James B. Francis, CFA

Chief Research Officer, CRB Monitor

Chart of the Month: A Look at Tier 3 CRBs

The CRB Monitor definition of a Tier 3 cannabis-related business, pulled directly from the source is:

“Posing the lowest perceived level of risk to financial institutions, Tier 3 CRBs are typically larger, older businesses making a foray into the cannabis space and derive only “incidental” revenue from (1) selling some products and services to Tier 1 CRBs and/or (2) selling hemp-derived products. Basically, Tier 3 businesses are like Tier 2; the key difference is the relative portion of the company’s revenue coming from these activities.”

Some notable examples of Tier 3 CRBs are The Scotts Miracle-Gro Company (NYSE: SMG), Amazon.com, Inc. (Nasdaq: AMZN), CVS Health (NYSE: CVS), and Teva Pharmaceutical Industries Ltd. (NYSE: TEVA).

Because our objective is to cover the complete ecosystem of all publicly-traded companies with a connection to cannabis, it is of critical importance that we include Tier 3 CRBs in the CRB Monitor database. We do this in spite of the fact that their participation in the cannabis industry is considered “incidental”. And this incidental relationship is fully realized when we take a peek at the performance of a basket of Tier 3 CRBs (433 of them) along with Tier 1’s and Tier 2’s and major broad equity indexes.

Source: CRB Monitor, Sentieo

Source: CRB Monitor, Sentieo

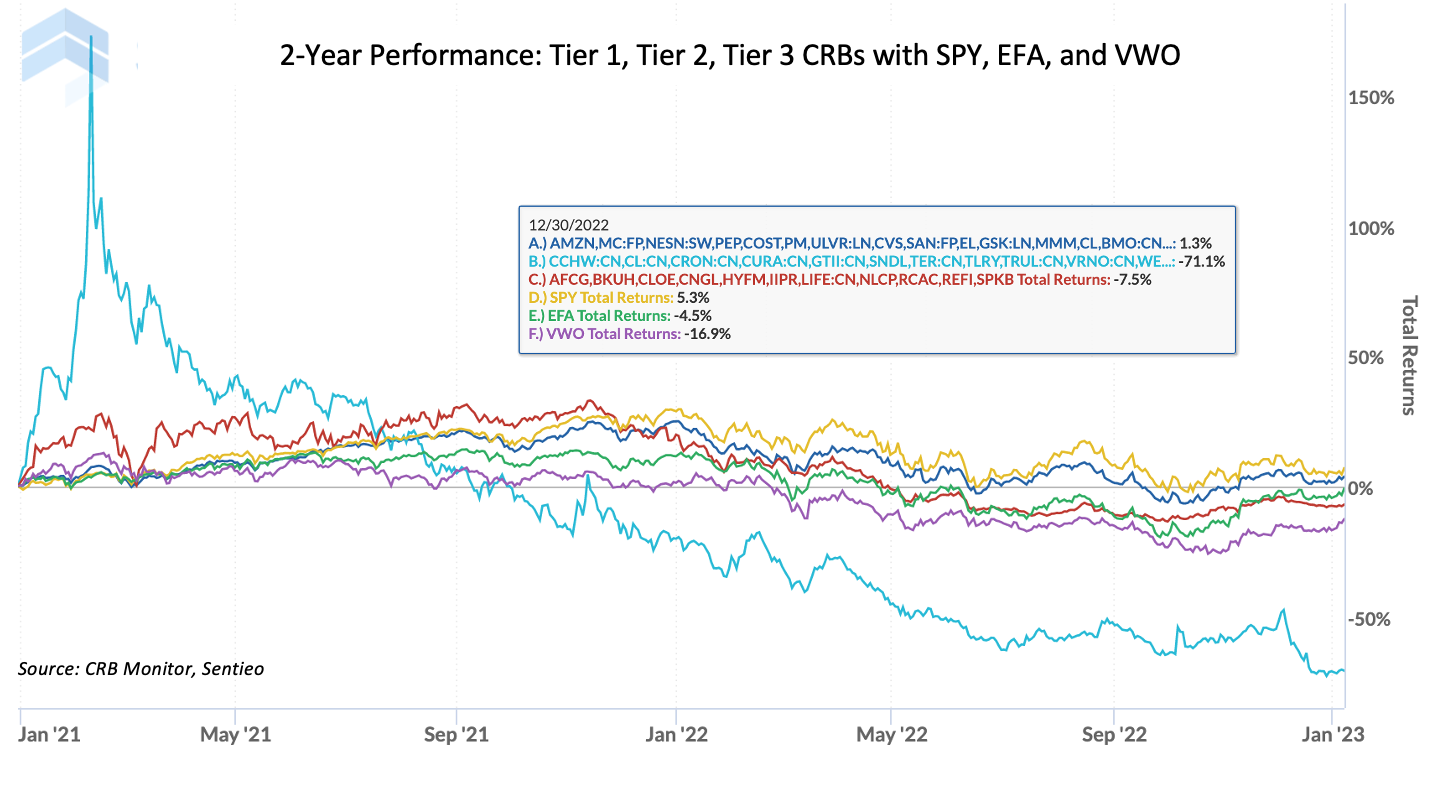

The above analysis tracks the most recent 2-year performance equally-weighted baskets of Tier 1 (light blue), Tier 2 (red), and Tier 3 (dark blue) CRBs plus the performance of SPY (S&P 500 ETF), EFA (MSCI EAFE ETF), and VWO (Emerging Markets ETF).

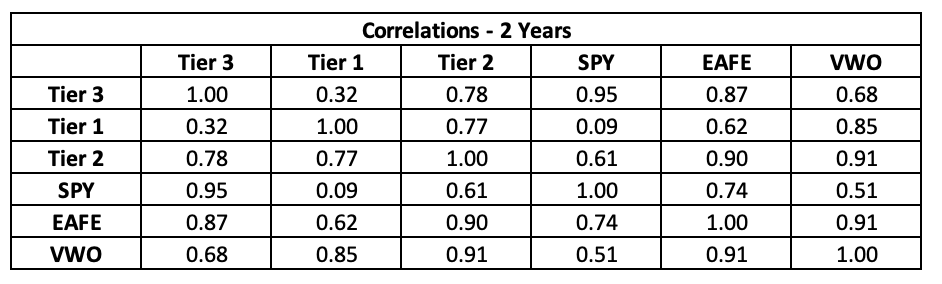

Not surprisingly, Tier 3’s have a high correlation (see table below) with US large cap equities (0.95), which is evidence that their cannabis-related revenue has little or no impact on performance. Tier 3’s also have very low correlation with Tier 1 (0.32), which would explain the significant performance differential in both the short and long term. But what is surprising here is that for this period Tier 1’s and Tier 2’s (highly correlated with each other) also have very high correlation with VWO, the emerging markets ETF. It would require a deeper dive into factor performance to better understand these results. Suffice it to say the last couple of years have featured uncertainty related to our emergence from a global pandemic and related supply shocks; therefore, similarities between emerging markets and cannabis (an emerging industry) are not too shocking but are higher than expected.

Source: CRB Monitor, Sentieo

Source: CRB Monitor, Sentieo

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"