CRB Monitor Chart of the Month: An Update On Cryptocurrency-themed ETPs

James B. Francis, CFA, Chief Research Officer, CRB Monitor

Peter Simcox, Senior Analyst, CRB Monitor

Tamara Guy, Research Analyst, CRB Monitor

[This is the fourth in a series of articles in which we track the progress and trends related to the market for digital asset-themed exchange traded products (ETPs). Given the fluid nature of the cryptocurrency markets as well as the widespread issuance of new crypto-themed ETPs, we believe that these periodic updates should be helpful to investors and stakeholders of all types as they navigate this space. Aside from an evolving market structure and size, we are in the midst of a rapidly changing regulatory environment that has traders, asset managers, custodians, and anyone that is crypto-adjacent, on a mission to keep up with all the rule-makers. And as such, CRB Monitor stays plugged into the regulators and exchanges, as well as the financial institutions that consume our data on a regular basis, to ensure that all their digital asset-specific information is up to date.]

In January 2024 The U.S. Securities and Exchange Commission (SEC) approved eleven spot Bitcoin-based exchange traded funds and in doing so introduced a new level of accessibility to cryptoassets for U.S. investors. CRB Monitor originally reported on this event with our February 2024 Chart of the Month. These eleven ETFs, which have now been trading for close to 2 years, invest in and designate spot Bitcoin (BTC) as the driver of their benchmark indexes. Since that time there has been an explosion of issuance, not only in the US but worldwide.

As of the date of this update, CRB Monitor now maintains data on over 900 globally listed, digital asset-themed exchange traded products (approximately 700 that hold at least one of over 100 different spot cryptocurrencies directly or via derivatives) and it appears as though this list will continue to grow into the future. Among these 900, a number focus heavily on the emerging digital asset and blockchain sector, investing more than 50% of their holdings in digital asset-related businesses (DARBs). We include these in our analysis below.

The following tables list the 10 largest U.S.-listed crypto-themed and 10 largest DARB ETPs as of 11/30/2025:

Top 10 Spot Crypto ETFs as of 11/30/2025

| Primary Exchange | Ticker | ETF Name | Fund Type | AUM (USD MM) | Expense Ratio |

| NASDAQ | IBIT | iShares Bitcoin Trust ETF | Spot | $70,844.29 | 0.25% |

| Cboe BZX | FBTC | Fidelity Wise Origin Bitcoin Fund | Spot | $17,972.70 | 0.25% |

| NYSE Arca | GBTC | Grayscale Bitcoin Trust ETF | Spot | $15,289.48 | 1.50% |

| NASDAQ | ETHA | iShares Ethereum Trust ETF | Spot | $11,131.03 | 0.25% |

| NYSE Arca | BTC | Grayscale Bitcoin Mini Trust ETF | Spot | $4,427.62 | 0.15% |

| NYSE Arca | BITB | Bitwise Bitcoin ETF | Spot | $3,648.42 | 0.20% |

| Cboe BZX | ARKB | ARK 21Shares Bitcoin ETF | Spot | $3,640.79 | 0.21% |

| NYSE Arca | ETHE | Grayscale Ethereum Trust ETF | Spot | $2,898.07 | 2.50% |

| Cboe BZX | FETH | Fidelity Ethereum Fund | Spot | $2,194.60 | 0.25% |

| NYSE Arca | ETH | Grayscale Ethereum Mini Trust | Spot | $2,174.07 | 0.15% |

Source: Issuer & Exchange Websites

Top 10 DARB-themed ETFs as of 11/30/2025

| Primary Exchange | Ticker | ETF Name | Fund Type | AUM (USD MM) | Expense Ratio |

| NYSE Arca | BLOK | Amplify Blockchain Technology ETF | DARB | $1,161.25 | 0.73% |

| NASDAQ | DAPP | VanEck Digital Transformation ETF | DARB | $565.90 | 0.65% |

| NYSE Arca | BITQ | Bitwise Crypto Industry Innovators ETF | DARB | $390.64 | 0.85% |

| NASDAQ | FDIG | Fidelity Crypto Industry and Digital Payments ETF | DARB | $344.29 | 0.39% |

