James B. Francis, CFA

Chief Research Officer, CRB Monitor

CRB Monitor tracks ~ 1,400 publicly-traded, Cannabis-Related Businesses (CRBs) globally, which have ~1,600 traded securities. We categorize CRBs into our proprietary cannabis risk tier framework and cannabis-linked (CLS) sectors. In addition, CRB Monitor unravels and maintains complex corporate structures, linking publicly-traded parent companies to their underlying operational plant-touching subsidiaries. Custodian banks, broker/dealers, and asset managers find our data essential for pre-trade compliance, risk management, index construction, and portfolio analytics.

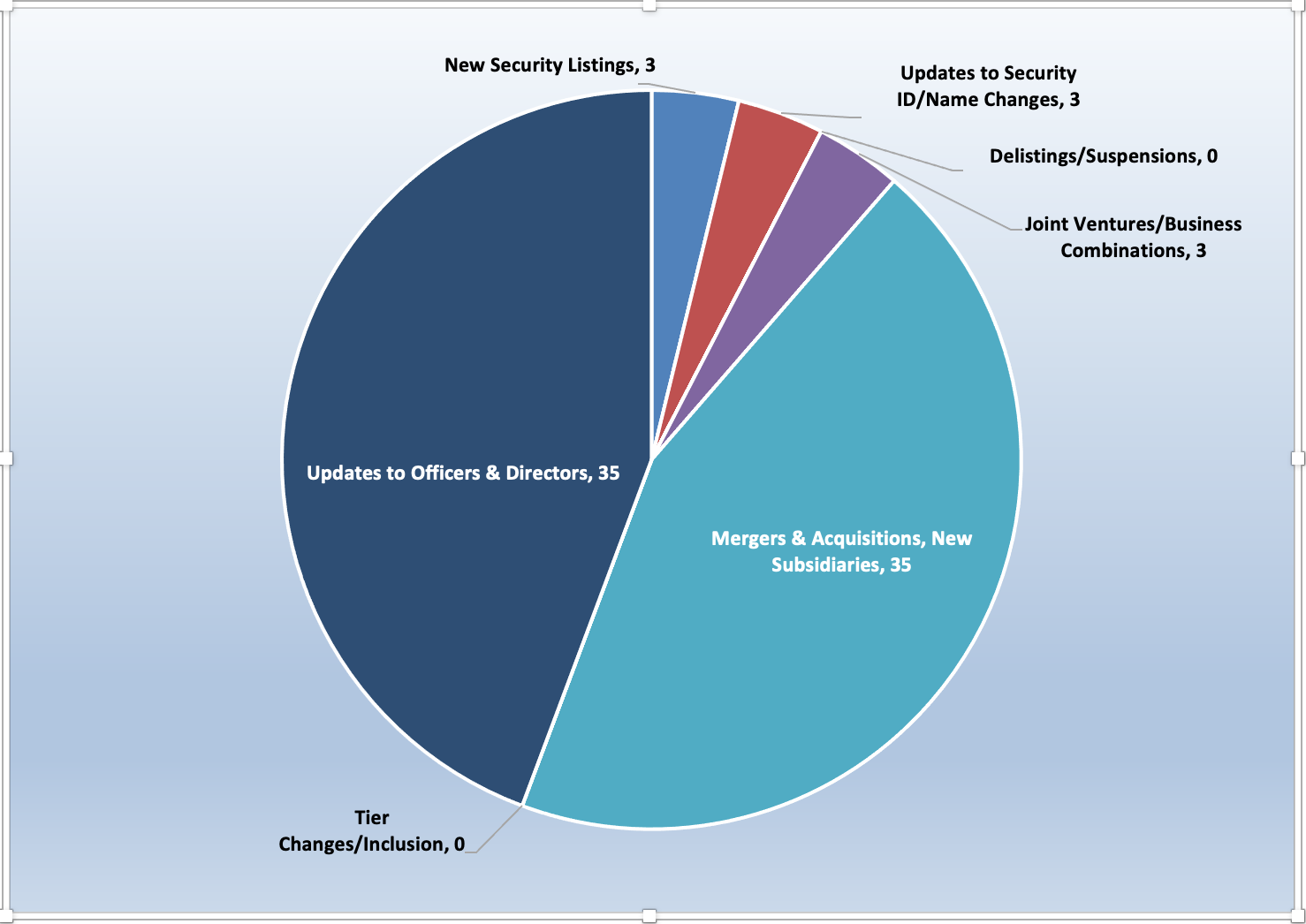

CRB Monitor Securities Database Updates

In 2021, CRB Monitor’s research team made thousands of database updates to securities’ profiles and added several thousand news-related source documents to the CRB Monitor database. Here is a summary of the updates for January 2022:

