James B. Francis, CFA

Chief Research Officer, CRB Monitor

This article provides CRB Monitor’s explanation of the digital asset ecosystem, the associated risks, and how CRB Monitor identifies and categorizes Digital Asset Related Businesses (‘DARBs’).

CRB Monitor as an Essential Tool for Financial Institutions

The new frontier for investors known as the digital asset ecosystem has become, for several reasons, a cause for concern among financial institutions of all sizes. As this asset class grows and evolves, it is safe to say that institutions need a reliable source of market intelligence as they develop and implement policies aimed at protecting their investor base from risk and potential illicit activity that are presented by wading into the digital asset pool.

CRB monitor’s rules-based methodology for identification and risk classification of digital asset-related businesses (DARBs) provides institutions with an essential tool that can be easily integrated into any risk and compliance platform.

Digital Assets Defined

A recent report by Coingecko.com estimated the size of the total global cryptocurrency market at $0.8 Trillion in October 2022, down from $3 Trillion in April 2022. The excessive volatility in this market makes a long term size forecast a challenging exercise; with that said, forecasts from early 2022 estimated the size of the crypto market to exceed $32 Trillion by 2027. Given the steep drop in cryptocurrency values over the last 12 months we would take this estimate with a grain of salt.

Additionally, research outlet technavio recently reported that The NFT market size is anticipated to grow by $119.9 million by 2027 at a CAGR of 35.02%. Major markets for non-fungible tokens include Singapore, China, and The Philippines.

The explosive growth over the last decade of both the market size and exposed risk to investors in digital assets have made it impossible (and to an extent) irresponsible for financial institutions to ignore it. In fact, a wide range of financial institutions now find themselves engaged in this easily misunderstood and historically volatile asset class.

Digital assets, including cryptocurrencies and several other digitally-produced tokens, have become a primary area of concern for financial institutions for several reasons, none the least of which is that historically, cryptocurrencies have a reputation for being conduits for illicit activity. This unlikely marriage of high-powered technology, finance and accounting, and energy consumption has made for a complex “wild west” of a market that presents several risks to investors.

Moreover, the recent revelations regarding the massive FTX fraud and its founder, Samuel Bankman-Fried, has not helped Digital Assets’ reputation.

The Hierarchy of the Digital Asset Universe

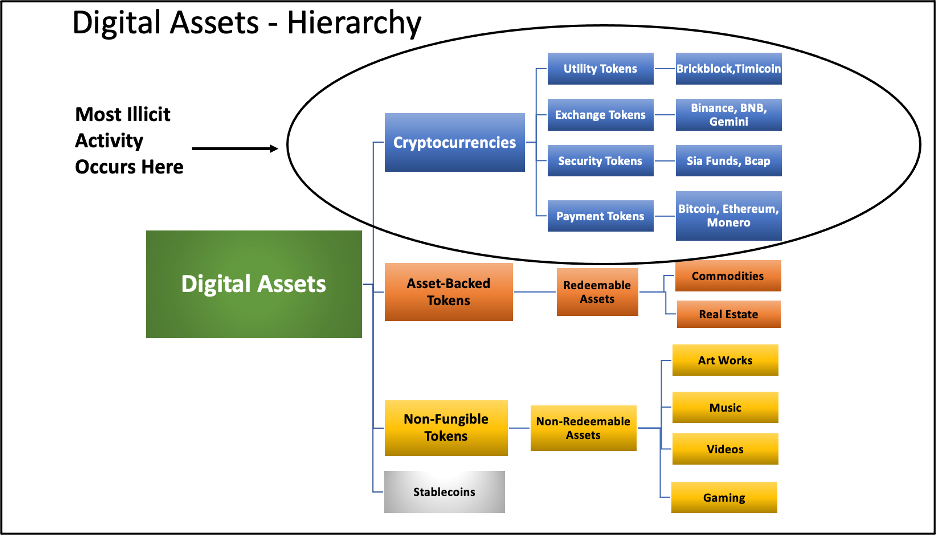

Various assets (or tokens) in the digital space fall into four main types: Cryptocurrencies, Asset Backed Tokens, Non-Fungible Tokens, and Stablecoins.

