James B. Francis, CFA

Chief Research Officer, CRB Monitor

Cannabis-Related Equity Performance

Source: CRB Monitor, Sentieo, Nasdaq

Source: CRB Monitor, Sentieo, Nasdaq

Cannabis Index Returns - Still Negative, But Less Negative

For the third month in a row, cannabis equities posted negative returns, but somewhat less negative than before. Contributing to their moderation was investors’ sentiment related to progress with the latest version of the SAFE Banking Act (S.1323). While still in early stages in the Senate by the end of April, this version gave investors and CRBs a ray of hope that, at the very least, their transactions would no longer be penalized by the US Federal Government. And it remains to be seen if this bill will pass the Senate and then the real test, a vote in the House of Representatives. But there is hope.

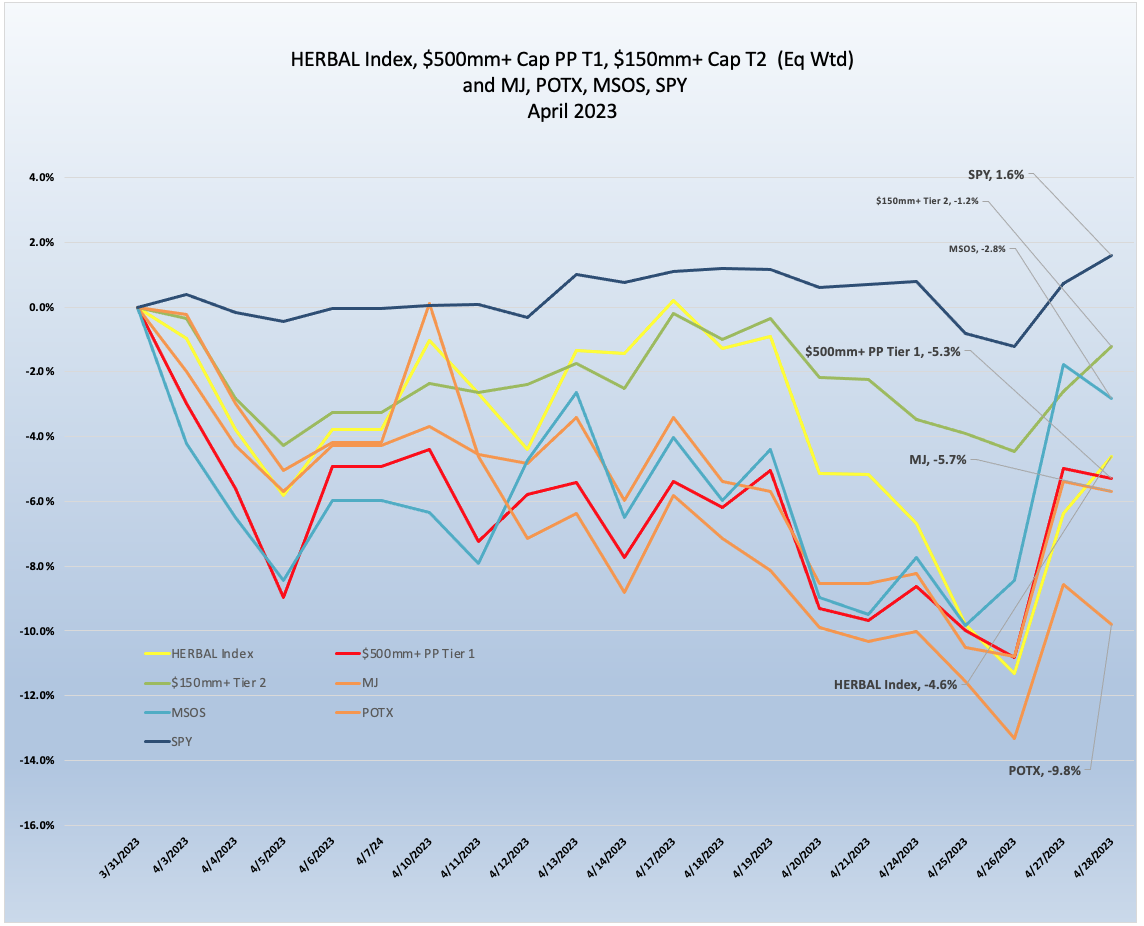

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), a mix of Pure Play Tier 1 and Tier 2 CRBs weighted by both investability and strength of theme (SOT), finished April in the middle of the pack of cannabis-themed indexes. A full description of HERBAL’s strengths and benefits can be found here: Introducing: The Nasdaq CRB Monitor Global Cannabis Index.

The HERBAL index fell by 4.6% in April 2023 and once again finished stronger than its closest competitor in the cannabis equity universe, the Global X Cannabis ETF (Nasdaq: POTX) (-9.8%). Similar to HERBAL, POTX is a pure play cannabis ETF with no US touchpoints and any deviations from the return of the HERBAL index will largely be due to differences in security weightings (Strength of Theme et al). This is the third consecutive month in which HERBAL has finished ahead of POTX.