Source: CRB Monitor

Cannabis News: M&A Activity

We continue our close watch on the cannabis news cycle, and in spite of the ongoing market correction January was a busy month for corporate activity. Here are some of the highlights from January 2022:

In January Wakefield, MA Tier 1B multistate operator Curaleaf Holdings, Inc. (CSE: CURA), one of leading vertically integrated multi-state cannabis operators in the US, announced the completion of its acquisition of Bloom Dispensaries aka Arizona Natures Wellness, a vertically integrated, single state cannabis operator in Arizona. With the close of the Transaction, Curaleaf's retail footprint has reached 13 dispensaries in Arizona and 121 nationwide. With this acquisition, Curaleaf now operates in 19 states plus the District of Columbia and, through its subsidiaries, holds more than 150 cannabis licenses.

Also in January Tier 1A MSO Medicine Man Technologies, Inc. (OTCQX: SHWZ) aka Schwazze, announced that it closed its transaction to acquire the assets of BG3 Investments, LLC dba Drift which consists of two cannabis dispensaries located in Boulder, Colorado. According to the announcement, “This purchase continues Schwazze's expansion plan in Colorado, adding to the Company's current dispensary footprint, and bringing the total number of dispensaries to twenty. As part of the purchase, Schwazze will also acquire the assets of Black Box Licensing, LLC, which contains certain intellectual property.” With this purchase, Schwazze now operates in 5 states (CO, PA, HI, NM, MA) and holds (directly or through its subsidiaries) 61 licenses either in active or pending status.

Still expanding its operations in the US, Tier 1A MSO Columbia Care Inc. (NEO: CCHW) announced that it opened its 80th dispensary with its new Cannabist location in Virginia Beach, VA. CCHW, which saw its market cap fall below the $1 billion level in the fall of 2021, managed to outperform the large cap basket in January with a return of -7.4%. With that said, CCHW’s stock price lost more than 60% for the 12 months ending 1/31/2022. Nevertheless, Columbia Care continues to operates in 17 states and, through its subsidiaries holds more than 110 cannabis licenses that are in either active or pending-approval status. Of its operations in Virginia, the announcement states “The Company is licensed to operate a market-leading total of 12 dispensaries between Columbia Care and gLeaf to serve the growing base of nearly 40,000 registered medical patients across the state. To support this retail footprint, Columbia Care currently operates nearly 148,000 square feet of existing cultivation and production capacity and has a fleet of delivery vehicles able to serve the entire state.”

In mid-January 1933 Industries Inc. (CSE: TGIF), a Canada-based vertically integrated cannabis company, announced that it signed a binding letter of intent to acquire 100% of all of the authorized and issued shares of Day One Beverages, Inc., “a disruptive beverage company with a portfolio of next-level CBD-infused sparking water products. TGIF currently operates in the cannabis industry through its wholly-owned Nevada subsidiary, Alternative Medicine Association LC. Per CRB Monitor, Alternative Medicine Association holds 13 active licenses for cultivation, manufacturing, retail, and wholesale of both recreational and medical cannabis. Day One is a bit of a departure for TGIF, given that its products are non-THC based.

Finally, small cap Tier 1A Canadian CRB Radient Technologies Inc. (TSXV: RTI) announced that it had completed its acquisition of all of the issued and outstanding securities of Alberta-based Tunaaaaroom Extracts. According to the announcement, “The Acquisition is an arm's length transaction for the purposes of the policies of the TSX Venture Exchange ("TSXV") and remains subject to final approval of the TSXV. Radient did not pay any finder's fees in connection with the Acquisition.” Back in December 2020, Tunaaaaroom Xtracts entered a licensing and co-develop agreement with Radient for development and sales of premium cannabis products, which are now sold through provincially licensed retailers in seven Canadian provinces and territories. It does not appear that Tunaaaaroom is, or will be, a licensed cannabis business.