| NYSE Arca | STCE | Schwab Crypto Thematic ETF | DARB | $280.51 | 0.30% |

| NYSE Arca | LFGY | YieldMax® Crypto Industry and Tech Portfolio Option Income ETF | DARB | $170.79 | 1.02% |

| NASDAQ | BKCH | Global X Blockchain ETF | DARB | $122.53 | 0.50% |

| NASDAQ | LEGR | First Trust Indxx Innovative Transaction & Process ETF | DARB | $121.54 | 0.65% |

| NYSE Arca | CRPT | First Trust SkyBridge Crypto Industry & Digital Economy ETF | DARB | $120.72 | 0.85% |

| NYSE Arca | IBLC | iShares Blockchain and Tech ETF | DARB | $88.22 | 0.47% |

Source: Issuer & Exchange Websites

It should be no surprise that volatility in cryptocurrency funds has not subsided. Meanwhile, the largest spot crypto- and DARB-themed ETPs have nearly tripled in AUM since July 2024, from $54 Billion to nearly $140 Billion as of 11/30/2025. We have also seen institutional ownership of spot crypto ETFs grow as well. According to Holdingschannel.com, mainstream financial institutions such as Jane Street, Susquehanna International, and Goldman Sachs are among the largest holders of spot crypto exchange traded funds, which would suggest that more traditional institutions no longer feel the regulatory pressure to avoid holding crypto-related investments.

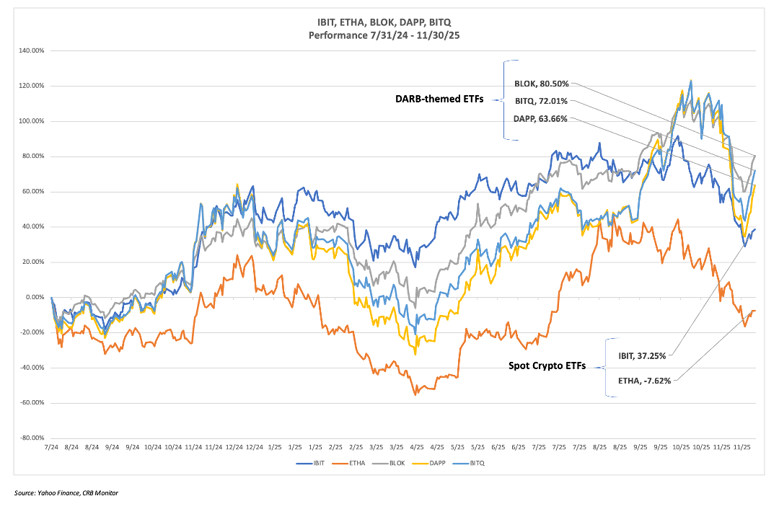

The following chart tracks the performance over this period for a sample of spot crypto and DARB-themed ETFs:

DA ETP Returns vs. ETP Asset Growth

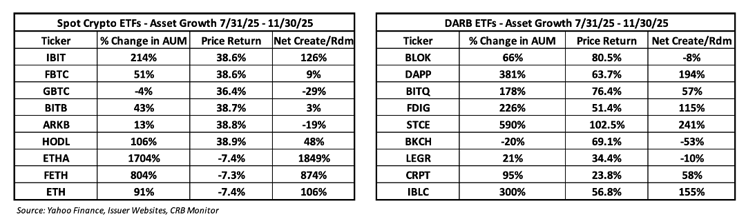

It is generally accepted that digital asset-related ETPs have experienced rapid asset growth since they exploded on the scene; however, the breakdown between asset returns and net creation/redemption growth might not be so obvious. The following tables show this breakdown for a sample of the largest spot- and DARB-ETPs:

Spot Crypto ETPs

What we are seeing in the table above is that the Ethereum-themed funds (-7%) have vastly underperformed the Bitcoin-themed funds (+38%) over this period while simultaneously outgrowing the BTC funds on a percentage basis (see ETHA, FETH, and ETH). Why has Bitcoin outperformed Ethereum so significantly, given that, at the end of the day, “crypto is crypto”, right? [While this is a topic worth delving into, we will save it for a future article. With that said, if there are no obvious reasons for this extreme performance difference, one might conclude that Ethereum looks undervalued relative to Bitcoin, but we will leave those conclusions to the thoughtful investor.]