HERBAL also finished ahead of the ETFMG Alternative Harvest ETF (NYSE Arca: MJ) (-5.7%) and behind the Advisorshares Pure US Cannabis ETF (NYSE: MSOS), which finished April at -2.8%.

MJ’s performance is likely to deviate from HERBAL’s due to a significant percentage of non-Pure Play cannabis holdings, more specifically tobacco stocks with either very small or even no cannabis exposure at all. And more recently, MJ added a 20% US plant-touching component via a holding in its sister fund, MJUS. The US plant-touching component also has the potential to impact MJ’s eligibility on investment platforms that restrict US cannabis exposure.

Monthly returns of the self-described and largest US plant-touching ETF, MSOS, can deviate materially from HERBAL’s as well, largely due to its holdings of CRBs with US Marijuana touch-points. [POTX’s and HERBAL’s methodologies prohibit them from holding any securities with direct US touch points while MSOS and MJ can.]

The performance of the CRB Monitor equally-weighted basket of Pure Play Tier 1 CRBs with $500mm+ market was -5.3% in April 2023, with the basket being more negatively affected by the Canadian (non-MSO) component than the MSO basket. Looking at the table below, we see how the CRBs without US touchpoints provided the drag on the basket for the month. A more detailed analysis of Tier 1 CRB performance can be found below.

The CRB Monitor equally-weighted basket of Tier 2 CRBs with $150mm+ market cap finished the month ahead of the Tier 1 CRB basket, posting a negative -1.2% return. While we expect Pure Play Tier 1 and Tier 2 CRBs to display high correlation (~0.8) in the long term, their respective performance has a tendency to diverge in the short term. This can be due to (among other factors) the lag from the impact (positive or negative) of market forces that affect their sources of revenue that are derived from the Tier 1 group. We’ll take a closer look at these later in this newsletter.

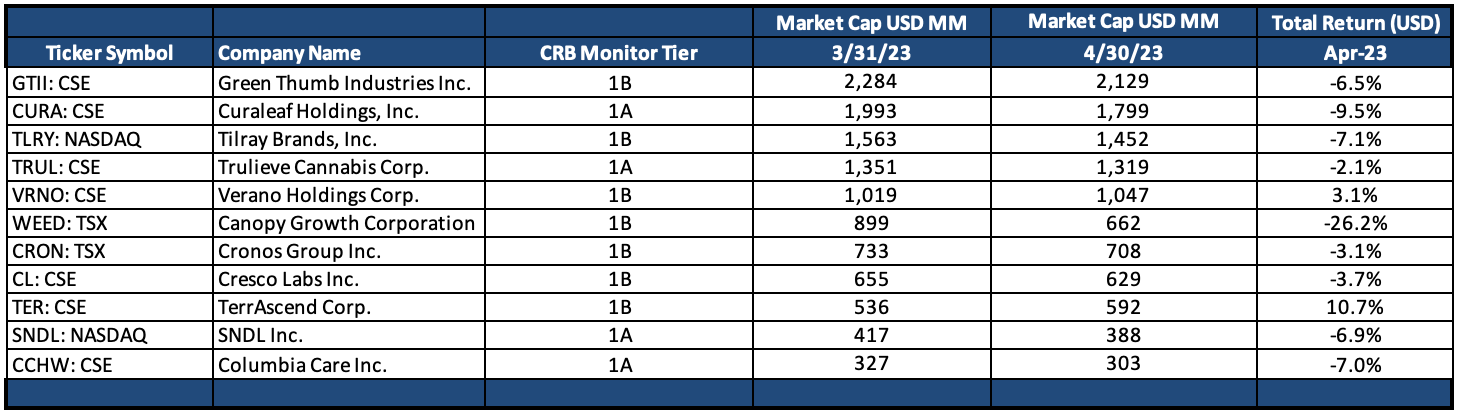

Tier 1 Pure Play CRBs w/Mkt Cap Over $500mm – April 2023 Returns

Source: CRB Monitor, Sentieo

CRB Monitor Tier 1

CRB equities continued their downward trend in April, although not quite as a bad as they had done in February and March. As usual, there were few positive stories to tell but we will try. We typically separate the MSO (US plant-touching) group from the Canadian (non-plant-touching) group. And while we saw some differences in performance between Canadian CRBs and MSOs, there were few winners in April.

Performance differences between the two groups is understandable given their respective sensitivity to, above all other things, the anticipated impact of US Federal cannabis reform and the accompanying sentiment. And given that sentiment has been the dominant factor driving cannabis equity returns, until any concrete legalization (or realistically, any reform at all) passes the US House of Representatives and the Senate and makes it to the President’s desk, this negative sentiment is likely to persist.