Select M&A/New Subsidiary Highlights:

|

Name |

Ticker Symbol |

CRBM Tier |

Event |

|

Tier 1B |

The Greenrose Holding Company Closes Asset Purchase of True Harvest, LLC |

||

|

Tier 1A |

Columbia Care Opens its 80th Dispensary with New Cannabist Location in Virginia Beach |

||

|

Tier 1B |

|||

|

Tier 1B |

|||

|

Tier 1B |

1933 Industries Signs Binding Letter of Intent to Acquire Beverage Company Day One |

||

|

Tier 1A |

|||

|

Tier 1B |

Cresco Labs Announces Termination of Blair Wellness Acquisition |

||

|

Tier 1A |

|||

|

Tier 1B |

Radient Completes Acquisition of Tunaaaaroom Xtracts and Makes Corporate Announcements |

Security/Exchange Highlights:

|

Company Name |

Ticker Symbol |

EVENT Type |

Result |

|

New Listing |

|||

|

ID/Name Change |

Sativa Wellness Group Announces Name Change and Strategic Update |

||

|

ID/Name Change |

CSE Bulletin: Name and Symbol Change - Nabis Holdings Inc. (NAB) |

||

|

New Listing |

|||

|

New Listing |

|||

|

ID/Name Change |

Select New Additions to CRB Monitor:

|

Name |

Ticker Symbol |

CRBM Tier |

CRBM Cannabis Sector (CLS) |

|

Tier 3 |

Food, Beverage & Tobacco |

||

|

Tier 3 |

Professional Services |

||

|

Tier 3 |

Media & Publishing |

||

|

Tier 1B |

Owner/Investor |

||

|

Tier 3 |

Fertilizers & Agricultural Chemicals |

Cannabis News: Regulatory Updates

As we move gradually toward universal acceptance of cannabis (in some form) at the state level, the federal government continues to struggle to get any legislation across the finish line for the President to sign.

In January, Rep. Ed Perlmutter (D. Colorado), the sponsor of the Secure and Fair Enforcement (SAFE) Banking Act, announced that he is seeking to attach an amendment that provides for research and innovation in the tech and manufacturing sectors. [In short, The SAFE Banking Act seeks to guarantee legal protections for financial institutions that provide banking services to licensed cannabis-related businesses (CRBs).] To enhance the probability that this bill passes in the Senate, Perlmutter is attaching SAFE Banking to another, non-cannabis related bill called the America COMPETES Act (HR 4521). Why is this necessary? Apparently this strategy would make SAFE Banking more appealing to members of congress that are on the fence. Most of us are old enough to remember that in 2021 SAFE Banking was appended, unsuccessfully, to the National Defense Authorization Act (NDAA). What might complicate matters for SAFE Banking are a couple of hurdles, none the least of which is that Rep. Perlmutter has announced his imminent retirement from Congress. There is also the issue that, by itself, SAFE Banking is not appealing to the progressive wing of Congress and will likely struggle to pass in the Senate. In the words of Joel Kopperud, Vice President of Government Affairs for The Council in an article published in January:

“Even this issue that enjoys broad bipartisan support appears to be constrained by progressive advocates who are fighting for more sweeping cannabis reform and holding SAFE hostage. Those efforts, led primarily by Senators Cory Booker (D-New Jersey) and Jeff Merkley (D-Oregon), are countering the SAFE Banking Act with criminal justice reform and descheduling measures. They would ask if the first cannabis reform law should benefit the business community or free incarcerated Americans still serving time for cannabis-related crimes.”

While there has been ongoing progress in state legalization, this gridlock at the US federal level has been frustrating. When something as simple as guaranteeing protections for financial institutions that provide services to cannabis businesses cannot pass both congressional houses, equity markets react in kind. Americans’ support for legalization and decriminalization of cannabis is overwhelmingly positive; in fact, according to this 2021 report by the Pew Research Center, fewer than 10% of Americans say that marijuana “should not be legal at all.” In spite of this, federal cannabis legalization is a political hot potato, with sharp divisions within and across party lines. In addition, we see little or no support from the current administration, in spite of the fact that cannabis decriminalization was featured as a plank in their 2020 election campaign.

As always, we will keep watching to see if and when the gridlock loosens and allows for at least one piece of cannabis reform to pass both houses this year. As Democrats face the threat of losing their majority in the House in 2022, they will have to hurry to get something passed and the clock is ticking.

Also in January, we were treated to the news that Ohio will be forced to take up the issue of marijuana legalization following the actions of a group of cannabis rights activists. The activists, called the Coalition to Regulate Marijuana Like Alcohol (CTRMLA), submitted an additional 29,918 signatures for a legalization initiative following a statement by the State that said their previous submission was “insufficient.” As a result of this successful initiative, legalization of recreational cannabis will be on the November 2022 ballot in Ohio.