Also of interest is the level of create/redeem activity over the period, which (aside from IBIT) is somewhat tepid for the Bitcoin funds over the last 16 months. And it should also be no surprise that GBTC has been shrinking, given its outsized expense ratio of 1.50%. Conversely, Ethereum ETFs have had explosive growth, with ETHA (the iShares ETF) being the big winner with more than 1800% growth in net creations over the last 16 months.

DARB-themed ETPs

In terms of size and number of funds, DARB-themed exchange-traded products have largely played a supporting role in the massive spot crypto ETF universe over the last 2 years. But this group is nonetheless interesting to follow. Looking at the table on the above right, we see that returns have been strong across the board, while create/redeem activity has been positive for most of the top 10 DARB funds.

Why buy these: Because the benchmark indexes and underlying holdings for DARB-themed ETPs are by definition mostly Tier 1 and Tier 2 DARBs, their performance is expected to have high correlation to spot crypto ETPs and therefore would serve as a viable proxy for BTC and ETH (among others) without the same degree of operating risk. And as a bonus, DARB ETPs have consistently outperformed BTC and ETH over this 16-month period.

[**It is also worth noting that DARBs (digital asset-related businesses), due to their exposure to cryptocurrencies, present “look-through” exposure to the various risks inherent native to the crypto universe, such as investment risk, operating risk, and regulatory risk. The CRB Monitor database of more than 2,700 digital asset-related businesses is an excellent source of data related to these risks.**]

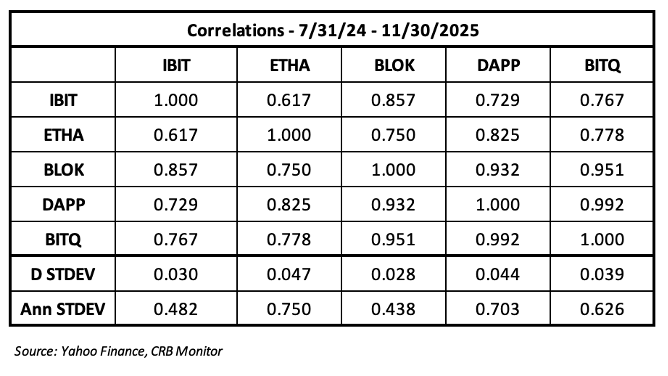

Correlations and Risk – Spot Crypto and DARB-themed ETPs

Taking a look at the correlation table for the 16-month performance period ending 11/30/25, there are a few surprises. While we are not surprised at the high correlation between IBIT and ETHA, we are surprised at the even higher correlations between the DARB and spot crypto ETPs in this analysis. It is also comforting to see that the correlations of the DARB-themed group (BLOK, DAPP, and BITQ) are very high, which would suggest that investors have several choices in that space that will offer similar returns. There are differences in volatility (see Annualized Standard Deviation), and (for example) we could say that over this period BLOK offered strong performance and the lowest relative volatility while having high correlation with both Bitcoin and Ethereum.

Spot Cryptocurrency ETPs – Regulatory Risk

As we mentioned above, spot cryptocurrency ETPs represent a significant opportunity for the crypto industry and for investors, as they provide a convenient and cost-efficient way to access exposure to the world’s largest cryptocurrencies. They also have the potential to attract new institutional and retail investors to the crypto space, increasing the liquidity, adoption, and credibility of digital assets. With that said, investing in spot crypto ETPs, while seemingly akin to most other exchange traded products, is not without its risks.

Therefore it is worth noting that spot crypto ETPs face a number of challenges and risks to investors, given that the ETPs do not provide cover from the embedded risks that are inherent in the digital asset industry. One reason for this is that, in the eyes of regulators (specifically the SEC), cryptocurrencies do not qualify as “securities”. Consequently, spot crypto ETPs are not fully covered by the Investment Company Act of 1940, and investors in these products - despite their exchange listings - are not afforded all the protections they would enjoy when holding investments that qualify as securities.

