James B. Francis, CFA

Managing Director of Publicly Traded Securities Research, CRB Monitor

CRB Monitor tracks 1,250+ publicly-traded, Cannabis-Related Businesses (CRBs) globally, which have ~1,500 traded securities. We categorize CRBs into our proprietary cannabis risk tier framework and cannabis-based sectors. CRB Monitor also unravels and maintains complex corporate structures, linking publicly-traded parent companies to their underlying operational plant-touching subsidiaries. Custodian banks, broker/dealers, and asset managers find our data essential for pre-trade compliance, risk management, index construction, and portfolio analytics.

CRB Monitor Securities Database

As of December 31, 2020, the breakdown of publicly-traded securities was as follows:

|

Security Type |

Tier 1A |

Tier 1B |

Tier 2 |

Tier 3 |

Totals |

|

Common Stock |

83 |

385 |

297 |

500 |

1,265 |

|

Preferred Stock |

|

6 |

2 |

2 |

10 |

|

Convertible Debt |

2 |

20 |

1 |

1 |

24 |

|

Debentures |

|

6 |

1 |

2 |

9 |

|

Rights |

|

4 |

3 |

|

7 |

|

Units |

|

1 |

10 |

|

11 |

|

Warrants |

9 |

70 |

23 |

13 |

115 |

|

Exchange Traded Funds |

|

23 |

1 |

|

24 |

|

Market Indexes |

|

23 |

|

|

23 |

|

Totals |

94 |

538 |

338 |

518 |

1,488 |

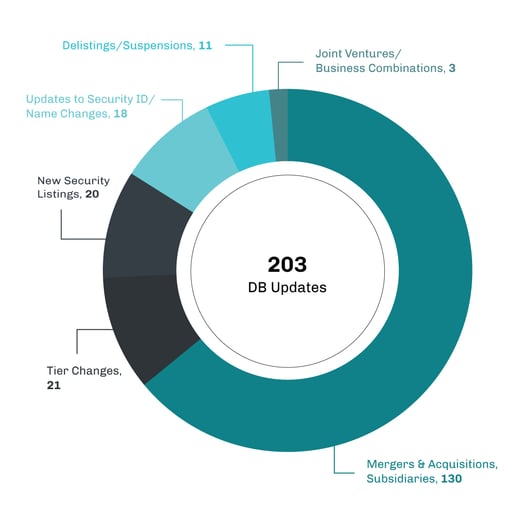

Of the thousands of announcements and filings reviewed during Q4 2020, our research resulted in a total of 1,168 updates to the CRB Monitor database (203 updates to issuers’ records, 965 news releases added). The complete list of securities and detail for these updates can be found in the CRB Monitor database. And for plenty of detail on our updates to the CRB Monitor database, please refer to our monthly newsletters: CRB Monitor October newsletter, CRB Monitor November 2020 newsletter, CRB Monitor December 2020 newsletter.

Source: CRB Monitor

CRBs In the News

The fourth quarter of 2020 was an active month for news related to publicly-traded cannabis companies. In the fourth quarter of 2020, we witnessed the latest in a series of recoveries of the historically-volatile cannabis industry, as election-related tailwinds provided the motivation investors needed to engage once again. Cannabis-related equities surged, first in anticipation of the November 3rd elections, then immediately after, as CRBs celebrated 1) an expansion of legal recreational marijuana at the state level and 2) the installation of a new, (apparently) more cannabis-friendly executive branch of government. A third factor, perhaps just as compelling, has been the economic impact of the COVID-19 pandemic, which continues to apply pressure on state governments to find new sources of revenue.

Tier 1B CRB Tilray (NAS: TLRY) announced their merger with Tier 1A CRB Aphria (TSX: APHA), in what would be the largest all-cannabis M&A deal in recent memory. With a combined market cap of $3.4 billion, the resulting entity (NAS: TLRY) would be the presumptive number one pure-play cannabis-related company in terms of revenue ($685 million). This is significant not only for the future of TLRY, but for managers of cannabis-themed funds and ETFs, given the significant impact to diversification and breadth of the investable cannabis universe. We will be watching that closely as it could be an indication of increased M&A activity in the months to come.

Another major story that emerged in Q4 2020 was the announcement by the largest Tier 1A CRB, Canopy Growth Corporation (TSX: WEED), that Canopy will be shutting down and ceasing operations at a number of its production facilities in Canada. Per the announcement, "The production sites impacted represent approximately 17% of the Company's enclosed Canadian footprint and 100% of its Canadian outdoor production footprint." Investors did not respond with optimism, as WEED’s shares lost 16% in the month of December, but were still up more than 76% for the quarter.

