James B. Francis, CFA

Chief Research Officer, CRB Monitor

CRB Monitor Securities Database

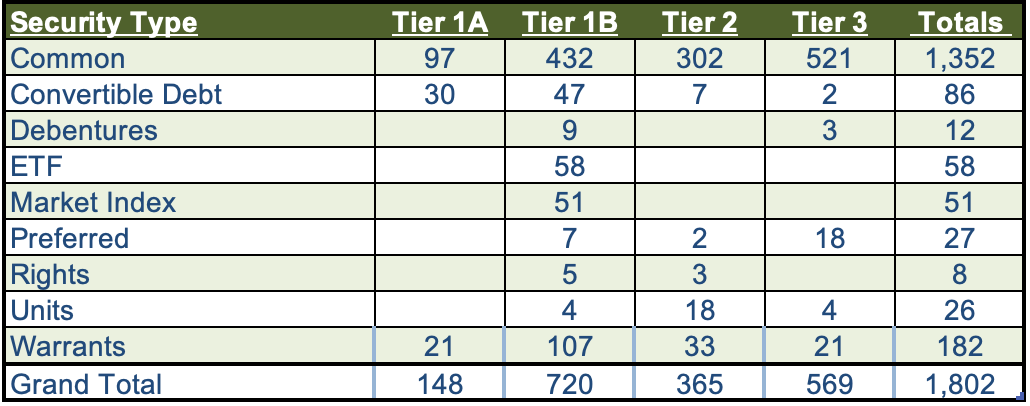

As of June 30, 2022, the breakdown of publicly-traded, cannabis-linked securities was as follows:

Of the thousands of announcements and filings reviewed during Q2 2022, our daily research resulted in a total of 643 updates to the CRB Monitor database (188 updates to issuers’ records, 455 news releases added). The complete list of securities and detailed profiles for more than 1,400 cannabis-linked issuers can be found in the CRB Monitor database. And for more detail on our updates to the CRB Monitor database, please refer to our monthly newsletters: CRB Monitor April 2022 newsletter, CRB Monitor May 2022 newsletter, and the CRB Monitor June 2022 newsletter.