As an example, the prospectus for the iShares Bitcoin Trust (IBIT), the largest spot crypto ETP worldwide, describes a critical and risky aspect of the create/redeem process as follows (this has not changed since IBIT’s launch in January 2024):

"The Trust will create Shares by receiving Bitcoin from a third party that is not the Authorized Participant and the Trust—not the Authorized Participant—is responsible for selecting the third party to deliver the Bitcoin. Further, the third party will not be acting as an agent of the Authorized Participant with respect to the delivery of the Bitcoin to the Trust or acting at the direction of the Authorized Participant with respect to the delivery of the Bitcoin to the Trust. The Trust will redeem Shares by delivering Bitcoin to a third party that is not the Authorized Participant and the Trust—not the Authorized Participant—is responsible for selecting the third party to receive the Bitcoin. Further, the third party will not be acting as an agent of the Authorized Participant with respect to the receipt of the Bitcoin from the Trust or acting at the direction of the Authorized Participant with respect to the receipt of the Bitcoin from the Trust. The third party will be unaffiliated with the Trust and the Sponsor...The Prime Execution Agent facilitates the purchase and sale or settlement of the Trust’s Bitcoin transactions. Bitcoin Trading Counterparties settle trades with the Trust using their own accounts at the Prime Execution Agent when trading with the Trust."

What all this suggests (and why investors should take note) is, because of the fractured nature of how digital assets transact, that the success of a critical link in the operational chain cannot be guaranteed. And while we will not go into the mechanics of typical, standard ETPs, suffice it to say that trade and settlement are not left to “unaffiliated third parties”.

Regulatory Updates – December 2025

2025 was a pivotal year for spot crypto ETPs: U.S. regulators streamlined listing processes, approved structural enhancements (i.e. in-kind redemptions), and expanded trading access via inter-agency coordination. Product diversity and expansion, from Bitcoin- and Ether-themed funds to those that feature exposure to XRP and other digital assets, exploded alongside record global investor flows, while regulatory frameworks matured toward mainstream integration.

US Developments

Disclosure Guidance: On July 1, 2025, the SEC's Division of Corporation Finance issued disclosure best practices for crypto asset ETPs, addressing prospectus requirements for creation/redemption mechanics, custody, and settlement.

In-Kind Creation and Redemption: On July 29, 2025, the SEC approved in-kind creation and redemption for all spot Bitcoin and Ethereum ETFs, permitting authorized participants to deliver or receive BTC/ETH directly instead of cash only. Jamie Selway, Director of the Division of Trading and Markets, said, “In-kind creation and redemption provide flexibility and cost savings to ETP issuers, authorized participants, and investors”

Generic Listing Standards: On September 17, 2025, the SEC approved generic listing standards for commodity-based trust shares, eliminating individual approval requirements for new crypto ETF filings. Exchanges may now list qualifying products directly, significantly expediting time-to-market.

Staking Developments: On September 25, 2025, REX-Osprey launched ESK - the first U.S. ETF offering spot Ethereum exposure with staking rewards. On November 10, 2025, the IRS issued Revenue Procedure 2025-31, establishing a safe harbor for crypto ETFs to stake proof-of-stake assets while maintaining grantor trust tax status. For more information please read our CRB Monitor Chart of the Month: Embedded Risks in Crypto ETPs - February 2025.

International Developments

MiCA Implementation The EU's MiCA regulation became fully operational on December 30, 2024, with legacy providers having until July 1, 2026 to obtain authorization.

UK Retail Access The UK FCA opened retail access to crypto ETNs on October 8, 2025.

Basel Standards The Basel Committee's SCO60 standard were initially intended to take effect January 2025 and are now set for January 1, 2026, applying a 1250% risk weight to Group 2b cryptoassets with exposures capped at 2% of Tier 1 capital.

As crypto investors continue to wade into a vast sea of operational risk and volatility, there are a number of considerations that will be essential components of compliance and risk management beyond those required for typical ETF investing. Rather, it can be assumed that an investment in a spot cryptocurrency ETF is akin, from a risk perspective, to an investment in the cryptocurrency itself. And it should not be overlooked that cryptocurrencies are actively traded on global exchanges of varying qualities and degrees of regulation, and as such lends itself to illicit activity. CRB Monitor reviews global regulators of crypto activity on an ongoing basis to ensure that our clients are fully aware of all the embedded risks in this volatile space.

Wondering what a Tier 1, Tier 2 or Tier 3 DARB is?

See our seminal ACAMS Today white paper Defining ‘Digital Asset-related Business’ and Digital-Asset Related Businesses - What Financial Institutions Need to Know