The MSO basket - Curaleaf Holdings, Inc. (CSE: CURA) (-9.5%), Trulieve Cannabis Corp. (CSE: TRUL) (-2.1%), and Green Thumb Industries Inc. (CSE: GTII) (-6.5%) and the shrinking, pending combination of Columbia Care Inc. (CSE: CCHW) (-7.0%) and Cresco Labs Inc. (CSE: CL) (-3.7%) were all negative for the month of April. Investors must be wondering if it’s possible for a company to shrink any more than these companies have, and it is breathtaking to watch as the slow crawl toward legalization essentially deflates them. As we have stated in the past, at this point CRBs are akin to long-dated call options, and investors no longer should time this market but rather pick up a handful of these lottery tickets and store them safely in a drawer.

There were two MSOs in the basket with positive returns: TerrAscend Corp. (CSE: TER) (+10.7%) and Verano Holdings Corp. (CSE: VRNO) (+3.1%). Verano reported Q4 2022 earnings at the end of March, which were less than spectacular but still positive (7% increase in revenue YoY). George Archos, Verano Founder, Chairman and Chief Executive Officer, is saying the quiet part out loud: “From a policy perspective, while we’re disappointed in the lack of substantive legislative or banking reforms which will place additional pressure on many industry operators, we’re encouraged by continued momentum in support of cannabis at the state level and progressive conversations at the federal level...”

Tier 1B CRB TerrAscend (+10.7%) reported record revenue for Q4 2022 in mid-March, which must have been a motivating factor for investors who were looking for a ray of light in the cannabis industry. And while TER reported big GAAP net losses ($299mm), revenues were up 27%.

The “legal” Canadian CRB basket was negative across the board amid the regulatory uncertainty that we seem to talk about far too often. Tilray Brands, Inc. (Nasdaq: TLRY) (-7.1%), Canopy Growth Corporation (TSX: WEED) (-26.2%), Cronos Group Inc. (TSX: CRON) (-3.1%) and SNDL, Inc.(Nasdaq: SNDL) (-6.9%) were all negative, with no particular bright spots.

Canopy Growth Corporation (TSX: WEED) was by far the worst performing CRB in either basket, losing yet another 26% of its market value in April alone. Back in February, this collapse was foreseen by Alan Brochstein of New Cannabis Ventures. In his editorial entitled This Popular Cannabis Company Moves Closer to Financial Trouble, Brochstein highlights several “red flags” related to WEED’s financial condition for investors to consider, including this: “We aren’t entirely surprised by the deterioration of Canopy Growth’s debt financing. The debt has been rising, and the cash has been falling. The company continues to burn a lot of cash in its operations. Canopy Growth’s move from a fixed-price convertible to a variable one could weigh on the stock.”

US equities were slightly positive and traded in a narrow range in April, as investors remained cautiously optimistic that the Fed might be taking a much-needed break from its activities. The S&P 500 posted a +1.6% for the month, outperforming cannabis once again.

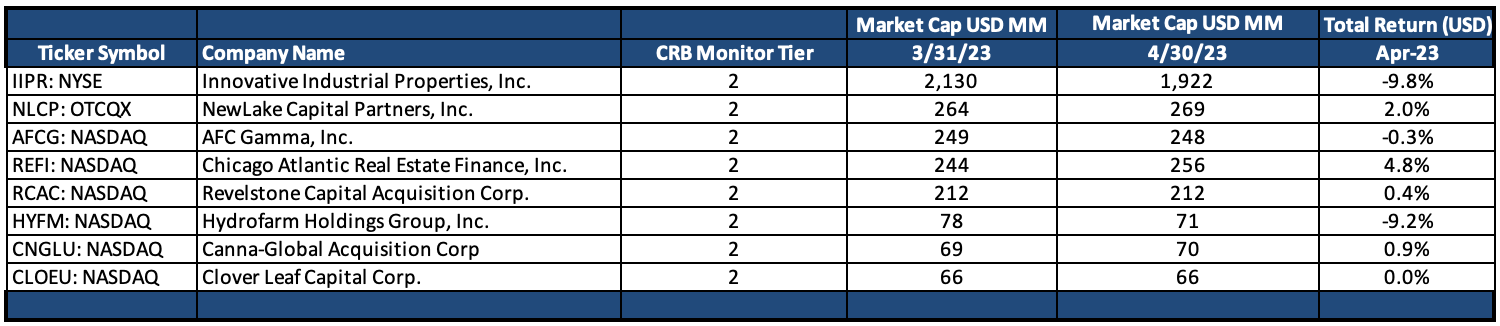

Tier 2 CRBs w/Mkt Cap Over $150mm – April 2023 Returns

Source: CRB Monitor, Sentieo

Source: CRB Monitor, Sentieo

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies posted a -1.2% return for April 2023, which outperformed the equally-weighted Tier 1 basket by 4.1%. While they are highly correlated (please see the “Chart of the Month” from our January 2023 newsletter), we expect Tier 1 and Tier 2 CRBs to “mean revert” periodically, but we also feel that there is no need to try to game them as a strategy. We have always said that when these two portfolios deviate from one another it could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given their direct revenue relationship, but the time it takes to mean revert is not so easy to predict.