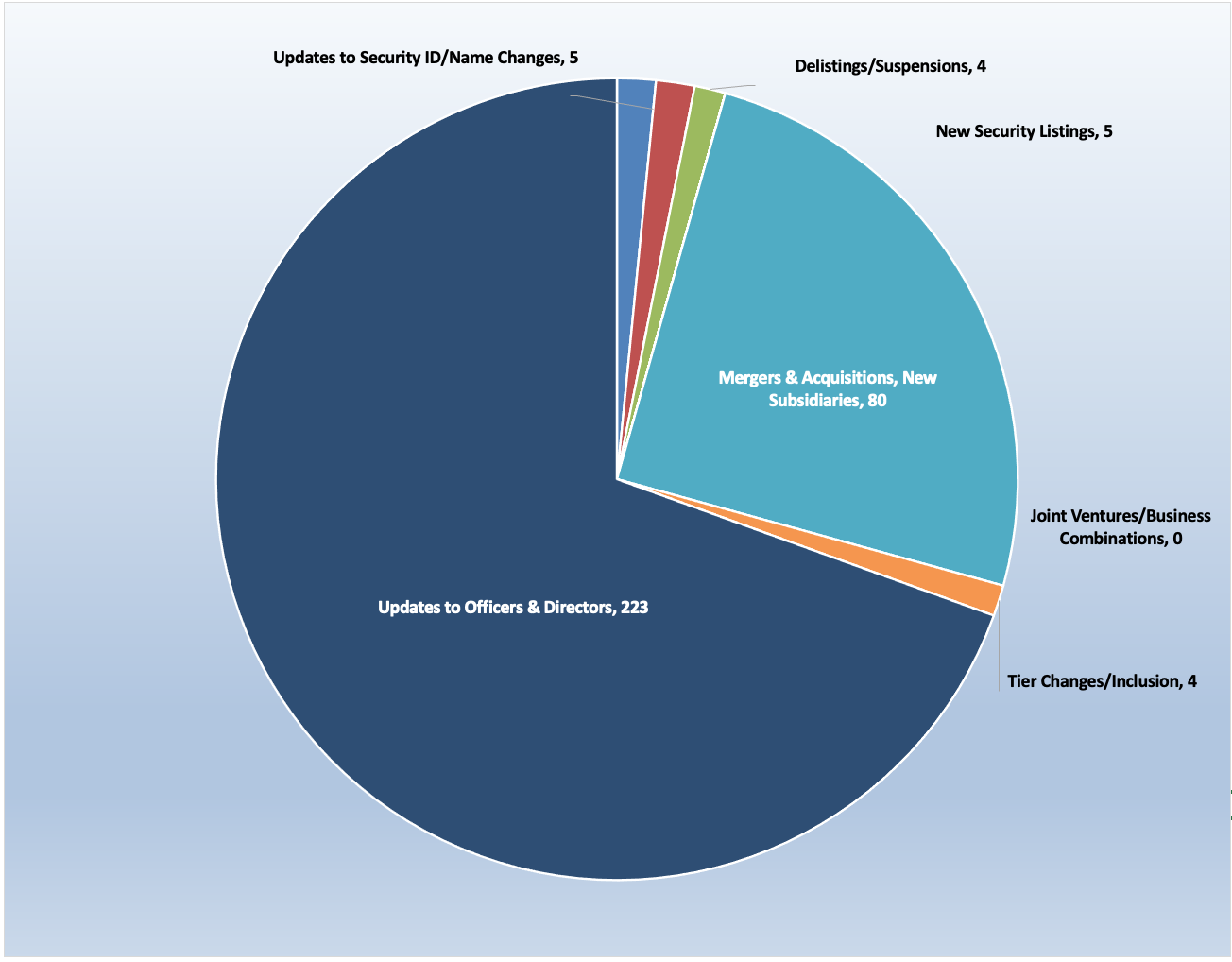

CRB Monitor Securities Database Updates – Q2 2022

Source: CRB Monitor

CRBs In the News

We closely tracked the cannabis news cycle throughout the second quarter of 2022, making hundreds of updates to the CRB Monitor database related to all types of relevant corporate activity. Cannabis equities suffered throughout Q2 2022, and we were there, standing by to capture all the critical information necessary to maintain the world’s best cannabis-linked securities database. The following is a sampling of some of the highlights from the Q2 cannabis news cycle.

In April, TerrAscend Corp. (CSE: TER), entered into a definitive agreement to acquire KISA Enterprises MI, LLC and KISA Holdings, LLC ("Pinnacle") a dispensary operator in Michigan, and related real estate, for total consideration of US$28.5 million. According to an April 14th press release, “The Transaction expedites TerrAscend's expansion into parts of Michigan that currently have limited access to Gage and Cookies branded retail locations. Following the close of the Transaction, TerrAscend's retail footprint will increase to 17 dispensaries in Michigan and 32 dispensaries nationwide.” Following the close of this acquisition, TerrAscend’s footprint expands to seven states and two Canadian provinces, and control (via its subsidiaries) of 84 cannabis licenses in various stages of approval.

Also in April, High Tide Inc. (TSXV: HITI), a Tier 1B CRB operating only in Canada, completed its acquisition of 100% of the equity interest of 2080791 Alberta Ltd. doing business as Boreal Cannabis Company, which operates two retail cannabis stores in Northern Alberta, for CAD$2.2 Million, plus the wholesale value of inventory (about $175,000). In the words of the original April 1st press release, “’Through its online consumption accessories sales, value-added CBD activities, and retail spaces, High Tide has managed to diversify itself within the cannabis value chain. We strongly believe Boreal Cannabis is in capable hands, and will continue to unlock value for not only shareholders, but our customers through competitive pricing and a customer-centric approach,’ said Glenn Boisvert, Chief Executive Officer of Boreal.”

In May, well-known Tier 1B CRB & multistate operator (MSO) Acreage Holdings, Inc. (CSE: ACRG.B.U) announced in a press release that it has completed the sale of its cultivation and processing facility in Medford, Oregon, and in conjunction with the sale, closed its dispensary in Powell, Oregon. Acreage also announced that it completed the consolidation and conversion of its dispensary in Brewer, Maine to adult-use. One of the most geographically diverse MSO’s, Acreage operates in 18 states with more than 100 licenses covering all aspects of the cannabis industry. In the words of Acreage CEO Peter Caldini, “We are thrilled to convert our Brewer dispensary in Maine to adult-use, further solidifying our leading retail market share position in the state...We look forward to expanding access to Maine residents as we continue to grow our footprint in this market. We are also pleased to have closed the sale of the facility in Oregon, as we work to complete our wind-down of operations in the state and focus on growing our presence in our core markets.”