The following graphic has been created to highlight what we feel is the greatest area of risk, largely due to its relative size for financial institutions: cryptocurrencies. With that said, CRB Monitor’s goal is to research and include all companies that derive revenue, directly or indirectly, from cryptocurrencies, asset backed tokens, NFTs, and stablecoins. And it should be noted that illicit activity can be found across the digital asset spectrum, including stablecoins and NFTs.

Source: CRB Monitor

Source: CRB Monitor

Digital Asset Types - Definitions

Cryptocurrency: A cryptocurrency is a digital, encrypted, and decentralized medium of exchange. Unlike the U.S. Dollar or the Euro, there is no central authority that manages and maintains the value of a cryptocurrency. Instead, these tasks are broadly distributed among a cryptocurrency’s users via the internet. (Forbes)

Asset Backed Token: A digital means by which investors can buy into traditional physical assets, such as commodities and real estate. Tokenizing these assets may improve liquidity and facilitates accessibility. (Coinmarketcap.com)

Non-Fungible Token (NFT): A digital asset that represents an image of a real-world object like a work of art, music, an in-game feature or video. NFTs are bought and sold online, frequently with cryptocurrency, and they are generally encoded with the same underlying software as many cryptos. (Forbes)

Stablecoins: A digital currency that is pegged to a “stable” reserve asset like the U.S. dollar or gold. While stablecoins have been created to reduce volatility relative to unpegged cryptocurrencies like Bitcoin, they have their shortcomings as well. (Crypto Law Insider)

Given the evolving nature of this space, our expectation is that new digital asset classes will emerge and bring about significant opportunities for both investors and financial institutions; however, they will also impose significant risks to those market participants as well.

Is a Digital Asset the Same as a Fiat Currency?

To define digital assets simply as “currencies” is not entirely appropriate, given that they differ from standard currencies in several critical ways. The means by which a digital asset is created, the venues on which it changes hands, and how it is accounted for are all specific to this asset class and are inconsistent with the characteristics of “traditional” currencies. These differences translate into key risks that can be misunderstood by the unsuspecting investor, producing unintended investment consequences.

A publication issued by the Texas State Securities Board features an excellent summary of the differences between digital assets and fiat currency. In the words of this publication, digital assets differ significantly from fiat currency in the following ways:

- No physical coins or bills. Virtual currencies exist only in computer code. Except for visual representation of Bitcoin and altcoins in advertising and displays, and coin-like tokens that may be produced for marketing purposes, there are no actual coins or bills.

- Not Legal Tender. Virtual currencies are not legal tender and are not issued or backed by a government. However, many virtual currencies, which are called convertible virtual currencies can be redeemed for fiat currency on a number of exchanges.

- Lack of Federal Regulation. Virtual currencies are legally not considered securities and are not currently regulated by any government agency or authority. However, regulation is being considered, especially where virtual currencies are traded on exchanges or used as a security to raise capital, functioning like stocks.

- No Consumer Protections. There are no protections for consumers or investors using virtual currency, and no mechanism for appealing transactions. For example, once a virtual currency transaction is completed, there is no reversing it. It can’t be challenged like an incorrect credit card charge or an unauthorized ATM withdrawal.”

Digital Assets and Related Risks

Given the rapid growth of digital assets and heightened regulatory attention, financial institutions now must do their best to understand how to navigate this space, as many of their customers are likely market participants in the digital asset universe.

This article is not meant to be a “primer” on the entire digital asset ecosystem, but rather an explanation of CRB Monitor’s methodology for identifying and classifying publicly-traded companies with exposure to digital assets.

CRB Monitor’s extensive experience in high risk industries (e.g., Cannabis and Psychedelics), have paved the way for us to develop a database of digital asset-related businesses (DARBs) which we believe provides the tools for financial institutions to integrate the identification and monitoring of DARBs into their rigorous compliance processes.