Performance across the Tier 2 basket was mixed in April, with most of the Tier 2 CRBs challenged for the month. Tier 2 agriculture supplier Hydrofarm Holdings Group, Inc. (Nasdaq: HYFM) (-9.2%) was challenged once again in April, falling by more than 9% for the second month in a row. HYFM tends to trade by appointment, and its illiquid nature (and accompanying wide bid/ask spread) can and will cause significant performance swings on any given day. As we reported last month, HYFM's Q422 earnings report came out on March 9th, sales were down significantly from Q421 and it was announced that HYFM is in the midst of a restructuring, which includes the consolidation of their product portfolio and phasing out of several manufacturing facilities. The extreme volatility and lack of liquidity is most likely keeping investors away, as they weigh the probability of an imminent bankruptcy.

Tier 2 REIT Innovative Industrial Properties, Inc. (NYSE: IIPR) (-9.8%), had its second down month in a row following an optimistic February. The mood appears somber as investors await IIPR’s Q1 2023 earnings, which will be reported in early May. IIPR bears a significant risk relative to the cannabis industry, given that their business depends on US cannabis cultivators paying their rent. Nevertheless, IIPR paid its 8.9% dividend in March, and it remains one of the only Tier 1 or Tier 2 CRBs with a dividend yield.

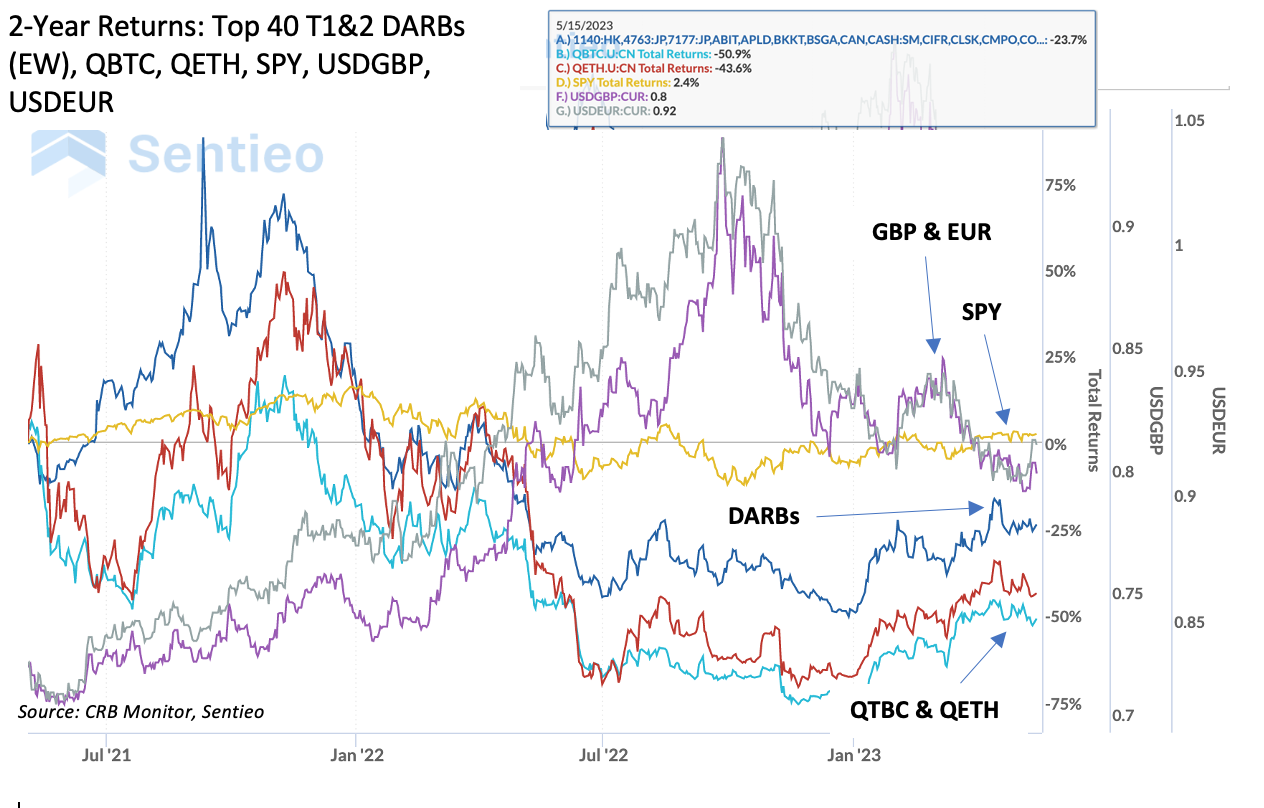

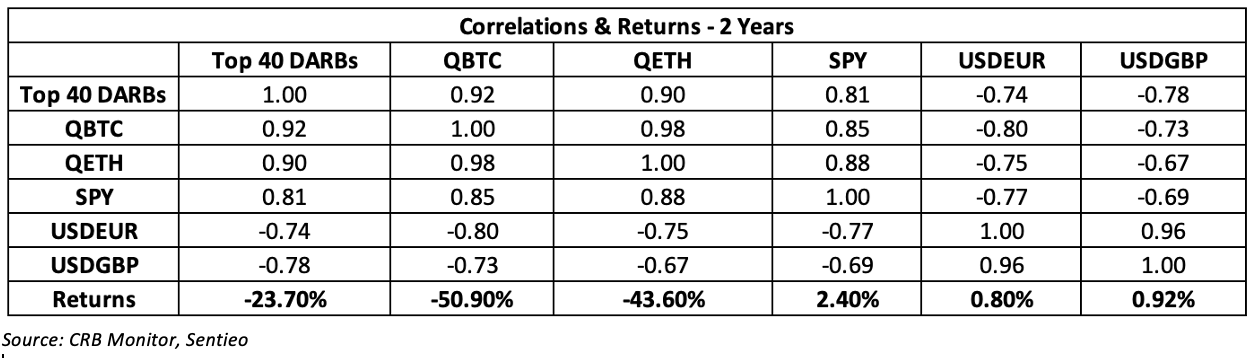

Chart of the Month: Digital Asset-Related Securities

It’s true that this newsletter is, by and large, dedicated to “cannabis-linked securities”; however, in the interest of our readers’ curiosity (and our own shameless self-promotion), we’d like to introduce some of our analysis related to our latest area of interest, Digital Asset-Related Businesses (DARBs).

