CRB Monitor Cannabis-Linked Securities July 2021 Update

James B. Francis, CFA

Chief Research Officer, CRB Monitor

CRB Monitor tracks ~ 1,400 publicly-traded, Cannabis-Related Businesses (CRBs) globally, which have ~1,600 traded securities. We categorize CRBs into our proprietary cannabis risk tier framework and cannabis-linked (CLS) sectors. In addition, CRB Monitor unravels and maintains complex corporate structures, linking publicly-traded parent companies to their underlying operational plant-touching subsidiaries. Custodian banks, broker/dealers, and asset managers find our data essential for pre-trade compliance, risk management, index construction, and portfolio analytics.

CRB Monitor Securities Database Updates

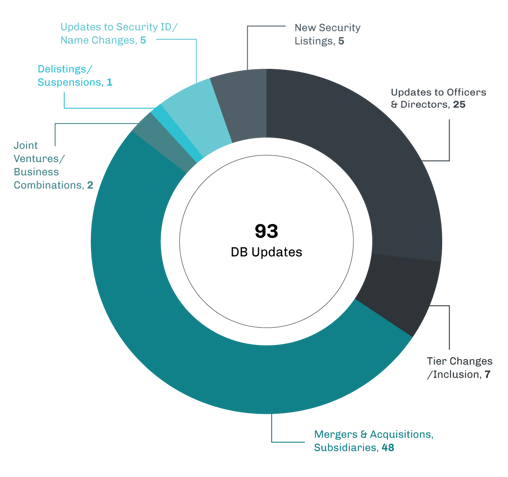

In 2021, CRB Monitor’s research team made more than 1,100 updates to securities’ information and added more than 5,000 source documents and relevant news articles to the CRB Monitor database. Here is a summary of the updates for July 2021:

Cannabis News Updates: M&A

The cannabis M&A train kept rolling in the month of July as CRB Monitor research identified mergers and acquisitions that resulted in 48 new subsidiary relationships for publicly-traded CRBs.

Tier 1B CRB Green Thumb Industries Inc. (CSE: GTII) expanded its US cannabis “thumb” print in July by establishing operations in Virginia with the closing of its acquisition of grower/processor/retailer Dharma Pharmaceuticals. This purchase broadens GTII’s presence in the US to 14 states and increases its subsidiaries’ total number of active cannabis licenses to 188.

Kiaro Holdings Corp. (TSXV: KO), a Tier 1B Canadian CRB added 7 newly-licensed Tier 1A retail locations in Ontario while securing an opening into distribution in Australia. Now operating in British Columbia, Ontario, and Saskatchewan, these acquisitions bring Kiaro’s active license total (all recreational cannabis) to 23. What’s also interesting about this transaction is that it includes the creation of “a new digital portfolio focused on the supply of high-quality consumption accessories to Canadian, American and Australian consumers,” according to a July press release.

In July, top 20 Tier 1A Sundial Growers Inc. (NASDAQ: SNDL), completed its acquisition of all the issued and outstanding shares of Spirit Leaf Retail Cannabis Network, aka Inner Spirit Holdings Ltd. This was a significant move for Sundial, which broadened and deepened its product set as well as diversified its presence, particularly in Canada. This acquisition expanded Sundial’s presence by 88 medical and retail licenses across 5 provinces and, in the words of Sundial’s PR department “establishes Sundial as one of Canada's largest vertically integrated cannabis companies.”

And we’d be remiss if we failed to mention the latest news regarding Tier 1B Verano Holdings Corp. (CSE: VRNO). In a continuation of the growth of its footprint in the medical and recreational cannabis market, Verano announced the opening of its 80th dispensary in the US, located in Pittsburgh and featuring Pennsylvania’s first drive-through service. Per the CRB Monitor database, this brings Verano’s active and pending license count to 130 across 18 states in the US.