In Rhode Island, Gov. Dan McKee (D)’s annual budget plan included a proposal to legalize marijuana while adding new language to provide for automatic cannabis expungements in the state. Under his plan, 25 percent of marijuana tax revenue and licensing fees would go to the “regulatory, public health, and public safety costs associated with adult-use cannabis.” Fifteen percent would go to local governments and 60 percent would go to the state general fund. According to the budget’s executive summary, Rhode Island’s sales tax revenue would be “boosted by the proposed introduction of adult-use cannabis tax revenue in FY 2023.” Also stated in the budget, the state is estimating that it will collect $1.2 million in general revenue for the 2023 fiscal year and $16.9 “with a full year of sales in FY 2024.”

Also in January, South Carolina took significant steps toward the legalization of medical marijuana, as a legalization bill was set to reach the state senate floor for a vote. Sponsor Sen. Tom Davis (R) announced that the bill, called the South Carolina Compassionate Care Act (S. 150, H.3361), would be taken up in the state senate in early February. If passed into law, South Carolina would be the 37th state to legalize cannabis for medical purposes.

Finally, in mid-January Mississippi lawmakers passed a cannabis legalization bill in defiance of the threat of a veto from the state’s governor, Tate Reeves (R). The bill, called the Mississippi Medical Cannabis Act (S. 2095), is said to be a narrow approach to legalization. According to the bill’s language, qualifying conditions for cannabis use are: cancer, Parkinson’s, Huntington’s, muscular dystrophy, glaucoma, spastic quadriplegia, HIV, AIDS, hepatitis, Alzheimer’s, sickle-cell anemia, Crohn’s, ulcerative colitis, neuropathy, spinal cord disease or severe injury as well as chronic medical conditions or treatments that produce severe nausea, cachexia or wasting, seizures, severe or persistent muscle spasms or chronic pain. Furthermore, qualified patients would be restricted to the purchase of no more than one “medical cannabis equivalency unit” per day. This is defined as 3.5 grams of cannabis flower, one gram of concentrate or up to 100 milligrams of THC in infused products. In spite of these conservative limits, it has been reported that Reeves opposes the bill and has threatened to veto it. More on this to come!