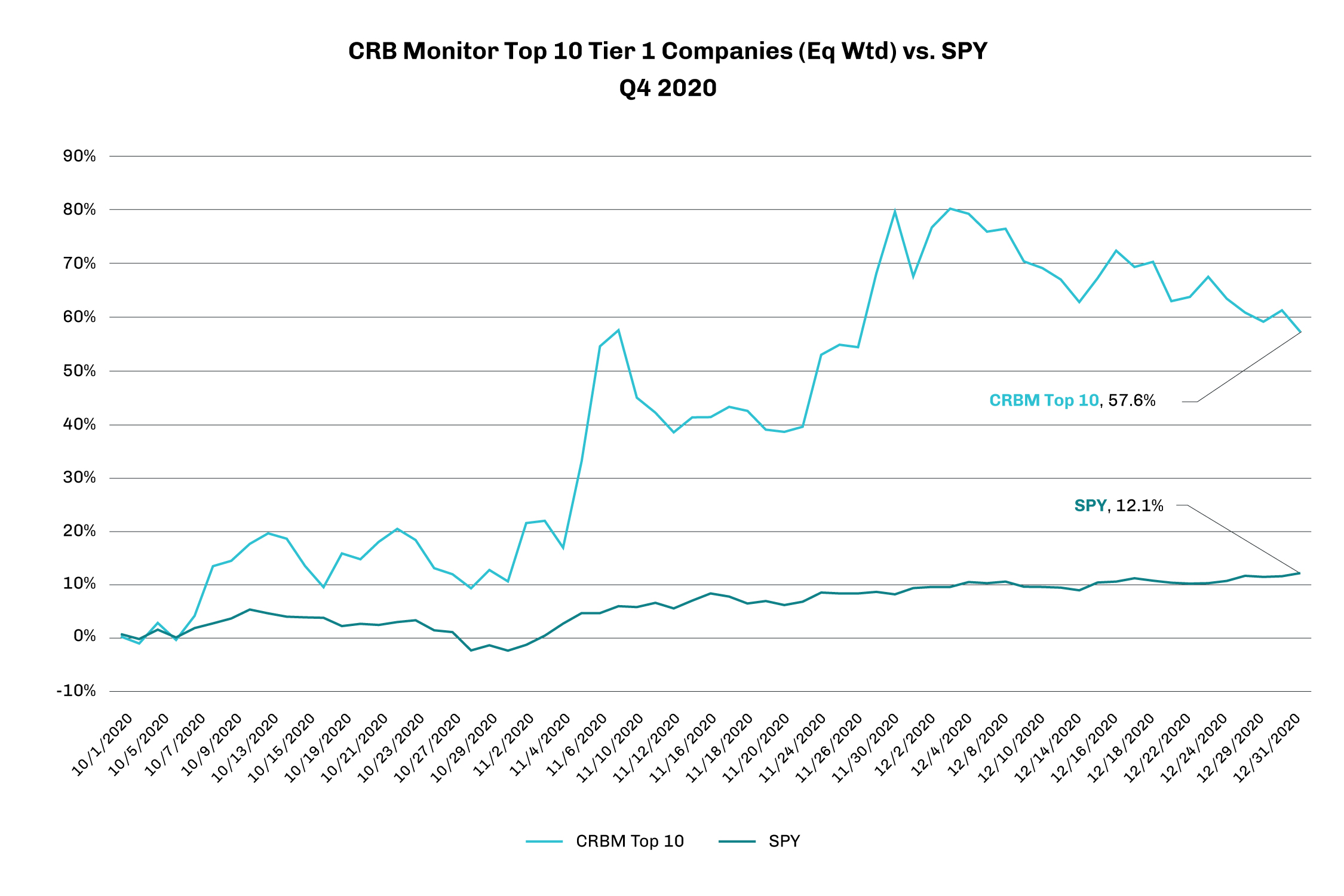

Cannabis-Linked Equity Performance

It would be an understatement to say that Cannabis-linked equities made a comeback in the fourth quarter of 2020, as Tier 1 CRBs clawed back much of the performance that investors had taken away in the prior twelve months (see table below). Sharp increases in CRB prices were an apparent response to cannabis-related ballot questions in five states, the details of which were highlighted in our CRB Monitor October newsletter. While the return of the equally-weighted basket of Tier 1 CRB’s was impressive (+15%), the lion’s share of the Q4 windfall performance came during the month of November (+42%), which is highlighted in our CRB Monitor November 2020 newsletter. Cannabis stocks retreated somewhat as investors took profits, but did little to tarnish Q4 CRB returns, which significantly outperformed the S&P 500 index (see below). The details and highlights can be found in our CRB Monitor December 2020 newsletter.

We will watch closely over the next few months as cannabis companies respond to the impact from significant forces – legalization/decriminalization, a prolonged economic recession brought about by the ongoing COVID-19 pandemic, and the need for increased taxation at the state level, not to mention a persistent black market – and how these forces will affect their stock prices going forward.

CRB Monitor “Top 10” Tier 1 Cannabis Companies – Performance

Source: CRB Monitor, Sentieo

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"

Interested in learning more about the CRB Monitor Securities Database? Visit our website to request more information and to get in touch with our team.

The information provided herein presents general information and should not be relied on as legal advice. If you have specific questions regarding a fact, please consult with competent legal counsel about the facts and laws that apply.