Select M&A/Subsidiary Highlights:

|

Name |

Ticker Symbol |

CRBM Tier |

Event |

|

Tier 1A |

Radient Technologies Inc. Enters into Binding Letter of Intent to Acquire Tunaaaa Room Xtracts Inc. |

||

|

Tier 1B |

|||

|

Tier 1B |

Icanic Brands Closes Acquisition of De Krown Enterprises LLC |

||

|

Tier 1B |

Trulieve Completes Acquisition of Keystone Shops in Pennsylvania |

||

|

Tier 1B |

|||

|

Tier 1A |

Harvest Health & Recreation Inc. Announces Divestiture of Utah Assets |

||

|

Tier 1B |

Jushi Holdings Inc. Completes Acquisition of Licensed Cultivator in Ohio |

||

|

Tier 1A |

Sundial Growers Completes the Acquisition of Spiritleaf Retail Cannabis Network |

||

|

Tier 1B |

Security/Exchange Highlights:

|

Company Name |

Ticker Symbol |

EVENT Type |

Result |

|

Name Change |

WeedMD Inc. Announces Intent to Change Corporate Name to Entourage Health Corp. |

||

|

New Listing |

CSE Bulletin: New Listing - Choom Holdings Inc. Warrants (CHOO.WT) |

||

|

Delisting |

|||

|

New Symbol |

PharmaDrug Announces Stock Ticker Symbol Change to (CSE: PHRX) |

||

|

ID/Name Change |

AgraFlora Organics International Inc. Changing Name to Agra Ventures Ltd. |

||

|

New Listing |

|||

|

New Listing |

AWH Announces Commencement of Trading on the OTCQX in the United States |

||

|

New Listing |

Select New Additions to CRB Monitor:

|

Name |

Ticker Symbol |

CRBM Tier |

CRBM Cannabis Sector (CLS) |

|

Tier 2 |

Financial Services |

||

|

Tier 3 |

Pharma & Biotech |

||

|

Tier 1B |

Owner/Investor |

||

|

Tier 1B |

Owner/Investor |

||

|

Tier 2 |

Financial Services |

Regulatory Updates

In mid-July 2021, Senate Majority Leader Chuck Schumer (D–NY), Senate Finance Committee Chairman Ron Wyden, (D-OR) and Senator Cory Booker (D-NJ) released a draft version of a bill that would effectively and permanently legalize marijuana in the United States. The bill, officially named the Cannabis Administration and Opportunity Act, is a comprehensive piece of legislation that if passed, would pave the way for the future of the cannabis industry while providing benefits to underserved communities as well. Quoting from the 30-page summary document:

“Today, more than 90 percent of Americans believe cannabis should be legal either for adult or medical use. Despite legalization under state law and broad public support for cannabis legalization, cannabis remains illegal under federal law. By ending the failed federal prohibition of cannabis, the Cannabis Administration and Opportunity Act will ensure that Americans – especially Black and Brown Americans – no longer have to fear arrest or be barred from public housing or federal financial aid for higher education for using cannabis in states where it’s legal.”

This sweeping bill, if it were to pass and be signed by the President, would:

- Remove marijuana from the Controlled Substances Act within 60 days of the bill’s enactment

- Expunge marijuana-related arrest records

- Reinvest in communities most harmed by the drug war

- Maintain the authority of states to set their own marijuana policies

- Impose a federal tax on marijuana products and put some of that revenue toward grant programs for people from underserved communities to participate in the industry

- Transfer regulatory authority over cannabis from the Drug Enforcement Administration (DEA) to the Food and Drug Administration (FDA), the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) and the Alcohol and Tobacco Tax and Trade Bureau (TTB)

Cannabis-linked Equity Performance

Source: CRB Monitor, Sentieo

We can see on the chart above how things have played out for the more significant players over the last 24 months of returns. It’s reasonable to assume that the larger, household-name CRBs – Tilray, Inc. (Nasdaq: TLRY) (-64%), Cronos Group Inc. (TSX: CRON) (-55%), and Canopy Growth Corporation (TSX: WEED) (-47%) – have done quite a bit of taking with very little giving over this period and investors should take note. In spite of the February 2021 spike, these three marquis CRBs, with their ambitious corporate strategies, have not delivered value for their shareholders and their performance has proven this out.

Conversely, for investors that chose wisely over the last two years their bets have paid off. Risk notwithstanding, High Tide Inc. (CSE: HITI) (+173%), Trulieve Cannabis Corp. (CSE: TRUL) (+195%), and Green Thumb Industries Inc. (CSE: GTII ) (+194%) have rewarded investors by implementing successful growth-driven strategies, particularly with expansion of operations throughout the United States. We should note that these three CRBs are companies with their primary listings on the CSE, and they all have a direct connection to the production and sale of US marijuana. Meanwhile, TLRY, CRON, and WEED have intentionally conducted their direct marijuana operations outside of the US, which has allowed them to list on TSX and Nasdaq. It would appear that this strategy has been a disappointment over the last 2 years for their shareholders.