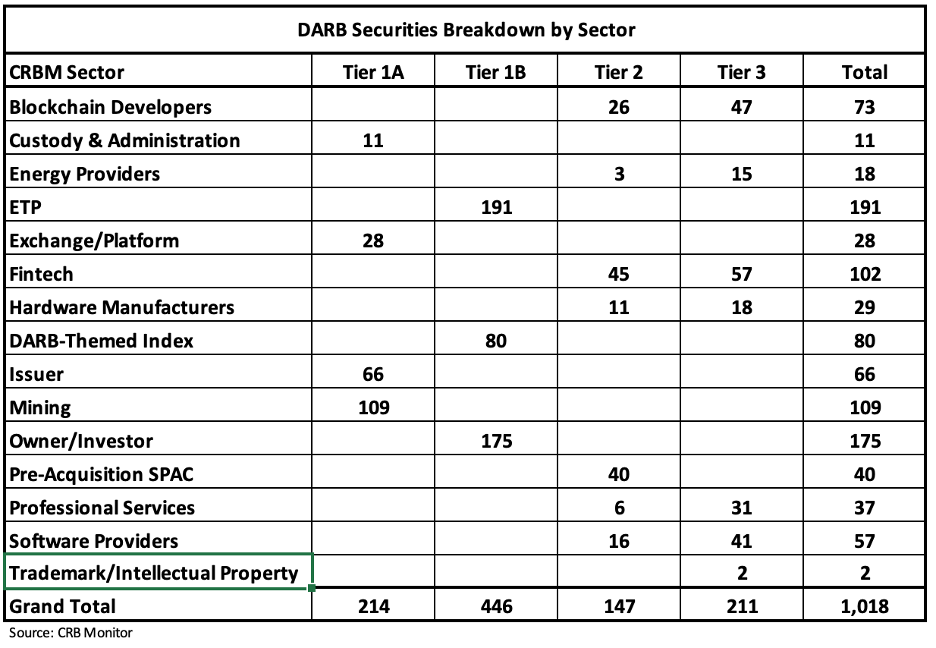

In addition to identification, we will present our definitions of Risk Tiers as they relate to the companies that derive revenue from the digital asset industry, which should be an excellent tool for financial institutions’ compliance teams as they seek to differentiate one DARB security from another. We use standard CRB Monitor processes to assign our digital asset-linked risk tiers as well as a “pure play/non pure play” designation for each security in the publicly-traded DARB securities universe.

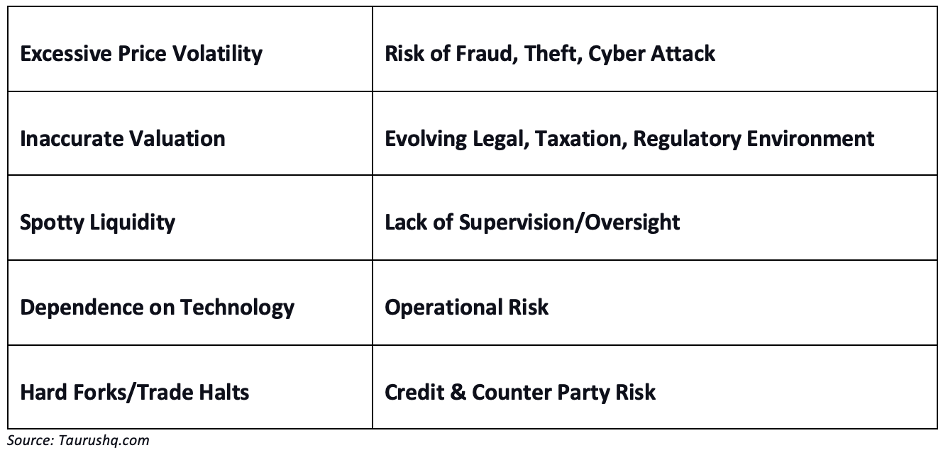

A description of the main risks associated with investing in and trading Digital Assets are highlighted in a recent whitepaper from Taurushq.com. In this article, the following risks include:

We highlight a few of these risks in this paper, but they are all notable. We will take a deeper dive into them in the future.

Digital Assets - Price Volatility and Comparison to Fiat Currencies

Aside from the potential for nefarious activity, digital assets are prone to extreme volatility that is atypical of the pricing behavior of standard currencies.

