis Operator Liberty Compassion Inc. (Tier 1B)

- Icanic Brands Enters into Definitive Agreement to acquire De Krown Enterprises LLC (Tier 1B)

- Metrospaces Announces Strategic Investment in Good Hemp (Tier 3)

- 22nd Century Advances Initiatives to Strengthen and Maximize Revenue Opportunities in Hemp/Cannabis Franchise (Tier 1A)

- Flora Expands Presence into EU; Signs LOI to Become Long-Term Strategic Partner to Hoshi International (Tier 1A)

- iBrands Corporation Appoints New CEO And Changes Business Focus (Tier 1B)

- Terra Tech Corp. Executes an Agreement to Acquire SilverStreak Solutions Inc. (Tier 1B)

- Willow Biosciences and Cellular Goods Announce Multiyear Supply Agreement for Cannabigerol (CBG) (Tier 1B)

- Greenrose Acquisition Corp Announces Intention to Voluntarily Delist from Nasdaq and List on the OTCQX Best Market (Tier 3)

- V Group, Inc. Keeps Creating Value for Shareholders (Tier 1B)

- Flora Growth to Acquire Koch & Gsell and Enter Europe with Leading Manufacturer of Natural Swiss Hemp Products (Tier 1A)

- Citizen Stash Cannabis Corp. (Formally Experion Holdings Ltd.) is Now Trading Under Symbol "CSC" on the TSX.V (Tier 1B)

- Weedmaps Cannabis Co. Debuts On Nasdaq After Merger With Spike Silver Acquisition Corp (Tier 2)

- Medical Marijuana, Inc. Names New Chief Executive Officer (Tier 1A)

- Red Light Holland to Partner with Leading Fresh and Dried Mushroom Producers on East Coast Facility (Tier 1B)

- The Parent Company Partners with Omura to Launch New Caliva Flowersticks (Tier 1B)

- Schwazze Signs Definitive Agreement to Acquire Drift (Tier 1A)

- Myconic Capital Becomes Ketamine One (Tier 2)

- Fiore Cannabis to Acquire California Cannabis Delivery Firm in $1.2 Million Transaction to Strengthen Market Focus (Tier 1B)

- Canapar Corp. Receives Shareholder Approval for Business Combination With RAMM Pharma (Tier 1B)

- Herb & CBD Hemp Cigarette Industry Leader Hempacco Announces Completion of Reverse Merger with Shareholders of Green Globe International, Inc., Ticker GGII (Tier 1B)

- Vertical Wellness Announces Merger with CanaFarma Hemp Products Corp. (Tier 1B)

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"