The navy blue line on this chart represents the 2-year performance of the largest 40 Tier 1 Pure Play and Tier 2 DARBs, equally weighted with annual rebalancing, vs. two major crypto ETF (QBTC in light blue, QETH in red). We also added SPY (S&P 500 ETF in yellow0, and two currencies - USDGBP (purple) and USDEUR (gray).

The chart above indicates (for the recent 2-year period) that a basket of CRBM Tier 1 and Tier 2 listed DARBs (Pure Play companies that are directly related to digital assets) had significantly higher returns (+20-25%) relative to Bitcoin and Etherium ETFs - the basket also exhibits high correlation vs. the cryptos as well. This is significant for investors that would like a solution that is composed of a diversified basket of listed companies rather than assuming the specific risk of one cryptocurrency.

The basket also exhibits high negative correlation to major fiat currencies (USD vs. EUR and GBP), which both fell by about 10% over the period. This demonstrates the significant absence of similarity to between crypto currencies and fiat currencies. We hope this is not a surprise, but it is important to keep pointing this out in case you’ve been influenced by the word “currency” in “cryptocurrency”.

For investors looking for exposure to digital assets, remember that these returns were reflective of one period; with that said, the basket is diversified across multiple DARB-related sectors and features Tier 1A, 1B, and 2 pure play DARBs. [Note: It is also possible to construct the DARB basket with a weighting scheme other than equal weighting, or a different tier mix, or screen for regulatory compliance as well.]

