James B. Francis, CFA

Chief Research Officer, CRB Monitor

CRB Monitor Chart of the Month: Digital Asset-Related Securities

It’s true that much of our research has been, by and large, dedicated to cannabis-linked securities; however, in the interest of our readers’ curiosity (and our own shameless self-promotion), we’d like to introduce some of our analysis related to our latest area of interest, Digital Asset-Related Businesses (DARBs). We plan to keep up our work in this rapidly-evolving, increasingly complex investment space.

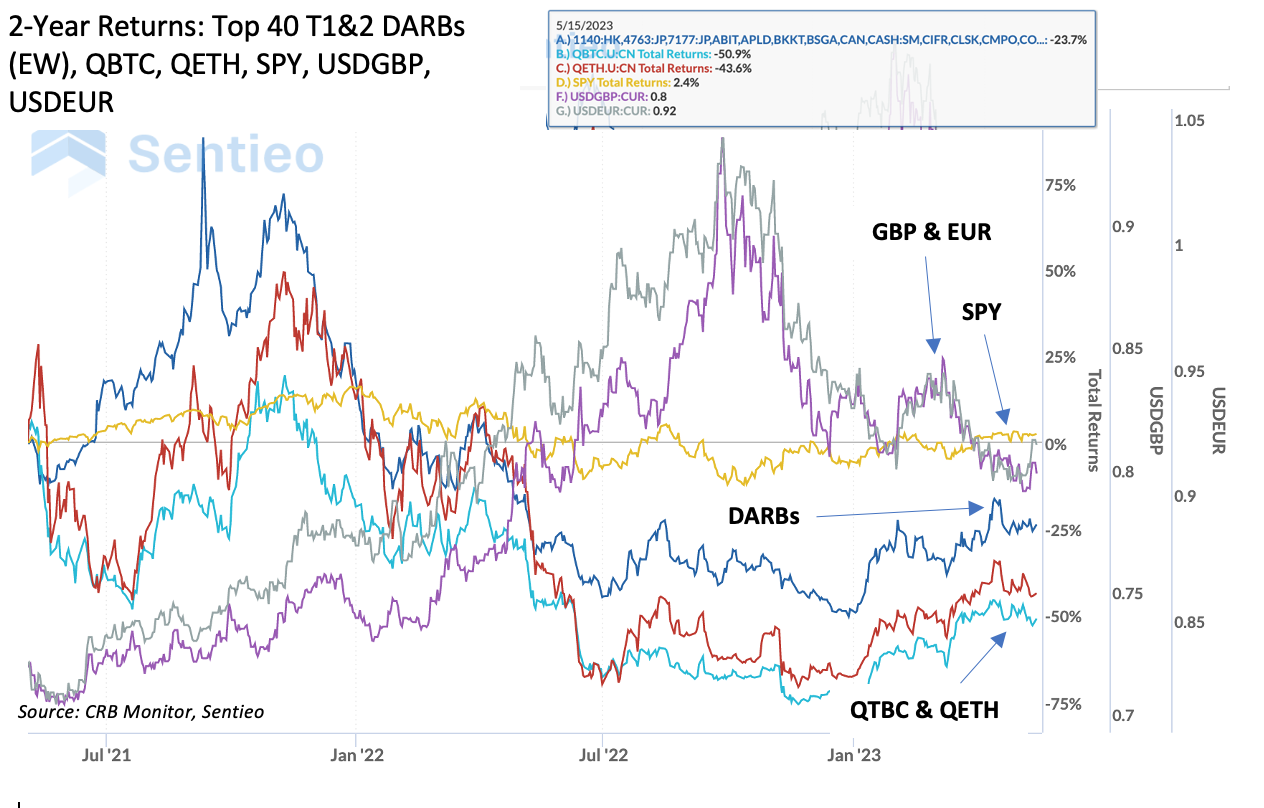

The navy blue line on this chart represents the 2-year performance of the largest 40 Tier 1 Pure Play and Tier 2 DARBs, equally-weighted with annual rebalancing vs. two major crypto ETFs (QBTC in light blue, QETH in red). We also added SPY (S&P 500 ETF in yellow), and two currencies - USDGBP (purple) and USDEUR (gray).

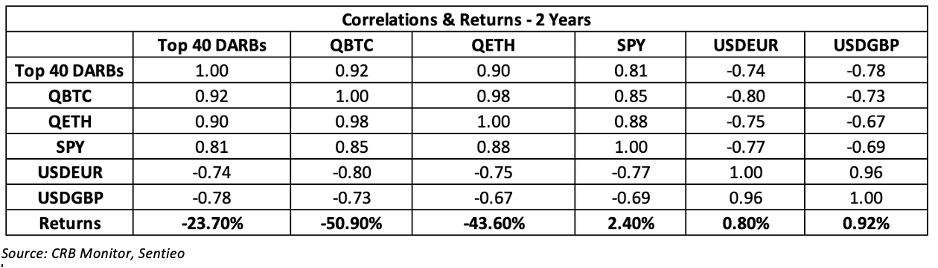

The busy-looking chart above indicates, for the recent 2-year period, that a basket of CRBM Tier 1 and Tier 2 listed DARBs (Pure Play companies that are directly related to digital assets) had significantly higher returns (+20-25%) relative to Bitcoin and Etherium ETFs - the basket also exhibits high correlation vs. the cryptos as well. This is significant for investors that would like a solution that is composed of a diversified basket of listed companies rather than assuming the specific risk of one cryptocurrency.

The basket also exhibits high negative correlation to major fiat currencies (USD vs. EUR and GBP), which both fell by about 10% over the period. This demonstrates the lack of similarity to between crypto currencies and fiat currencies. We hope this is not a surprise, but it is important to keep pointing this out in case you’ve been influenced by the word “currency” in “cryptocurrency”.

For investors looking for exposure to digital assets, remember that these returns were reflective of one period; with that said, the basket is diversified across multiple DARB-related sectors and features Tier 1A, 1B, and 2 pure play DARBs. [Note: It is also possible to construct the DARB basket with a weighting scheme other than equal weighting, or a different tier mix, or screen for regulatory compliance as well.]

Wondering what a Tier 1, Tier 2 or Tier 3 DARB is?

See our seminal ACAMS Today white paper Defining “Digital Asset-Related Business” and our blog Digital Asset-Related Businesses - What Financial Institutions Need to Know)