In June, Canadian Tier 1A CRB Sundial Growers Inc. (NASDAQ: SNDL) announced that it entered into a purchase agreement, in the form of a "stalking horse bid" to acquire all the assets of Tier 1B CRB Zenabis Global Inc. (TSXV: ZENA) including its wholly-owned subsidiaries. The press release provides some historical context for this transaction: “In December 2020, Sundial announced the acquisition of a special purpose vehicle (the "Investment") which owned $58.9 million of aggregate principal amount of senior secured debt (the "Senior Loan") of Zenabis Group. On June 1, 2021, HEXO announced it had acquired all the issued and outstanding common shares of Zenabis Global Inc. The Senior Loan remained outstanding following the acquisition by HEXO and bears interest at a rate of 14% per annum in addition to monitoring fees and royalties based on quarterly sales revenue. As at June 16, 2022 the outstanding unpaid principal balance is $51.9 million.” Sundial Growers will assume control of six active cannabis licenses, all through Zenabis’ Ontario subsidiaries. Sundial Growers operates in seven Canadian provinces and its subsidiaries hold 134 cannabis licenses for cultivation, manufacturing, retail, and testing.

Regulatory Updates

In April, the State Legislature in Louisiana approved a medical marijuana expansion bill (HB566) In committee. If passed, this law would shift authority over medical marijuana and more importantly, would expand cultivation in the state. This bill, which appears to be driven almost exclusively by missed revenue opportunities, would also remove the limit of two production licenses in the state, which are held exclusively by the agricultural centers at Louisiana State University and Southern University.

An article in Marijuana Moment quotes Gary Chambers, a candidate for the U.S. Senate, regarding the revenue potential of increased licenses in the State of Louisiana: “We are missing out on golden opportunities in this state to build a gateway to better roads, bridges and schools and this committee has the capacity to help us expand that industry.”

Another marijuana bill sponsored by Rep. Joe Marino (I), HB 135, to allow the sale of medical marijuana to certain qualifying out-of-state patients also cleared the full Louisiana House in April with a vote of 72-22.

In May, Rhode Island Governor Dan McKee (D) signed the bill that made Rhode Island the 19th state to legalize recreational marijuana.

Until the passage of this new law, Rhode Island was a medical marijuana-only state, with approximately 70 licenses in active status, largely for cultivation (an additional 150 are inactive). This new legislation adds 33 new retail licenses (24 standalone, 9 hybrid) issued for the sale of recreational marijuana.

Aspects of this law include:

- A plan to adopt automatic expungement of prior civil or criminal marijuana possession charges

- Legalizes the sale and possession of up to 1 ounce of cannabis for adults ages 21 and older, with no more than 10 ounces for personal use kept at a person’s residence.

- Creates a Cannabis Control Commission that is authorized to issue licenses to cannabis retailers and cultivators, and set regulations for the industry.

- Approved hybrid licensees could start to grow and manufacture marijuana for adult consumers starting August 1, 2022.

- There will be a two-year moratorium on new cultivation licenses issued in Rhode Island.

In the words of Gov. McKee, “This bill successfully incorporates our priorities of making sure cannabis legalization is equitable, controlled, and safe…In addition, it creates a process for the automatic expungement of past cannabis convictions. My Administration’s original legalization plan also included such a provision and I am thrilled that the Assembly recognized the importance of this particular issue. The end result is a win for our state both socially and economically.”

Finally, in June an article in Politico reported that “Democrats are looking for a weed deal.” According to this article, reporters interviewed more than a dozen lawmakers, staffers, advocates and lobbyists, all of which agreed that in recent weeks “the tone has changed on Capitol Hill.” Apparently, the more progressive senators are slowly warming to another option: adding provisions to a broadly supported bill that would allow financial institutions to offer banking services to the cannabis industry, called the SAFE Banking Act. This should come as no shock to those of us who have been following the progress (or lack thereof) of any meaningful cannabis-oriented legislation that would pass both houses of Congress. And with the midterm elections approaching in the next few months, Democrats are beginning to look desperate to pass any legislation that they can take home to their constituents, who overwhelmingly support legalization.

The issue with SAFE Banking is that it is not supported by Democrats who are looking for legalization/decriminalization to pass first. Taking them out of sequence is a non-starter for senators like Cory Booker (D-New Jersey) who has stated that he won’t support a bill that only helps the industry and does not do anything meaningful for people hurt by the war on drugs. And even if Democrats are willing to give in, the outlook for even SAFE Banking is uncertain, particularly if Republicans take back the Senate in the midterms. In the words of the Politico article, “SAFE may not even receive a hearing in either chamber under Republican leadership, let alone a floor vote. That is motivation enough for both Republicans who support cannabis banking and Democrats who want comprehensive legislation to find a middle ground.”