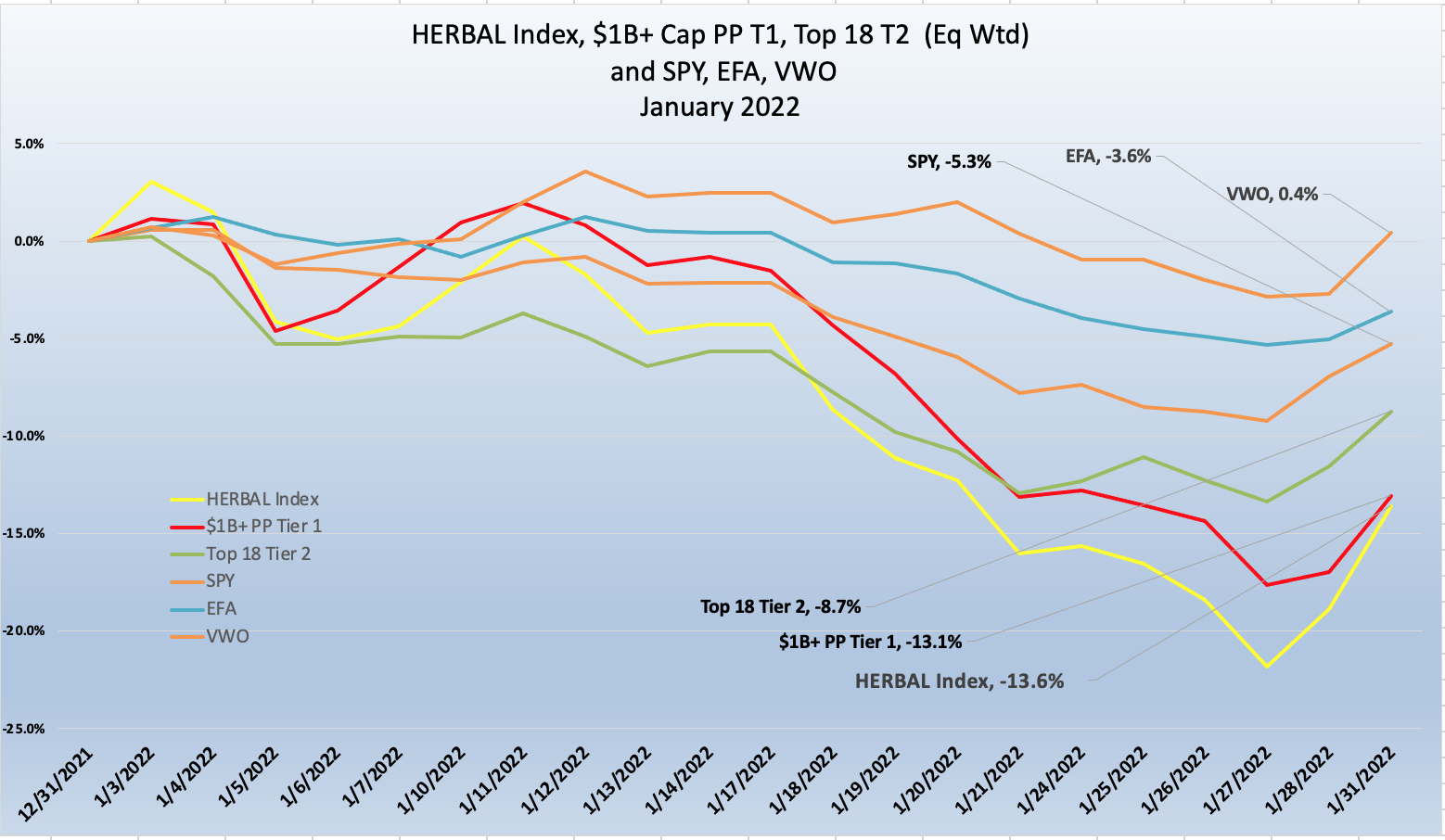

Cannabis-linked Equity Performance

Source: CRB Monitor, Sentieo, Nasdaq

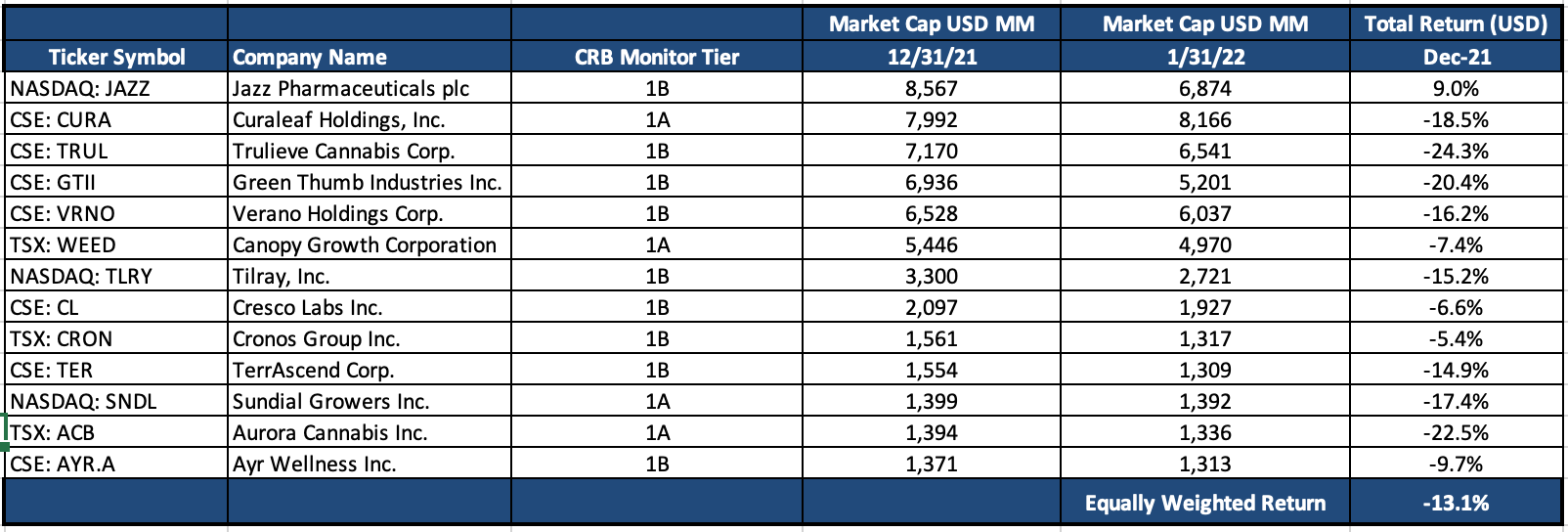

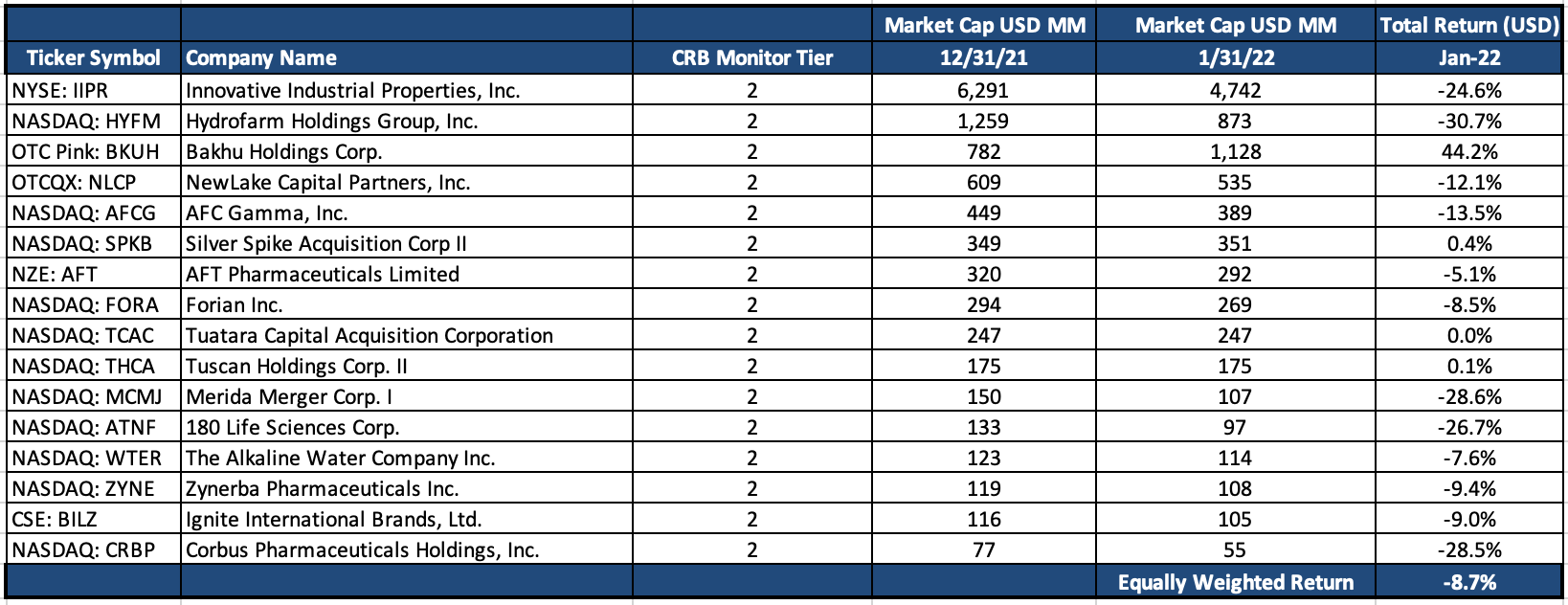

The CRB Monitor basket of the top 13 ($1b+ market cap) pure play Tier 1 CRBs, equally-weighted, fell by 13.1% in January 2022, giving investors essentially no period of relief from the industry-wide selloff that began in early February of 2021. An equally-weighted basket of the top 17 Tier 2 CRB’s performed slightly better, down by 8.7%. Over the same period, a sampling of broad equity indexes (S&P 500, MSCI EAFE, Emerging Markets) were flat to negative, but significantly outperformed the equally-weighted CRB baskets.

The Nasdaq CRB Monitor Global Cannabis Index (HERBAL), which we will now track in our securities newsletters, performed in line with the cannabis industry at -13.6% for January. We will also feature this new index in a forthcoming article on CRBMonitor.com.