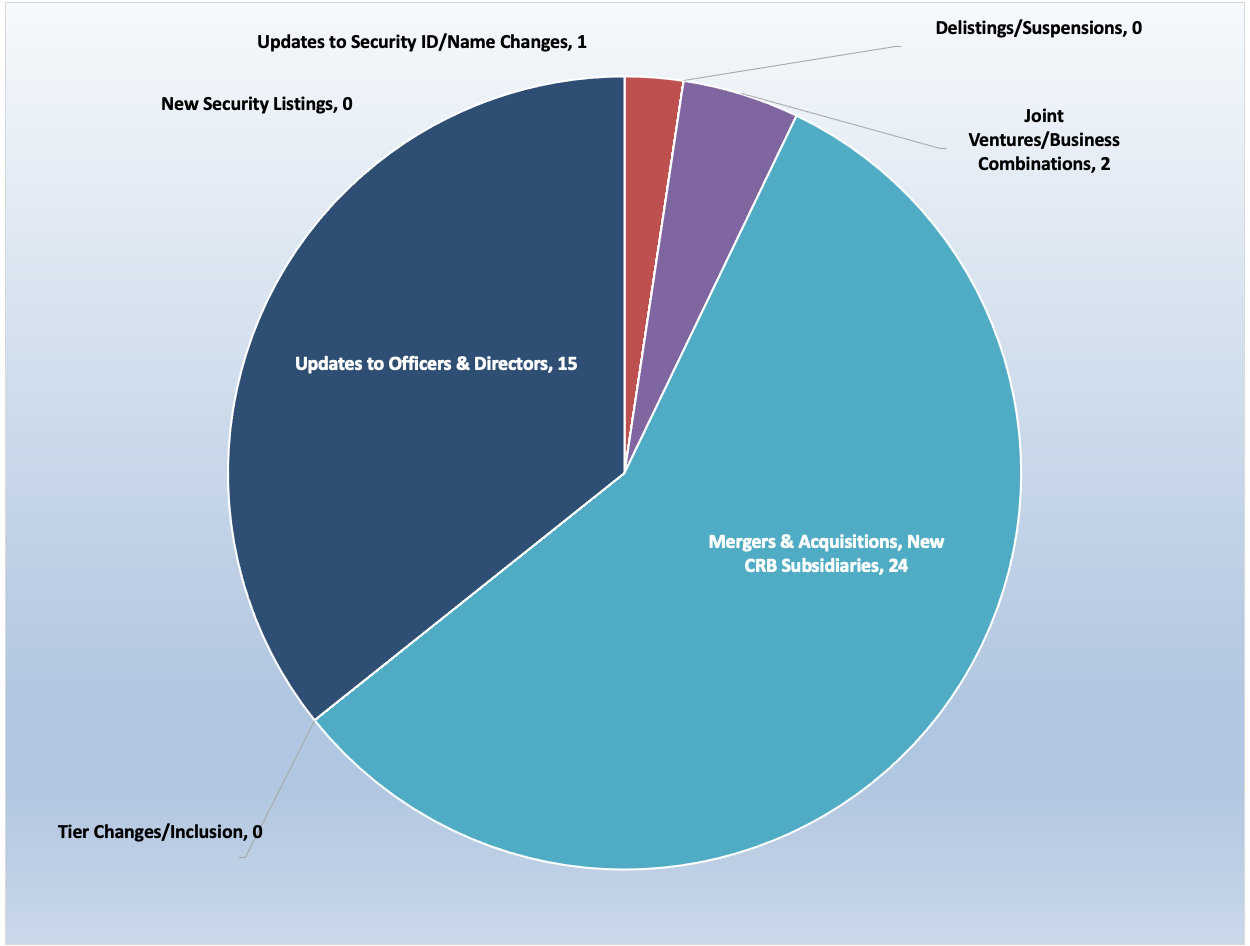

CRB Monitor Securities Database Updates - April 2023

CRB Monitor’s research team monitors the information cycle daily and maintains securities’ profiles to reflect the current state of the cannabis ecosystem. Here is a summary of the updates for April 2023:

Source: CRB Monitor, Sentieo

Cannabis Business Transaction News - April 2023

M&A activity continues to be slow to non-existent, except for the usual group of MSOs (Verano, Trulieve, etc.) expanding operations by opening new local dispensaries across the US. With that said, there is renewed optimism due to the latest and greatest version of cannabis reform on the Hill, the SAFE Banking Act 2023 (S.1323) (see our recap below). But even if SAFE Banking passes, these companies are facing the reality that the US federal government has not gotten materially closer to federal legalization or decriminalization, and this is having a profound (negative) impact on the profits and earnings forecasts of many, if not all, cannabis-related businesses.

And as we have stated in previous newsletters, we are seeing signs of consolidation in the cannabis industry and expect an increase in acquisitions in the months to come.

Here are some of the April highlights:

In early April, Tier 1B Canadian CRB MediPharm Labs Corp. (TSX: LABS) issued a press release announcing the completion of MediPharm’s acquisition of all of the issued and outstanding common shares of VIVO Cannabis (now a private Tier 1A business) in an “all-equity business combination transaction” effective April 1, 2023. In the words of the press release, “The Arrangement combines two highly complementary businesses, creating a unique and market differentiating international medical cannabis leader.” MediPharm cited several advantages to the acquisition, including product leadership, diversification, expanded opportunities, and a stronger balance sheet. In the words of David Pidduck, Chief Executive Officer of MediPharm: "We are very excited to be starting a new chapter in the evolution of MediPharm Labs. VIVO is a strong cultural fit, and a great strategic fit. Together the two organizations have a much clearer path to profitability. I want to welcome all the VIVO employees and thank the teams on both sides that worked over many months to help bring us together." Following the VIVO acquisition (upon which VIVO shares were delisted), LABS controls, through its subsidiaries, 12 cannabis licenses for Retail, Cultivation, and Manufacturing.

Tier 1B hemp-related CRB Charlotte's Web Holdings, Inc. (TSX: CWEB) announced in an April press release that they have formed a joint venture with AJNA BioSciences PBC ("AJNA"), a botanical drug development company focused on mental health and neurological disorders, and a subsidiary of Tier 1B non-Pure Play CRB British American Tobacco P.L.C. (LSE: BATS). According to the announcement, “BATS is contributing US$10 million as the JV's initial investor. AJNA is partially owned and was co-founded by its president, Joel Stanley, the former CEO and Chairman of the board of Charlotte's Web, together with certain other founding members of CW....The JV was established to pursue FDA-approval for a novel botanical drug to target a neurological condition identified by the JV leadership team, which will be comprised of CW, AJNA and BAT representatives. This novel botanical drug will be developed from certain proprietary hemp genetics of CW. The JV plans to engage with the FDA to file an Investigational New Drug ("IND") application and commence Phase I clinical development in 2023.”

Also in April (and related to the regulatory story below), Tier 1A MSO Trulieve Cannabis Corp. (CSE: TRUL) announced in a press release the grand opening of Georgia’s first medical cannabis dispensary in Macon. Speaking about Georgia finally issuing cannabis licenses, Kim Rivers, CEO of Trulieve, said: “We believe that access to medical cannabis improves lives, and Trulieve is proud to be the first to provide that access to the state of Georgia...We look forward to providing high quality products and an elite experience.” With this license, TRUL’s footprint continues to expand in the US, as they have now been issued 129 cannabis licenses in either active status or pending approval. They operate in 16 states and 2 Canadian provinces.