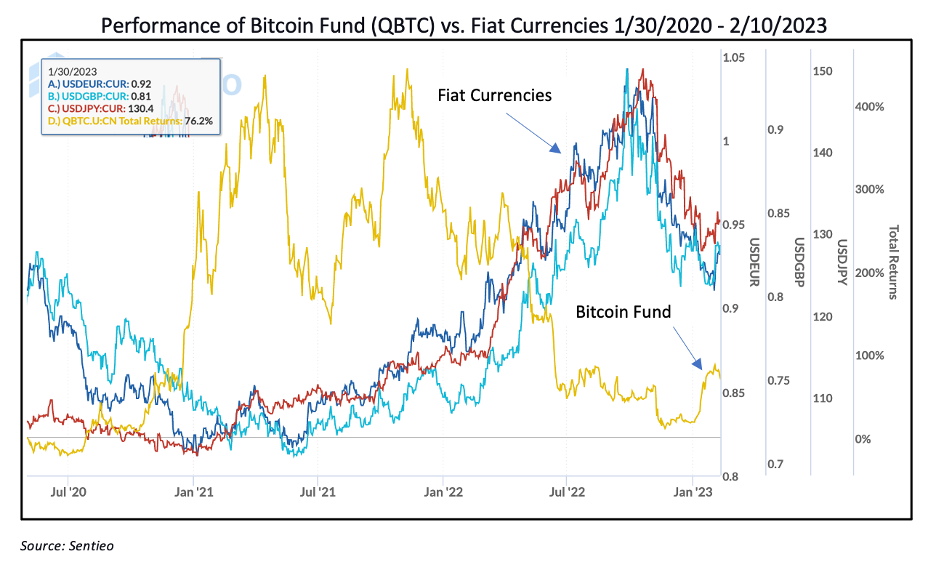

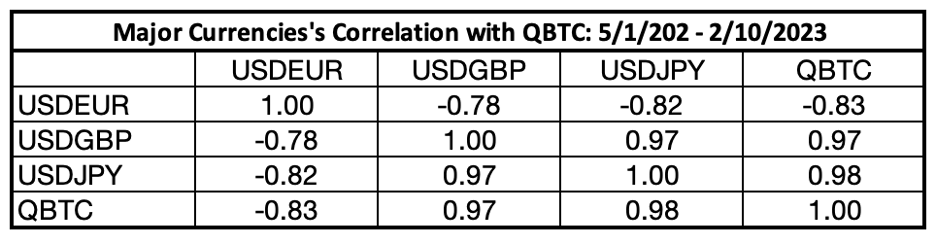

As shown in the following chart and accompanying correlation table, the performance of cryptocurrency does not resemble that of a currency at all. Major currencies, because they are technically linked via the global macroeconomy, tend to exhibit similarities in performance, while crypto (represented on the following chart by the Canadian closed-end Bitcoin Fund (TSX: QBTC.U)) appears to have little or no correlation to the performance of major currencies.

The bottom line is that trading in Digital Assets is largely unsupervised with not nearly enough adults in the room to protect investors.

Furthermore, trading in digital assets is largely unsupervised, rife with manipulation and lacking investor protections.

Digital Assets and the Potential for Illicit Activities

In its recent publication entitled A Guide to Anti-Money Laundering for Crypto Firms, AML-themed website complyadvantage.com makes the following statement about cryptocurrency:

“While it is difficult to find a consistent legal approach at the state level, the US continues to progress in developing federal cryptocurrency legislation. The Financial Crimes Enforcement Network (FinCEN) does not consider cryptocurrencies to be legal tender but considers cryptocurrency exchanges to be money transmitters on the basis that cryptocurrency tokens are “other value that substitutes for currency.” The Internal Revenue Service (IRS) does not consider cryptocurrency to be legal tender but defines it as “a digital representation of value that functions as a medium of exchange, a unit of account, and/or a store of value” and has issued tax guidance accordingly.”

The rapid growth in financial institutions’ appetite for digital assets has caused concerns for financial institutions, who strive to maintain a complete understanding, if not accounting, of their clients’ financial activities. While it is true that the handful of listed crypto exchanges feature some degree of transparency into their transactions, there exist a significant number of venues which allow for “dark” activity. And any non-transparent transaction represents a break in the chain of information, which can indicate money-laundering activity.

A recent article published by the Financial Action Task Force (FATF) details the ways in which cryptocurrency transactions can be conduits for illicit activity, and describes the cycle in which criminals operate. As an example, bad actors will use ransomware to hack into government or corporate servers, then use digital assets to collect ransom payments. The transactions can be concealed from regulators by activities including layering, and anonymized via digital service platforms known as mixers and tumblers.