Tier 1 Pure Play CRBs w/Mkt Cap Over $1B – January 2022 Returns

Source: CRB Monitor, Sentieo

Tier 2 CRBs w/Mkt Cap Over $100mm – January 2022 Returns

Source: CRB Monitor, Sentieo

CRB Monitor Tier 1

With nothing in particular (fundamentals, sentiment, regulatory outlook) to prop them up, cannabis equities once again languished in the month of January. This ongoing funeral march has been difficult for investors to stomach, and those that took the plunge at any point in the last few years must be wondering what the definition of “the long term” really is. Nevertheless, for those investors who still believe (and that includes CRB Monitor), we will continue to closely follow this emerging asset class with great interest.

There weren’t many positive cannabis equity stories to report in January. With that said, Tier 1B Jazz Pharmaceuticals plc (Nasdaq: JAZZ) outperformed the field, posting a 9% return for the month. Since their announcement of the acquisition of GW Pharmaceuticals in February 2021, JAZZ has returned a negative 7.5%, which is about 50% higher than the rest of the cannabis industry (the equally-weighted Tier 1 basket was -58.5% over the same period). While JAZZ has experienced its own periods of volatility over the last 12 months, risk is dampened by diversification at the product level – cannabis is significant but not their only offering. In addition, Epidiolex, GW Pharma’s epilepsy drug, is the only FDA-approved cannabis-derived medical product on the market; this has helped to control volatility as well.

Tier 1B multistate operator (MSO) Cresco Labs Inc. (CSE: CL) was one of the kinder CRB’s to investors in January, losing only 6.6% amidst a field of double-digit negative performing stocks. By their own admission, Cresco Labs is “built to become the most important company in the cannabis industry by combining the most strategic geographic footprint with one of the leading distribution platforms in North America.” And in spite of this ambitious goal, Cresco found itself terminating their acquisition of Baltimore-based dispensary Blair Wellness LLC during the month. Nevertheless, Cresco operates in 10 states (Maryland would have made it 11) and holds 110 cannabis licenses in either active or pending status.

What’s happened to Tier 1B powerhouse MSO Trulieve Cannabis Corp. (CSE: TRUL)? We know them as the largest fully licensed medical marijuana company in the State of Florida, now operating more than 160 dispensaries. Trulieve’s active or pending-approval license count, through their subsidiaries, is now over 200. With all that said, TRUL stock plunged during January, losing nearly a quarter of its value. And the monster acquisition of Tier 1 CRB Harvest Health and Recreation, which was completed in October of 2021, has not seemed to help matters. TRUL stock has been down more than 32% since the closing of that deal. However, Trulieve’s footprint has grown far beyond the state of Florida, and they are one CRB that investors might see as undervalued in 2022.

On a somewhat brighter note, perennially-depressed stock Cronos Group Inc. (TSX: CRON) was one of the best-performing pure play CRBs in our basket, returning a negative 5.4% for the month of January. CRON has been a chronic (no pun intended) disappointment for its largest investor, tobacco giant Altria Group, Inc.(NYSE: MO). Altria spent $1.8 billion (with a “B”) for a 45% stake in CRON in December 2018, and since that time Cronos has lost more than 71% of its value and it’s market cap now sits at $1.3 billion, implying that Altria’s ownership in Cronos is now down to about $585 million (with an “M”). Nevertheless, it is possible that CRON has turned the corner and investors might be jumping back in, in spite of the fact that Cronos delayed reporting on its Q3 2021 earnings in January. We will be watching to see how this one plays out.

CRB Monitor Tier 2

An equally-weighted basket of the largest CRB Monitor Tier 2 companies had a -8.7% return for January 2022, which outperformed the performance of the equally-weighted Tier 1 basket by 4.4%. When these two portfolios deviate, it could be a signal for investors to rebalance into (out of) the Tier 1 basket and out of (into) Tier 2’s given the direct revenue relationship, but the time it takes to mean revert is not so easy to predict.

Given its relative size and direct relationship to plant-touching cannabis operations, we tend to follow Innovative Industrial Properties, Inc. (NYSE: IIPR, CLS Sector REITs) closely. IIPR is an internally-managed real estate investment trust (CLS sector - REIT) focused on “the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators for their regulated state-licensed cannabis facilities.” We write about IIPR frequently, largely due to the fact that its stock has defied the volatile price patterns of the cannabis space as it has consistently outperformed its peers as well as its CRB-customers. It is also, by far, the largest Tier 2 CRB by market capitalization.