[One final note on longer term performance: For investors in an equally-weighted, diversified index of the top 10 pure play CRBs, the 2-year performance through July 2021 has been a respectable 51%.]

Cannabis equities tended to underperform mainstream equities in July 2021, in an apparent protracted correction that followed a brief, but significant rally in early February. Are we seeing the makings of another prolonged selloff, similar to what we witnessed beginning back in April 2019? This could be the case, given the ongoing regulatory gridlock at the federal level (see news analysis above) and cannabis companies’ apparent inability to deliver consistent profits over an extended period of time. Or have the larger players (i.e. Tilray) overextended themselves via their blockbuster acquisitions, leaving too little cash on the balance sheet to weather another wave of the pandemic and subsequent economic turndown? Once again, stay tuned for future developments.

The CRB Monitor index of Top 10 pure play CRBs (equally weighted) had a return of -12.1% for July 2021, with all 10 constituents in negative territory for the month. The Top 10 index underperformed major domestic and global indexes (SPX, EAFE, and EMF) for July.

CRB Monitor “Top 10” Tier 1 Cannabis Companies – July 2021

Source: CRB Monitor, Sentieo

CRBs In the News

The following is a sampling of highlights from the July 2021 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

- Exactus Joins with Panacea Life Sciences to Create Premier CBD Wellness Platform (Tier 1B)

- Radient Technologies Inc. Enters into Binding Letter of Intent to Acquire Tunaaaa Room Xtracts Inc. (Tier 1A)

- Thermic Science Receives its First North American Shipment of Thermic Infrared Heating Paint for Manufacturing the First Batch of North American Made Thermic Infrared Portable Heaters for Retail Consumer Sales and Distribution Across North America, Confirms ENDO/CSi-FR Acquisition (Tier 2)

- Columbia Care Completes Acquisition of CannAscend, Owner and Operator of Four Dispensaries Across Ohio (Tier 1A)

- VIVO Cannabis(TM) Announces Results of 2021 AGM and Election of New Directors (Tier 1B)

- Harborside Completes Acquisition of Sublime, California's Award-Winning Infused Pre-Roll Brand (Tier 1B)

- TransCanna Appoints Chief Financial Officer Peter Gregovich, Former CFO of Eaze (Tier 1B)

- Gaia Expands Extraction Laboratory TRU Extracts and Closes Acquisition of Canna Stream (Tier 1B)

- HempFusion Closes Acquisition of Sagely Naturals (Tier 3)

- Verano Maximizes Ohio Footprint by Closing on Acquisition of Dayton Dispensary, Mad River Remedies (Tier 1B)

- IM Cannabis Closes Acquisition of MYM Nutraceuticals (Tier 1B)

- Curaleaf Appoints Ranjan Kalia As Chief Financial Officer (Tier 1A)

- Farmhouse Inc. Subsidiary Wins Suit Against Operating Los Angeles Cannabis Business (Tier 3)

- High Tide to Acquire Regina Retail Portfolio, Strengthens Presence in Saskatchewan (Tier 1B)

- Nova Cannabis Announces Graduation to the TSX (Tier 1B)

- Audacious Acquires LOOS, a California Shot Beverage and Edibles Company (Tier 1B)

- Agrify Receives Hemp Cultivation and Production License, Opens New Facility and Product Showcase in Billerica, Massachusetts (Tier 2)

- InterCure Advances Towards NASDAQ Listing (Tier 1B)

- Cansortium Opens New Dispensary in Deerfield Beach, Florida (Tier 1B)

- Empower Announces Sale of Its Cannabis Related Assets (Tier 1B)

- OTC Markets Group Welcomes Cansortium to OTCQX (Tier 1B)

- Aurora Cannabis Announces Appointment of New Independent Director (Tier 1A)

- Flora Growth to Partner with Avaria to Distribute Award-Winning Pain Cream Brand KaLaya Across LATAM & Produce Its CBD Formulations (Tier 1A)

- Aleafia Health Announces the Appointment of Mark J. Sandler as Board Chair (Tier 1B)

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"