An article by ComplyAdvantage.com explains one method that money laundering is accomplished via digital asset exchanges as it compares to traditional currencies:

“Money laundering with fiat currencies requires customers to create accounts with banks (and other financial service providers) by submitting personal identifying information – money launderers then use the banks’ infrastructure to conduct transactions, transferring illegal funds into and out of the financial system in an attempt to disguise their origin. By contrast, for crypto laundering, cryptocurrency exchange users do not have to identify themselves to the same extent or use regulated banking infrastructure to move their funds. Cryptocurrency transactions require only the unique addresses of users’ crypto wallets and take place directly between senders and recipients anywhere in the world with no need for scrutiny by a centralized authority or intermediary administration.”

Digital Assets - Regulatory Implications

Given the explosive growth and interest in digital assets, governments around the world are scrambling to develop and implement a regulatory framework that will limit the risk of bad actors in the space.

The nascent and fragmented regulatory regime of the digital asset space imposes significant risks for both the digital assets and their respective investors, leaving substantial loopholes that lend themselves to criminal activity. Investors risk significant volatility in digital asset values from increased regulatory scrutiny and proscription. Without regulation digital assets do not have the same level of legal support as fiat currencies. While they can be exchanged on several licensed exchanges, they do not have the support of any government or central bank. Regulatory legislation regarding cryptocurrency has been addressed in thirty-seven states; however, the licensing of businesses related to digital assets by the US federal government has yet to happen.

Recent Statements from US Regulators

As recently as December 2022, US regulators have issued statements related to specific risks in the digital asset space.

First, as an apparent response to the adverse consequences on investors from catastrophic, crypto-related events like the FTX collapse, the SEC is now showing a growing interest in related risks. In December 2022 the US Securities and Exchange Commission (SEC) issued a statement entitled Sample Letter to Companies Regarding Recent Developments in Crypto Asset Markets, which insists on broader disclosures from companies’ that have any exposure to digital assets:

“Recent bankruptcies and financial distress among crypto asset market participants have caused widespread disruption in those markets. Companies may have disclosure obligations under the federal securities laws related to the direct or indirect impact that these events and collateral events have had or may have on their business. The Division of Corporation Finance believes that companies should evaluate their disclosures with a view towards providing investors with specific, tailored disclosure about market events and conditions, the company’s situation in relation to those events and conditions, and the potential impact on investors.”

Also included in the release was a sample letter that the SEC would issue in the event that a company’s crypto-related disclosures are deemed insufficient. CRB Monitor believes that these new disclosures will uncover a new wave of companies doing business in the digital asset space that financial institutions will want to be aware of.

Second, on January 3, 2023 the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency issued their Joint Statement on Crypto-Asset Risks to Banking Organizations. This brief statement highlights eight critical areas of risk including incidence of fraud, inaccurate representations, legal uncertainties, and extreme market volatility, admonishes financial institutions as it warns against potential areas of concern:

“It is important that risks related to the crypto-asset sector that cannot be mitigated or controlled do not migrate to the banking system...The agencies will continue to closely monitor crypto-asset-related exposures of banking organizations. As warranted, the agencies will issue additional statements related to engagement by banking organizations in crypto-asset-related activities. The agencies also will continue to engage and collaborate with other relevant authorities, as appropriate, on issues arising from activities involving crypto-assets.”

CRB Monitor Inclusion and Classification Methodology for Digital Assets

CRB Monitor recognizes the importance of both the breadth and accuracy of this information to financial institutions worldwide. We therefore perform ongoing rigorous research in order to capture the full extent of the global ecosystem of publicly traded companies that derive revenue from the creation and movement of digital assets.

The goals of our multi-layered approach to securities research are to:

- Identify any and all publicly-traded companies that meet the definition of a Digital Asset Related Business (DARB);

- Assign a CRB Monitor Risk Tier to each company;

- Determine if the company is “Pure Play” or “Non-Pure Play”; and

- Assign a digital asset-linked sector to each company.

Security Identification and Daily Monitoring

CRB Monitor’s securities research team performs daily global document searches involving thousands of published reports, including: regulatory filings, financial statements, exchange announcements, investor presentations, press releases, and news articles, to locate companies that have a connection to the digital assets market. Once possible candidates for inclusion are identified, the team goes through the rigorous process of validation and approval of the inclusion of each company and its related securities.

The DARB universe is updated continuously via additional global document searches, using the current database of issuers. Any relevant news related to DARBs automatically generates an alert, and analysts then determine any action that might be required.

