Applying Risk Ratings to Digital Asset Regulators

James B. Francis, CFA, Chief Research Officer , CRB Monitor

Peter Simcox, Senior Analyst, CRB Monitor

With the digital asset space neither going away nor becoming more simple for investors to grasp as a concept, financial institutions are wedged between a rock and a hard place, craving a transparent, regulatory framework while trying to accommodate the needs of their clients and shareholders. And while these institutions expand their participation in the still-nascent digital asset industry through custody, trading, and even new digital asset issuance, the desire for greater transparency and a global regulatory framework persists.

It is for this reason that 18 months ago CRB Monitor began its coverage of digital asset-related businesses (DARBs). Using our traditional inclusion and risk-tiering methodologies, we provide our customers with daily coverage of more than 1,400 DARBs which have varying degrees of exposure to the highly-volatile digital asset ecosystem. Similar to our cannabis data, our coverage of DARBs can be an essential risk management tool for financial institutions worldwide.

Here are some recent quotes from regulators regarding the need for transparency and regulation in the digital asset space:

- “Recent events have confirmed the urgent need for imposing rules which will better protect Europeans who have invested in these assets, and prevent the misuse of crypto industry for the purposes of money laundering and financing of terrorism.”- Elisabeth Svantesson, Swedish Finance Minister, "Digital finance: Council adopts new rules on markets in crypto-assets (MiCA)."

- “Rampant fraud and dysfunction have become the hallmarks of cryptocurrency and it is time to bring law and order to the multi-billion-dollar industry.” - New York Attorney General Letitia James, “Attorney General James Proposes Nation-Leading Regulations on Cryptocurrency Industry”

- "Banks considering engaging in crypto-asset-related activities face a critical task to meet the 'know your customer' and 'anti-money laundering' requirements, which they in no way are allowed to ignore...A bank engaging with crypto customers would have to be very clear about the customers' business models, risk-management systems and corporate governance structures to ensure that the bank is not left holding the bag if there is a crypto meltdown." - Federal Reserve Governor Christopher Waller, “Banks pump the brakes on cryptocurrency as regulators signal growing concern”

CRB Monitor’s Coverage and Rating of Global Financial Regulators

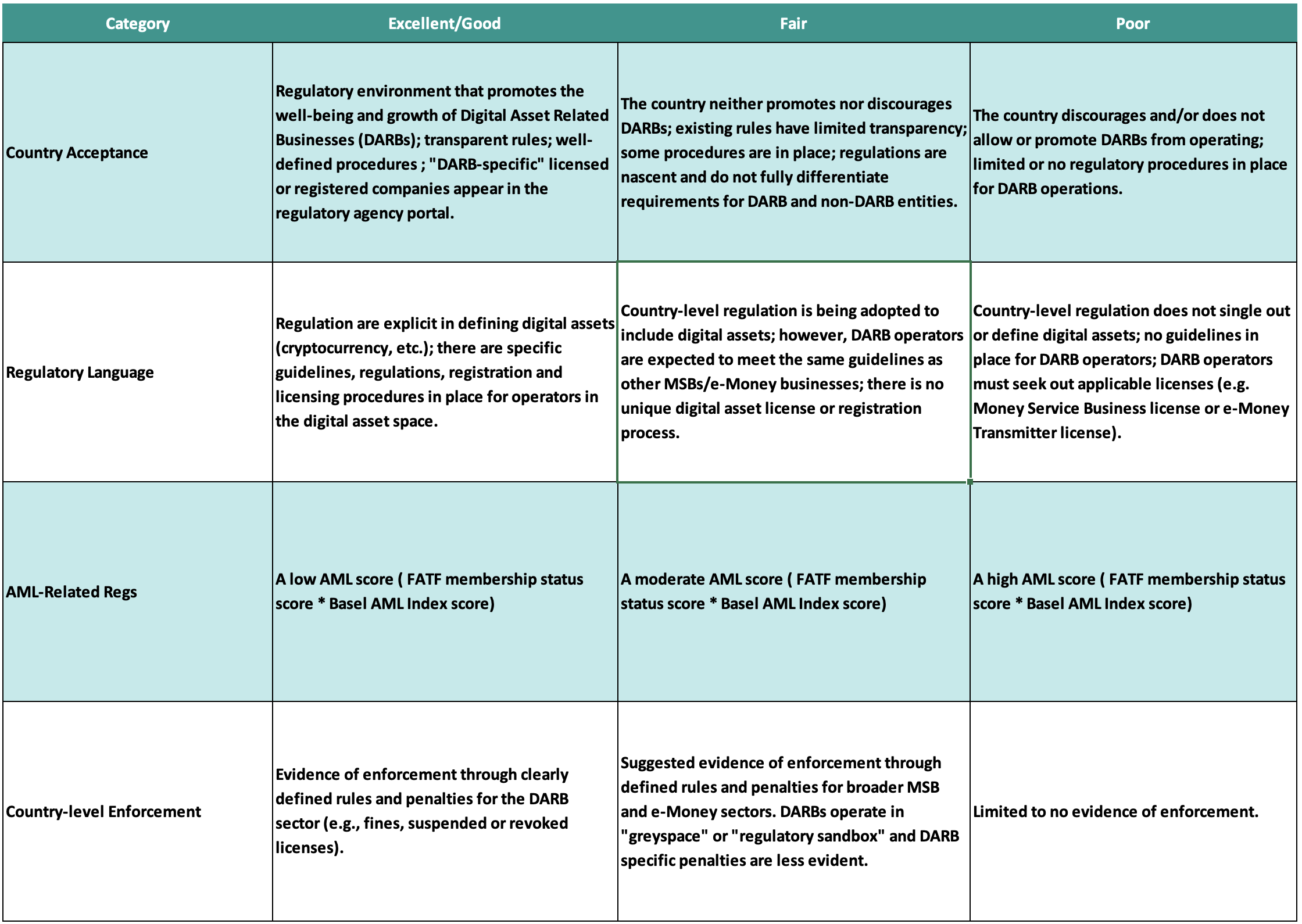

The table above provides a summary of our research into country-level regulators and the guidelines that were applied to construct a model to compare them with regard to their relative structure and effectiveness.