Finally, Tier 1A MSO Curaleaf Holdings, Inc. (CSE: CURA) issued a press release announcing the opening of Curaleaf Boca Raton Glades, the company’s 59th dispensary in Florida and 151st dispensary nationwide. According to the press release, “Located at 7875 Glades Rd, Boca Raton, FL 33434, Curaleaf Boca Raton Glades is the first of two new locations to open in the Sunshine State this month. The company will open its 60th Florida dispensary, Curaleaf West Palm Beach, 300 Clematis St, West Palm Beach, FL 33401, by the end of the month pending regulatory approvals...Curaleaf continues to prioritize the Florida market through the expansion of its retail footprint and the continued innovation of its assortment of products and brands. As part of these efforts, the Company also announces it will be expanding Grassroots, a premium brand of cannabis flower and pre-rolls, into the state on April 21st.” with the addition of this new Tier 1A CRB, CURA’s license total is 140 in either active or pending status. They currently have licensed operations in 19 states plus Portugal, Spain, and Denmark.

Select CRB Business Transaction Highlights:

|

Company Name |

Ticker Symbol |

CRBM Tier |

Event |

|

Tier 1B |

MediPharm Labs Corp. Completes Acquisition of VIVO Cannabis Inc. and Confirms Final Ownership Ratio |

||

|

Tier 1B |

|||

|

Tier 1A |

|||

|

Tier 1B |

|||

|

Tier 1A |

Columbia Care Continues Momentum in Virginia with Opening of Ninth Dispensary ahead of 4/20 Holiday |

||

|

Tier 1B |

High Tide Celebrates its 76th Store Opening in Alberta on the ‘420’ Holiday |

||

|

Tier 2 |

|||

|

Tier 1B |

iAnthus Commences Adult-Use and Expands Medical Operations in New Jersey |

||

|

Tier 1A |

Trulieve Announces Georgia’s First Medical Cannabis Dispensary |

Security/Exchange Highlights:

|

Company Name |

Ticker Symbol |

EVENT Type |

Result |

|

New Listing |

Lifeist Wellness Changes OTC Markets Ticker Symbol to LFSWF Effective Today |

Select Database Updates in CRB Monitor:

|

Name |

Ticker Symbol |

CRBM Tier |

CRBM Sector |

|

3 |

Health Care Equipment, Devices & Supplies |

||

|

3 |

Financial Services |

||

|

MediPharm Labs Corp. (Warrants) |

1B |

Owner/Investor |

Cannabis Regulatory Updates - April 2023

Here are some of the cannabis-related regulatory highlights from April 2023:

We would be remiss in our duty to inform if we didn’t lead with some words on the SAFE Banking Act (S.1323), which has generated considerable buzz throughout the cannabis industry. If it passes, this latest version of SAFE Banking, which was presented in the Senate on April 26, will have a profound impact on the cannabis industry. Without any actual progress toward federal legalization, the legislation would protect banks that work with state-legal cannabis businesses from being penalized by federal regulators. And this is a big deal, as one of the barriers for legal CRBs has been the suggestion that all their transactional activities are currently considered money laundering according to US federal laws. There is explicit language in the Controlled Substances Act, which states, “The Controlled Substances Act (“CSA”) makes it illegal under federal law to manufacture, distribute, or dispense marijuana.”

And the new SAFE Banking Act does not just apply to big banks.

According to a story in Marijuana Moment: “This latest version further makes clear that the safe harbor is extended to Community Development Financial Institutions (CDFIs) and Minority Depository Institutions (MDIs) that make commercial loans to minority-owned businesses—a new provision that advocates pushed for last Congress.”

In a quote from Senator Jeff Merkley (D. Oregon), “Forcing legal businesses to operate in all-cash is dangerous for our communities; it’s an open invitation to robbery, money laundering, and organized crime—and it’s way past time to fix it,” Merkley said in a press release. “For the first time, we have a path for SAFE Banking to move through the Senate Banking Committee and get a vote on the floor of the Senate.”

The implications of this legislation for the cannabis market are positive, but it is a far cry from US legalization, which many would argue is necessary for the long-term survival of the cannabis industry for CRBs both in the US and in Canada. With that said, the SAFE Banking 2023 has a long road ahead, as it needs to pass a Senate vote before making its way to the Republican-controlled House of Representatives, then if it passes it will hit President Biden’s desk, so stay tuned.

Also in April, the State of Georgia, which legalized cannabis for medical use in 2015, has finally issued its first 5 cannabis licenses to CRBs. According to a report on Fox 5 Atlanta website, “The Georgia Access to Medical Cannabis Commission has officially issued the state’s first five dispensing licenses during a public meeting...Botanical Sciences LLC and Trulieve GA Inc. plan to open medical cannabis dispensaries in Bibb County, Chatham County, and Cobb County.” The article goes on to report: “Georgia law authorizes the commission to issue up to five initial dispensing licenses to each production licensee. This is based on the number of registered patients. A six dispensing license could be issued to each of the production licensees based on the number of patients now exceeding 25,000, according to Georgia law. Addition licenses could be added for each additional 10,000 patients added.”