CRB Monitor Risk Tier and Sector Classification

CRB Monitor follows a proprietary, rules-based methodology for assigning risk tiers to any and all public companies that derive revenue from the digital asset industry. This methodology is similar to CRB Monitor’s process for assessing risk for companies linked to the Cannabis industry, which can be found at CRB Monitor.

Financial institutions find this tiering system essential as they develop their individual best practices and implement policies related to transacting and custody of digital asset-related businesses.

CRB Monitor Tier 1A

CRB Monitor defines companies as Tier 1A DARBs if they have direct exposure to one or more digital assets. In other words, Tier 1A DARBs are classified as such if they directly own, hold, trade or transact digital assets. They will also be the companies that will likely face the greatest degree of regulation by their countries and states (if applicable) of operation.

Tier 1A DARBs fall into four main sectors:

- Miners/Validators – participants that are awarded digital assets or tokens for validating transactions

- Issuers - issuers of the tokens themselves

- Exchanges/Platforms - on-line locations where digital assets are traded

- Custody & Administration - financial institutions providing custodial services for digital assets

The IRS views digital assets as capital assets and has explicit regulation regarding revenue reporting and tax regulation, which directly coincides with the activities revolving around the exchanges, issuers, miners, and custodians of digital assets. Given their direct exposure to digital assets, CRB Monitor regards these as the riskiest DARBs and therefore assigns them to Tier 1A.

CRB Monitor Tier 1B

CRB Monitor tiers businesses in Tier 1B if they have a financial or controlling interest in a Tier 1A DARB. To understand the nature of a Tier 1B, it is necessary to examine the nature of the underlying, linked 1A businesses to make a full risk assessment before making this tier assignment.

CRB Monitor fundamentally views Tier 1B DARBs differently from “indirect” Tier 2 and Tier 3 DARBs (defined below). Also included in Tier 1B are ETPs which hold digital assets and/or Tier 1 DARBs and Digital Asset-themed indexes. Included in Tier 1B are the following digital asset-linked sectors:

- Owner/Investor of a Tier 1A DARB

- Exchange Traded Product (ETP)

- Digital Asset-themed Index

CRB Monitor Tier 2

Tier 2 companies pose moderate risk to financial institutions and are defined as businesses that derive a majority of their revenue from the digital asset industry, without directly possessing a digital asset. Companies in this risk tier provide goods and/or services to Tier 1A and/or Tier 1B businesses. Some examples of Tier 2 DARBs include companies in the following sectors:

- Software providers

- Hardware manufacturers

- Fintech

- Blockchain developers

- Energy providers

- Professional Services

- Pre-Acquisition SPACS

- Trademark/Intellectual Property

CRB Monitor Tier 3

Posing the lowest-perceived level of digital asset-related risk to financial institutions, Tier 3 DARBs are often established companies that have adapted their business models to enter the digital asset ecosystem.

By definition, Tier 3 DARBs earn less than 50% of their total revenue from the digital asset industry and this revenue is often incidental to the company’s core business. Tier 3 DARBs include, but are not limited to, companies in the following sectors:

- Software providers

- Hardware manufacturers

- Fintech

- Blockchain developers

- Energy providers

- Professional Services

- Pre-Acquisition SPACS

- Trademark/Intellectual Property

CRB Monitor Pure Play/Non-Pure Play Designation

In addition to Risk Tier, CRB Monitor defines a Tier 1A or Tier 1B DARB as “Pure Play” if it derives 50% or more of its revenues from the digital asset industry. Conversely, “Non-Pure Play” Tier 1A and Tier 1B DARBs derive less than 50% of their revenues from the digital asset industry. This differentiation is essential for financial institutions who enforce holdings or trade-based restrictions related to a company’s exposure to the digital asset space. The Pure Play/non-Pure Play designation could also be a useful data point for investors in the DARB space. [We will be writing more about investment implications in future publications.]

By definition, all Tier 2 DARBs are considered Pure Play while Tier 3 DARBs are considered Non-Pure Play.

CRB Monitor is a comprehensive, global database of companies that derive revenue from high risk industries, including Cannabis, Psychedelics, and Digital Assets. Our securities database features primary, secondary, and tertiary security listings and is updated daily for any changes to those listings. CRB Monitor is used daily by some of the world’s largest custody banks to screen for and monitor both client holdings and transaction activity.

CRB monitor’s rules-based methodology for identification and risk classification of digital asset-related businesses provides institutions with an essential tool that can be easily integrated into any risk and compliance platform.