IIPR gave back a large portion of its brilliant 2021 performance in January 2022, returning -24.6% for the month. In early January, IIPR delivered a quarterly update to its investors, wherein the company stated:

“As of Jan 5, 2022, Innovative Industrial Properties invested roughly $1.7 billion across its portfolio. Moreover, it committed an additional $316.1 million for the reimbursement of some tenants and sellers for the completion of construction and improvements at IIPR’s properties…since the beginning of the fourth quarter through Jan 5, it has made 29 acquisitions for properties in California, Colorado, Michigan, North Dakota and Pennsylvania.”

In spite of all this great news, investors chose to take the money and run, and IIPR sold off steadily for most of January.

Another Tier 2 CRB which struggled in January was Hydrofarm Holdings Group, Inc. (Nasdaq: HYFM, CLS Sector Agricultural & Farm Machinery). Hydrofarm is an independent distributor and manufacturer of hydroponics equipment and supplies, primarily to cannabis cultivators. Similar to IIPR, HYFM appeared to be in free fall for the entire month (-30.7%). On January 7, Hydrofarm came out with its Fiscal 2021 Outlook, which had this comment:

“…at this time, management continues to expect 8% to 10% organic top line growth for the full calendar year of 2022, which will likely be weighted toward the back half of 2022 as the industry laps strong comps in the first half of this year and several states that have recently enacted pro-cannabis legislation build momentum through 2022. In addition, management expects to benefit from the full year of ownership in 2022 of the five businesses acquired during 2021.”

Apparently this statement was not sufficient motivation for investors to purchase HYFM stock, or at least stop selling it for the remainder of January. It is quite possible that Street is looking closely at macro factors (inflation, interest rates) that will undoubtedly have a negative impact on the cannabis industry in 2022.

CRBs In the News

The following is a sampling of highlights from the January 2022 cannabis news cycle, as tracked by CRB Monitor. Included are CRB Monitor’s proprietary Risk Tiers.

- Verano Welcomes Veteran CPG Industry Finance Executive Brett Summerer as Chief Financial Officer (Tier 1B)

- The Greenrose Holding Company Closes Asset Purchase of True Harvest, LLC (Tier 1B)

- Columbia Care Opens its 80th Dispensary with New Cannabist Location in Virginia Beach (Tier 1A)

- Halo Collective Names Cannabis Veteran Sky Pinnick as Chief Marketing Officer (Tier 1B)

- Columbia Care Opens its 80th Dispensary with New Cannabist Location in Virginia Beach (Tier 1A)

- Diego Pellicer Worldwide, Inc. Signs Non-Binding Letter Of Intent To Acquire Hemp Choice Distribution, LLC (Tier 1B)

- Curaleaf Names Matt Darin President (Tier 1A)

- High Tide to Acquire Fastendr™ Retail Kiosk and Smart Locker Technology Through Acquisition of Bud Room Inc. (Tier 1B)

- Leafly Announces Post-Combination Board of Directors (Tier 2)

- Agrify Enters Into a 10-Year Agreement with Gold Leaf For Its Total Turn-Key Solution (Tier 1A)

- MariMed Announces Agreement to Acquire Kind Therapeutics USA, LLC, A Maryland Licensed Vertically Integrated Cannabis Business (Tier 1B)

- MPX International announces the Integration of H12 Brands with its Wholly-Owned Subsidiary, Canveda Inc. (Tier 1B)

- General Cannabis d/b/a TREES Closes Acquisition of TREES Portland, TREES Waterfront & TREES Mlk; Acquisition Adds to the TREES Retail Footprint With Expansion in Oregon (Tier 1A)

- PHBI – Pharmagreen Announces Affirmed MOU To Acquire Licensed California Cannabis Company(Tier 1B)

- Flora Growth Appoints Industry Authority Tim Leslie as Chairman of Its Newly Formed Advisory Board(Tier 1A)

- Halo Collective Expands into Functional Beverages, Agrees to Acquire H2C Beverages and Establishes a $30M Distribution Agreement with Elegance Brands (Tier 1B)

- High Tide Opens New Canna Cabana Location in Regina, and Provides Timing for Release of Fourth Quarter and Fiscal Year 2021 Financial Results and Webcast (Tier 1B)

- Creso Pharma Announces Next Phase of Execution Spearheaded by Three New Appointments (Tier 1B)

- MariMed To Acquire Illinois Craft Cannabis License Allowing for Vertically Integrated Cannabis Operations (Tier 1B)

- CURALEAF COMPLETES ACQUISITION OF BLOOM DISPENSARIES (Tier 1A)

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"