Cannabis-Linked Equity Performance

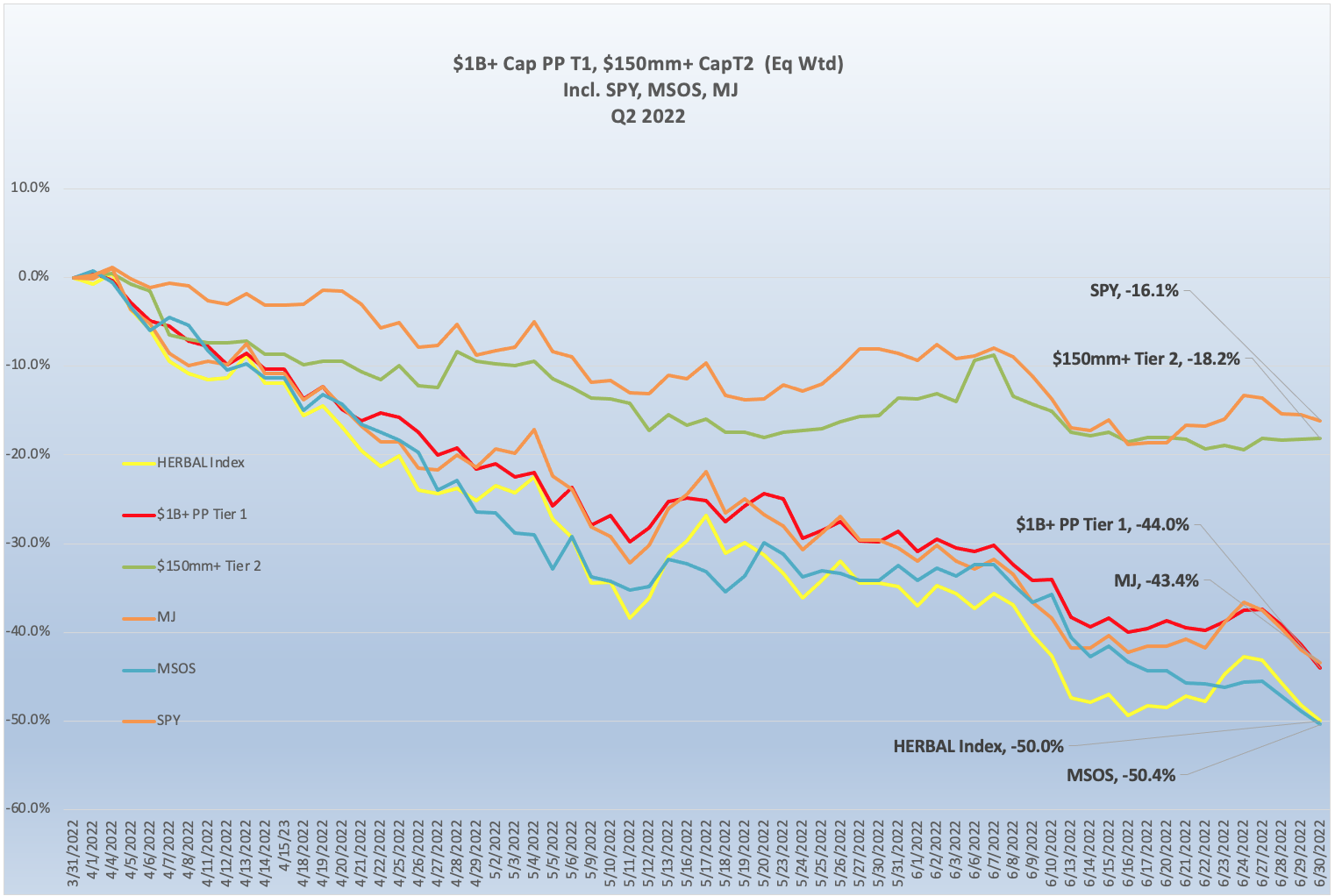

Source: CRB Monitor, Sentieo

Cannabis Index Returns

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), is a mix of Pure Play Tier 1 and Tier 2 cannabis related equities, weighted by both investability and strength of theme (SOT). A well-conceived representation of the universe of legal, pure play cannabis equities, HERBAL was down 50.0% for the 2ndquarter of 2022. HERBAL’s performance was consistent with other cannabis-themed vehicles, like the ETFMG Alternative Harvest ETF (NYSE Arca: MJ). MJ’s outperformance (-43.4%) relative to HERBAL was largely due to the fund’s 20% holding in non-pure play CRBs, which tend to have low correlation with Pure Play cannabis. The MSO-heavy Advisorshares Pure Us Cannabis ETF (NYSE: MSOS) lost 50.4% in Q2. The MSOS performance will deviate from both HERBAL and MJ largely due to its holdings of CRBs with US Marijuana touch-points, which dominate in that fund. [MJ and HERBAL cannot hold any securities with direct US touch points.]