Botanical Sciences LLC is a private business that, according to the CRB Monitor database holds one active license (production) issued by the state of Georgia as well as a license from the US Drug Enforcement Administration. Trulieve GA, Inc., a private business, is a subsidiary of MSO Trulieve Cannabis Corp. (CSE: TRUL). Trulieve GA holds the other four (1 production, 3 retail) active Georgia licenses.

In April, the Texas (that’s right, Texas) House of Representatives passed a bill to decriminalize marijuana and create a process to facilitate cannabis conviction expungements, and now sending it to the Texas Senate for consideration. According to a story in Marijuana Moment, “The 87-59 vote on the legislation from Rep. Joe Moody (D) comes one day after the chamber preliminarily approved the measure on second reading. Also on Wednesday, a House committee heard testimony on a separate bill to more broadly legalize and regulate cannabis sales...The vote comes about a month and a half after the House Criminal Jurisprudence Committee unanimously passed the measure, which would remove the risk of arrest or jail time for low-level possession of cannabis and allow people to eventually erase cannabis issues from their criminal records.”

The article mentions that two previous cannabis decriminalization bills had been proposed (in 2019 and 2021) but both died in the Texas Senate, so we would not recommend any endzone dances at this point.

Finally, in an April story in The San Antonio Current, “Americans overwhelmingly support cannabis being legal for medical or recreational use, and public support for legalization has skyrocketed over the past two decades.” According to research newly compiled by the Pew Research Center, “fewer than half of Americans say they have ever used cannabis and a far smaller number partake in it regularly.” But the report also states, surprisingly, that “around nine-in-ten Americans say marijuana should be legal for medical or recreational use”.

While we won’t go into all the detail from this Pew report, it is worth reading and both investors and consumers should be encouraged by these trends.

CRBs In the News

The following is a sampling of highlights from the April 2023 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

- MediPharm Labs Corp. Completes Acquisition of VIVO Cannabis Inc. and Confirms Final Ownership Ratio (Tier 1B)

- High Fusion Announces Management Changes (Tier 1A)

- AYR Wellness COO Leaves (Tier 1B)

- Charlotte's Web forms Joint Venture with BAT and AJNA BioSciences to Seek FDA-Approval for Proprietary Full Spectrum Hemp Extract Botanical Drug (Tier 1B)

- Curaleaf Closes $20 Million Utah Acquisition (Tier 1A)

- Integrated Cannabis Solutions Closes Acquisition of Houdini Labs (Tier 1A)

- Lifeist Wellness Changes OTC Markets Ticker Symbol to LFSWF Effective Today (Tier 1B)

- Ayr Wellness Closes Acquisition of Tahoe Hydroponics (Tier 1B)

- MediPharm Labs Provides Update on VIVO Integration and Board Appointee (Tier 1B)

- IntelGenx Announces Organizational Changes to Support Global Growth Strategy (Tier 1B)

- Rapid Dose Announces Board of Director Changes (Tier 1A)

- SponsorsOne Announces Resignation of Chief Financial Officer (Tier 3)

- Lobe Sciences, Ltd. Announces the Acquisition of Altemia(TM) & Company (Tier 1B)

- KHIRON LIFE SCIENCES ANNOUNCES NEW CFO (Tier 1A)

- Schwazze Signs Definitive Documents to Acquire One Medical Retail Dispensary in Denver, Colorado, from Standing Akimbo (Tier 1A)

- GRN Holding Corporation Continues To Execute Business Plan With Acquisition Of California Corporation With Multiple Cannabis Licenses (Tier 2)

- Cannabis MSO MariMed Expands Board With the Addition of Kathleen Tucker (Tier 1B)

- Flora Growth Corp. Announces the Appointment of Hussein Rakine as CEO and Member of the Board of Directors (Tier 1A)

- Indoor Harvest Corp. Appoints Trevor Smith to the roles of CFO and COO (Tier 2)

- Schwazze Seeks to Expand in New Mexico With $38 Million Cannabis Acquisition (Tier 1A)

- iAnthus Commences Adult-Use and Expands Medical Operations in New Jersey (Tier 1B)

- Allied Corp Signs Joint Venture With Blueberries Medical Corp. to Expand Product Offering and Bring Derivative Products to Global Markets (Tier 1B)

- Shiny Health & Wellness Announces CFO Transition (Tier 1B)

- GABY Inc. Announces a Strategic Acquisition of Highly Regarded and Well Established CBD Brands: Hempfusion(TM), Sagely Naturalstm and Apothecanna(TM) (Tier 1B)

- Akerna Announces Sale of Software Business to MJ Freeway Acquisition Co, Coinciding with Merger with Gryphon Digital Mining (Tier 2)

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"