One of the biggest financial challenges for cannabis businesses is paying taxes. And even though cannabis remains federally illegal as a controlled substance, the IRS still wants its cut of taxes… in full.

Known as 280E, as in Section 280E of the Internal Revenue Code, companies that traffic in Schedule I and II drugs cannot deduct general business expenses, such payroll, rent and advertising. Essentially, because the business is illegal, companies can’t legally deduct the regular costs of doing business. But they are still expected to pay taxes. They can, however, reduce income by calculating the cost of goods sold.

U.S. Rep. Earl Blumenauer is once again trying to change the IRS code with the Small Business Tax Equity Act of 2023 (HR 2643), introduced April 17. It would exempt marijuana businesses conducting marijuana sales in compliance with state law from the 280E restriction. The bill currently awaits a hearing by the House Committee of Ways and Means.

“State-legal cannabis businesses are denied equal treatment under 280E. They cannot fully deduct the cost of doing business which means they pay two or three times as much as a similar non-cannabis business,” said Blumenauer in an announcement. Blumenauer did not respond to a request for further comment.

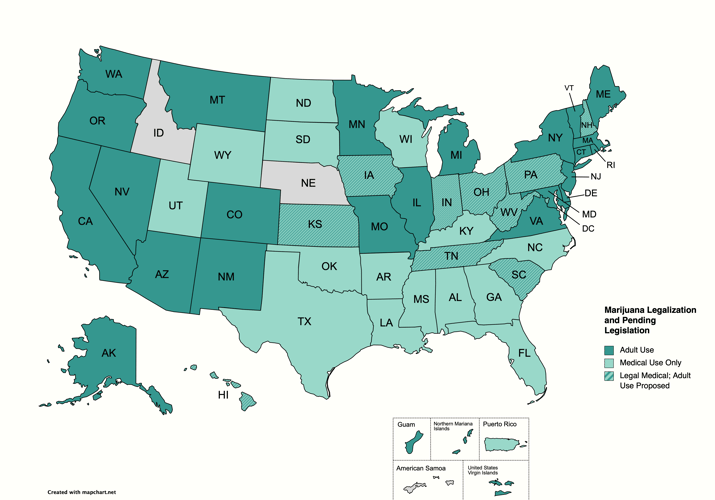

Map includes states with low-THC access for medical use. Some states have multiple legalization bills pending. Color indicates highest use proposed. Map created using mapchart.net.

“The two greatest challenges cannabis entrepreneurs are currently faced with are the lack of access to capital and unfair tax burdens,” said Saphira Galoob, executive director of the National Cannabis Roundtable in an announcement released by Blumenauer. “By eliminating the impact of 280E on state-legal cannabis operations, Congress would be giving these businesses, including small and minority operators, the opportunity to remain financially viable and to reinvest in their companies, communities, and workforce through tax credits and deductions that are routinely offered to other domestic industries.”

However, Mark Friedlich, vice president of U.S. Affairs for Wolters Kluwer Tax & Accounting, said there is still no majority support in Congress to pass such a change, especially following the tough budget negotiations that has left the House floor in chaos. Friedlich is a member of the U.S. Senate Finance Committee’s Chief Tax Counsel’s Advisory Board and an advisor to 14 state tax authorities.

“It won’t pass. We’ve had probably 18 bills introduced of this type over the last 10 years. They go nowhere,” he said.

New states allowing cannabis tax deductions

However, states that have legal cannabis markets are trying to make it financially easier on the companies by allowing state income tax deductions and credits.

Recently, Colorado, New Jersey and Washington, D.C., have passed laws allowing for tax deductions. In Illinois and Connecticut, budget bills including the tax provision await their governors’ signatures. And this year, cannabis business deductions are allowed in New York as part of the 2023 budget bill signed last year.

Additionally, Minnesota and Delaware, two of the newest states to legalize adult use, included business income tax deduction provisions in their legalization acts.

These states join others such as Arkansas, California, Colorado, Hawaii, Louisiana, Maine, Michigan, Missouri, Montana, New Mexico, Oregon, Pennsylvania and Vermont in allowing cannabis businesses to deduct the costs of doing business from their state taxes.

Hard to measure impact on businesses

Accurately measuring the impact of these deductions on business operations and tax coffers, however, is not easy.

A letter from the Joint Committee on Taxation during the consideration of the Tax Cuts and Jobs Act in 2017 estimated changing 280E would result in $500 million in lost federal tax revenue for 2023, and $4 billion from 2018 through 2027. Since 2017 of course, several more states have opened to medicinal or adult use of cannabis, so the amount could be even higher today.

However, Bluemnauer reportedly believes such a change would result in increased tax revenue because more businesses would be encouraged to properly file their taxes.

Friedlich agreed that many cannabis businesses don’t report their full income. “That’s one of the problems. Small businesses, especially in the cannabis area, don’t want to claim anything because they are an all-cash business,” he said. “They would need to report income for the amount of deductions they are claiming.”

He said businesses fear that reporting in states would result in federal audits. “Rather than reducing their overall tax liability, it will increase liability because of audits that will be forthcoming.”

That may be the case in California. It enacted AB 37 in 2019, which allowed sole proprietorships and partnerships to claim credits and deductions beginning in 2020. These cannabis businesses are required to fill out tax information reporting form 4197. The legislation also required the state Franchise Tax Board to report to the legislature the number of deductions claimed in a tax year, as well as the total dollar amount.

In December, the FTB reported that as of April 2022, the number of 2020 tax returns reporting cannabis activities is still below a threshold to be disclosed under state taxpayer privacy rules. For tax year 2021, only 44 personal income tax returns included form 4197 indicating cannabis activities, and none claimed any deductions or credits.

FTB spokesperson Daniel Tahara said in an email that it is possible that businesses took deductions and credits but did not complete this form.

“No taxpayers operating under the Personal Income Tax Law filed 4797s indicating they had deductions or credits. However, the 4797 is informational only and there is no penalty for not including the form with their tax return. It is highly likely that many taxpayers should have filed the 4797, but didn’t, or filed the form but did not complete it correctly,” he said.

The FTB said taxpayers may not be aware of the form. “FTB is undertaking efforts to improve taxpayer awareness of the existence, purpose, and correct usage of form 4197,” it said in the report.

Additionally, under California Corporation Law, cannabis corporations have been able to claim state income tax deduction since Proposition 64 legalized commercial cannabis in 2016.

California offers new cannabis business credits

In addition to allowing expense deductions, California is offering two types of cannabis business credits for tax years 2023 through 2027. Both credits are nonrefundable but may be carried over eight years.

The High-Road Cannabis Tax Credit offers qualifying retailers and microbusinesses with employees a credit of up to 25% of their qualified employee-related business expenditures, up to $250,000. Because there’s a $20 million funding limit, businesses need to make a “Tentative Credit Reservation.” The reservation system is expected to be online July 1.

The $10,000 Cannabis Equity Tax Credit is available to equity licensees that have received approval of the fee waiver and deferral program administered by the California Department of Cannabis Control.

-- Maria Brosnan Liebel, CRB Monitor News