The CRB Monitor equally-weighted basket of Pure Play Tier 1 CRBs with $1b+ market cap lost 44% in Q2 2022. This basket is essentially a hybrid of the companies without US touchpoints and MSO’s. Their equal weighting will cause their returns to deviate from the other indexes, which all employ some variation of market cap weighting.

The CRB Monitor equally-weighted basket of Tier 2 CRBs with $150mm+ market cap has outperformed the Tier 1 lately, falling by 18.2% for Q2. As we have indicated in the past, Pure Play Tier 1 and Tier 2 CRBs tend to display high correlation in the long term, but their respective performance has a tendency to diverge in the short term, given the occasional lag from the impact (positive or negative) of market forces. One lingering reality cannot be avoided, that for better or worse Tier 2 CRBs will eventually inherit the overall success or failure of the Tier 1 universe.

From the chart above, we can see that cannabis investors were not rewarded for their patience in Q2 2022. While unemployment numbers are consistently falling to historic lows, they are not keeping pace with inflation. As we have written recently, the economy was eventually going to overheat, given pandemic-related residual shocks to the supply chain, pent-up demand from bulging savings accounts, and two Covid-related relief packages that inflamed consumer demand even further. And perhaps the event with the greatest impact, we witnessed an unscheduled invasion of Ukraine by Russia. Then we had the much-anticipated 0.75% Fed rate hike, which finally hit in mid-June. All of these factors drove investors away, as evidenced by the -16% return of the S&P 500 (see SPY on the chart above).

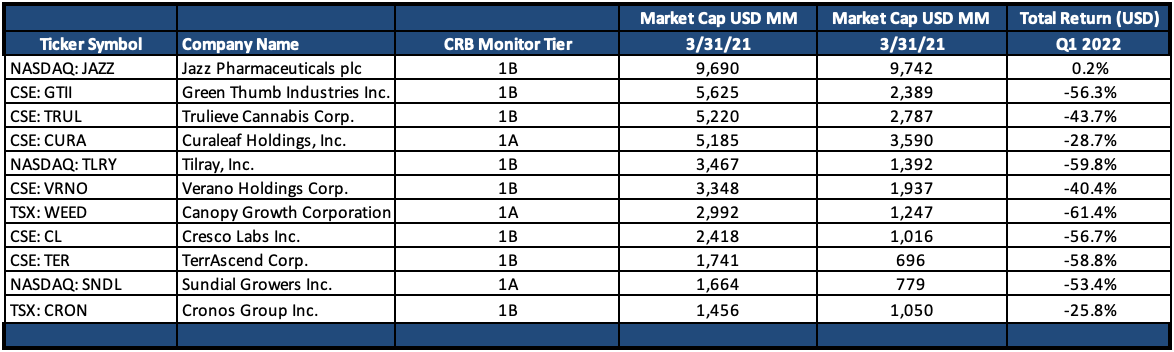

Tier 1 Pure Play CRBs w/Mkt Cap Over $1B – Returns 2nd Quarter 2022

Source: CRB Monitor, Sentieo

CRB Monitor Tier 1

In typical fashion the best performing stock in the Tier 1 basket was Tier 1B Jazz Pharmaceuticals plc (Nasdaq: JAZZ) (+0.2%). Since their announcement of the acquisition of GW Pharmaceuticals in February 2021, JAZZ has outperformed the rest of the Tier 1 CRB basket. As we have written regarding this performance disparity: While JAZZ has experienced its own periods of volatility over the last 18 months, risk is dampened by diversification at the product level – revenue from cannabis is significant but not their only offering. In addition, Epidiolex, GW Pharma’s epilepsy drug, is the only FDA-approved cannabis-derived medical product on the market; this has helped to control volatility as well, largely because JAZZ is insulated from all the regulatory false starts that have plagued Tier 1 and Tier 2 CRBs across North America.

Otherwise, there was little to be happy about in Tier 1 CRB space during Q2 2022. The persistent headwinds that we mentioned above made for a perfect storm for investors, as the cannabis market effectively lost a breathtaking 50% of its value. For investors that stayed around for this bloodbath, there was little to celebrate and even less to look forward to. Time is running out on any progress toward federal legalization/decriminalization/banking reform, as legislators are unlikely to find common ground in the few months remaining before midterm elections. And it appears that the economic headwinds that have assaulted global equities will be with us for at least the balance of 2022, barring anything unforeseen.