As we have learned from our research in the cannabis space, a complete understanding of the complex regulatory environment is essential before one can assess company-level risk related to businesses that derive revenues, either directly or indirectly, from the digital asset industry. As such, we have established a series of factors related to each country's approach to emerging technology and sector acceptance and compares the varying levels of enforcement present - all conducted country by country.

Each regulator's final risk score is an aggregate of 4 categories that are related to transparency, effectiveness, and enforcement of regulations. This final risk score for each country provides insight and understanding of the risks that operators and investors face as they navigate the global digital ecosystem. Not surprisingly, risk scores are remarkably different from country to country, and some of the most “developed” markets have a long way to go with their digital asset-related regulatory frameworks. Furthermore, because regulators’ digital asset policies are in a constant state of evolution, CRB monitor considers this work a “living document” that will evolve along with the space.

The following heat map displays the risk scores for regulatory authorities in 28 global markets. Final scores are calculated on a scale of 1 to 3. The higher the score, the lower the effectiveness of the regulatory authority (i.e. Green = Good, Red = Not so Good):

Here are some examples of the results of our research:

France, Rating: Excellent

The French Financial Markets Authority (AMF) mandates that Digital Asset Service Providers (DASPs) register with them when offering crypto-asset custody services, including safeguarding private keys and executing transactions on behalf of clients, as well as providing services like buying/selling crypto-assets using legal tender currency, exchanging digital assets, and operating digital asset trading platforms. The registration process involves thorough checks to verify the reputation and competence of DASPs and their managers/beneficial owners. Furthermore, DASPs must adhere to regulations concerning anti-money laundering and counter-terrorist financing for their custody and buying/selling services involving legal tender currency. The AMF keeps a comprehensive database of registered and licensed entities offering these services. In recent news, the AMF granted a Digital Asset Service Provider (DASP) license to Forge, a subsidiary of the Societe Generale Group. “The DASP license approval represents the highest level of regulatory certification currently possible for digital asset activities. It demonstrates a comprehensive level of security and reliability of compliance, internal control and cybersecurity processes and systems, as well as the maintenance of sufficient regulatory capital. As the first DASP-licensed company, SG-FORGE anticipates the implementation of the European MiCA regulation, which aims to regulate and secure the crypto-asset market at European Union level by 2024.”

Austria, Rating: Good

Austria received an overall good score for its progress in regulating Digital Asset Related Businesses (DARBs). The Austrian Financial Market Authority (FMA) is the primary regulator in the space and sets clear expectations and requirements for companies operating there. Virtual asset service providers are required to register with FMA. Austrian regulators demonstrate excellent transparency through a database of registered/licensed entities. The country also has cracked down on bad actors with clear evidence of enforcement and penalties.

Canada, Rating: Fair

Canada's primary securities regulator, the Canadian Securities Administrators, receives a fair score due to their ongoing development and regulatory improvement in the Digital Asset Space. Per the CSA, "To help protect investors, all crypto asset trading platforms must be registered in Canada. Registration adds a layer of investor protection because, for a crypto asset trading platform (CTP) to be registered in Canada, it needs to meet the same standards (designed for your protection and to promote stability in our investment markets) that apply to every other investment dealer in the country". While the country is making efforts to improve regulation in the space, Digital asset companies are still expected to meet the standards in place for TradFi.

New Zealand, Rating: Fair

Despite robust AML/CFT procedures, New Zealand's cryptocurrency regulatory environment receives an overall fair score. With the Reserve Bank of New Zealand acting as the regulatory authority, the country currently treats digital assets as property. Digital Asset Related Businesses (DARBs) register as financial service providers or money service businesses/e-money due to the government having no distinction currently in place. However, New Zealand-based trading platforms must register on the financial service providers register (FSPR). New Zealand encounters challenges in the cryptocurrency space, such as insufficient domestic acceptance and a lack of transparent measures.

South Africa, Rating: Poor

South Africa’s cryptocurrency regulatory environment receives an overall poor score. The nation's Financial Sector Conduct Authority is lacking in its transparency and enforcement of the sector; combining this with a low FATF/Basel AML score leaves significant room for improvement. South Africa is reported to be developing and releasing regulations by late 2023.

CRB Monitor reviews and monitors digital-asset related company data daily. Our commitment to providing accurate and valuable insights drives our continuous research efforts to keep our clients well-informed about the evolving regulatory landscape and its impact on digital asset- related businesses. Please stay tuned for further updates as we continue to enhance our coverage and understanding of the digital asset sector.

CRB Monitor is a comprehensive, global database of over 1,700 listed cannabis-related securities, 75,000 private cannabis-related businesses, 201,000 cannabis licenses, and 133,000 individuals with connections to the cannabis space. Our goal is to provide our clients with 100% of the private and publicly-traded global cannabis ecosystem and our subscribers include many of the largest financial institutions worldwide.

We have recently added to our coverage more than 200 psychedelics-related securities and more than 1,400 digital asset-related securities.

Wondering what a Tier 1, Tier 2 or Tier 3 DARB is?

See our seminal ACAMS Today white paper Defining ‘Digital Asset-related Business’ and Digital-Asset Related Businesses - What Financial Institutions Need to Know)