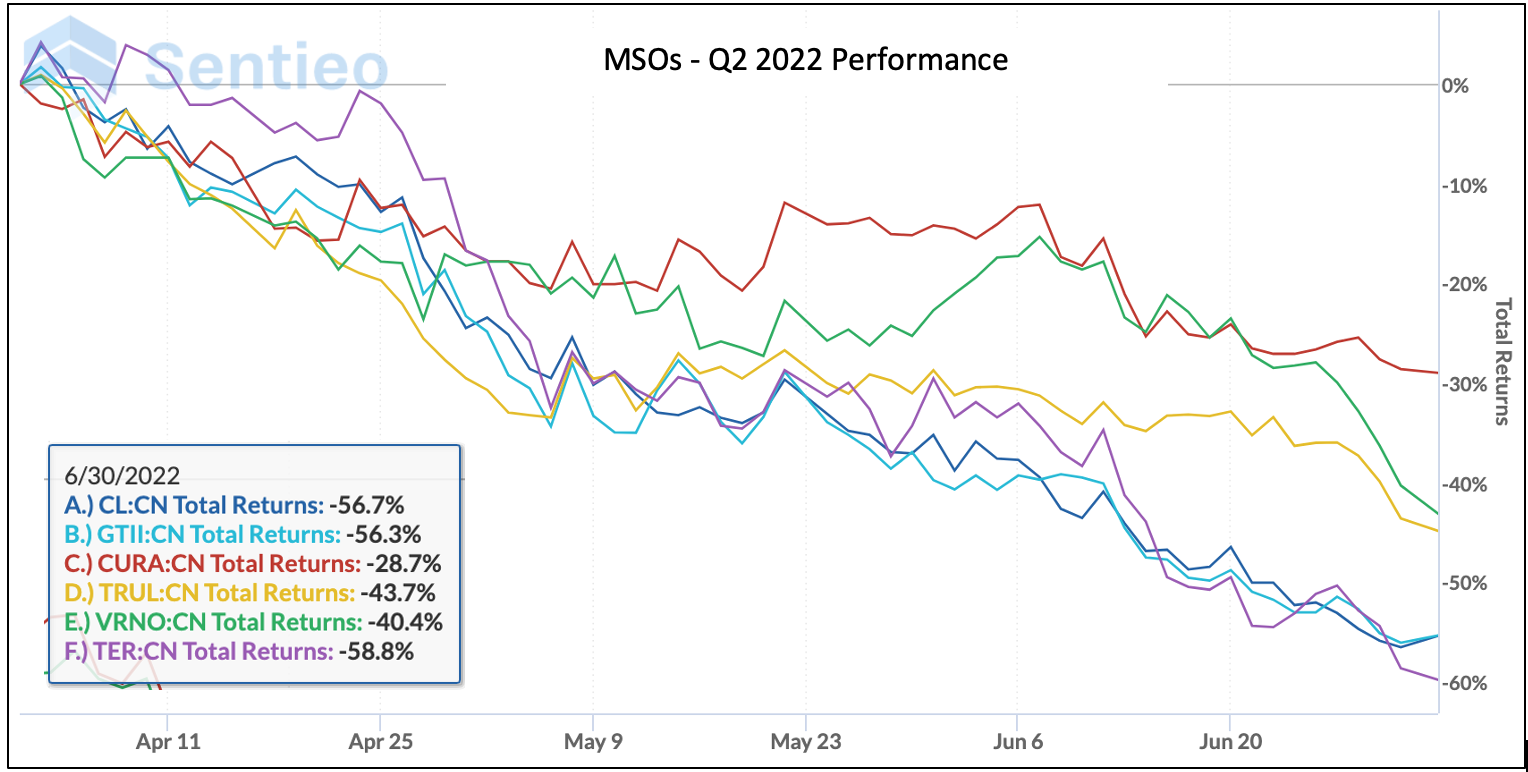

Looking at the performance of multi-state operators (MSOs), the free-fall appeared to happen across the board. Cresco Labs Inc. (CSE: CL), fresh off their 3/23/22 announcement of their acquisition of Columbia Care Inc. (NEO: CCHW) got hammered, falling by more than 56% for the quarter. We witnessed similar performance from Curaleaf Holdings, Inc. (CSE: CURA) (-28.7%), Verano Holdings Corp. (CSE: VRNO) (-40.4%), Trulieve Cannabis Corp. (CSE: TRUL) (-43.7%) and Green Thumb Industries Inc. (CSE: GTII) (-56.3%) (see chart below).

Source: Sentieo

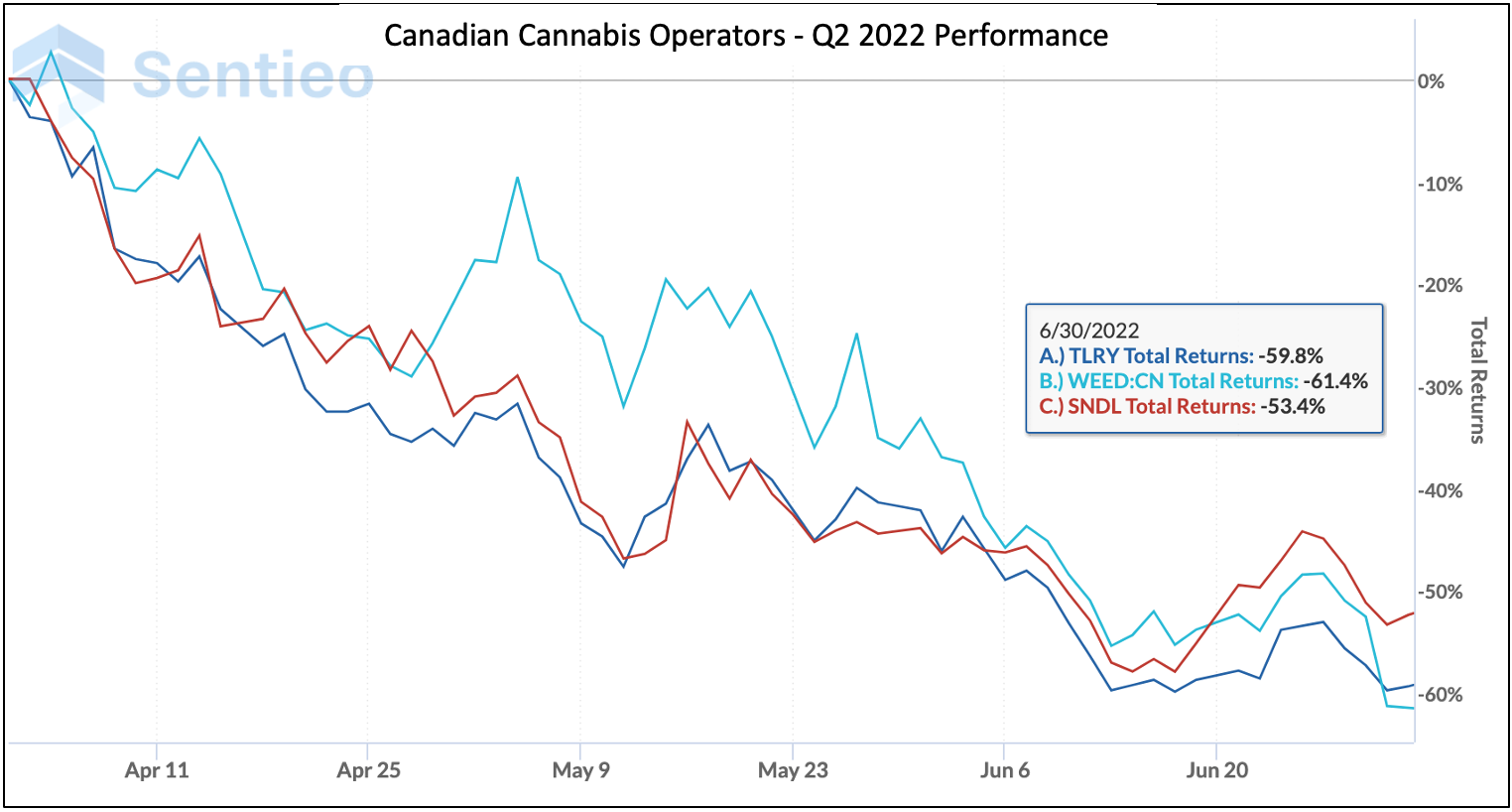

The Canadian operators’ luck was no better, with abysmal performance from Tilray Brands, Inc. (Nasdaq: TLRY), Cronos Group Inc. (TSX: CRON) (-59.8%), Canopy Growth Corporation (TSX: WEED) (-61.4%), and Sundial Growers Inc. (NASDAQ: SNDL) (-53.4%). Canadian CRBs would benefit from US federal legislation as they would no longer be prohibited from selling cannabis across their southern border.

Source: Sentieo

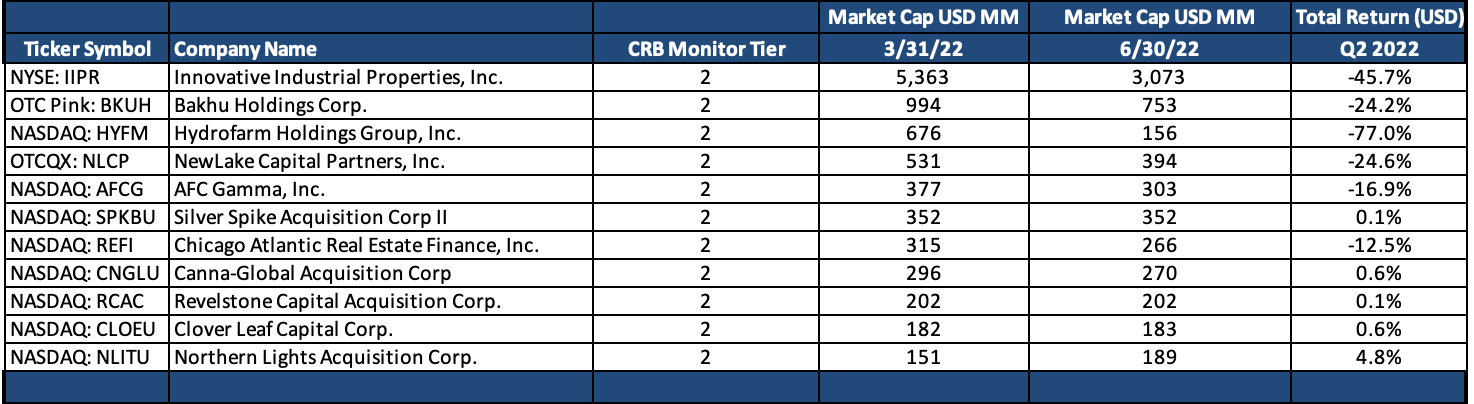

Tier 2 CRBs w/Mkt Cap Over $150mm – Returns 2nd Quarter 2022

Source: CRB Monitor, Sentieo

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies returned -18.2% for the second quarter of 2022, which outperformed the equally-weighted Tier 1 basket by about 26%. When these two portfolios deviate, it could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given the direct revenue relationship, but precisely when these two groups will converge is not so easy to predict. It is difficult to imagine that this outperformance will persist for long, given that Tier 2 CRBs derive a majority of their revenues by being providers of goods and services to Tier 1 CRBs.

Given its relative size and direct relationship to plant-touching cannabis operations, we tend to follow Innovative Industrial Properties, Inc. (NYSE: IIPR) closely. IIPR is an internally-managed real estate investment trust (CLS sector - REIT) focused on “the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators for their regulated state-licensed cannabis facilities.” We write about IIPR frequently, largely due to the fact that its stock has historically defied the volatile price patterns of the cannabis space as it has, until recently, consistently outperformed its peers as well as its CRB-customers. It is also, by far, the largest Tier 2 CRB by market capitalization.

With its -45.7% return in Q2, IIPR has given back essentially all of its performance since the summer of 2020, having returned +230% from July 2020 to November 2021 before losing all of it, as the 2-year return through June of 2022 is now flat. What happened? In April, we introduced a report by Blue Orca Capital which recommended a short position in IIPR, and highlighted several reasons why investors should view IIPR as overvalued. Reasons include: impairments due to tenant default, alleged illicit activity by tenants, and anxiety over falling CRB share prices and potential cash flow shortages. Given IIPR’s disposition of being fully embedded in the US Marijuana space (particularly cultivation), their price sensitivity to these issues is understandable. One observation from the report: “…we think IIPR is more akin to a high risk cannabis bank, providing de facto for long term leases. This is significant, as a book of loans to cannabis companies should not trade at the same book multiple or yield as real estate assets.”

Another “large” Tier 2 CRB that we continue to follow as it descends into the abyss is Hydrofarm Holdings Group, Inc. (Nasdaq: HYFM, CLS Sector Agricultural & Farm Machinery). Hydrofarm is an independent distributor and manufacturer of hydroponics equipment and supplies, primarily to cannabis cultivators. Similar to IIPR, HYFM has been in a free fall for the better part of 2022, posting a 2nd quarter return of -77%.

As we wrote in our June newsletter, HYFM stock is down nearly 88% YTD! A company with 100% exposure to one segment of the cannabis industry, HYFM has not recovered from a dismal Q4 earnings report, in which they reported an $11mm net loss, in spite of an increase in sales over the quarter.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"