CRB Monitor Chart of the Month: CRBs and Inventory Turnover

James B. Francis, CFA

Chief Research Officer, CRB Monitor

In our quest for all the answers related to these curious, sometimes-legal cannabis-linked businesses, we direct our attention to a common multiple: inventory turnover. Quite simply, inventory turnover is the ratio of cost of goods sold (COGS) to average inventory for a particular period. In the words of Investopedia.com, here is a summary of what inventory turnover is useful for:

- “Inventory turnover measures how efficiently a company uses its inventory by dividing the cost of goods sold by the average inventory value during the period.

- Inventory turnover ratios are only useful for comparing similar companies, and are particularly important for retailers.

- A relatively low inventory turnover ratio may be a sign of weak sales or excess inventory, while a higher ratio signals strong sales but may also indicate inadequate inventory stocking.

- Accounting policies, rapid changes in costs, and seasonal factors may distort inventory turnover comparisons.”

Inventory turnover is an area of focus for the entire cannabis industry and it is referenced in essentially all company financials. Here is an excerpt from Tier 1B Lifeist Wellness’s (TSXV: LFST) most recent Management Discussion and Analysis:

“The Company continues its forward-looking inventory management strategy, designed to: 1) reduce the amount of slow-moving inventory; 2) improve inventory turnover; and 3) leverage existing technology to further reduce the inventory risk.”

Similarly we have this statement that can be found in Tier 1B MSO Ayr Wellness Inc.’s (CSE: AYR.A) Q2 2023 Financials:

“Pennsylvania is a similar story to Nevada, where, in a steady market, we maintained our improved margins, thanks to our optimization efforts in the state. This is a market where we see the opportunity to improve inventory turnover to generate cash and will be increasing our internalization efforts.”

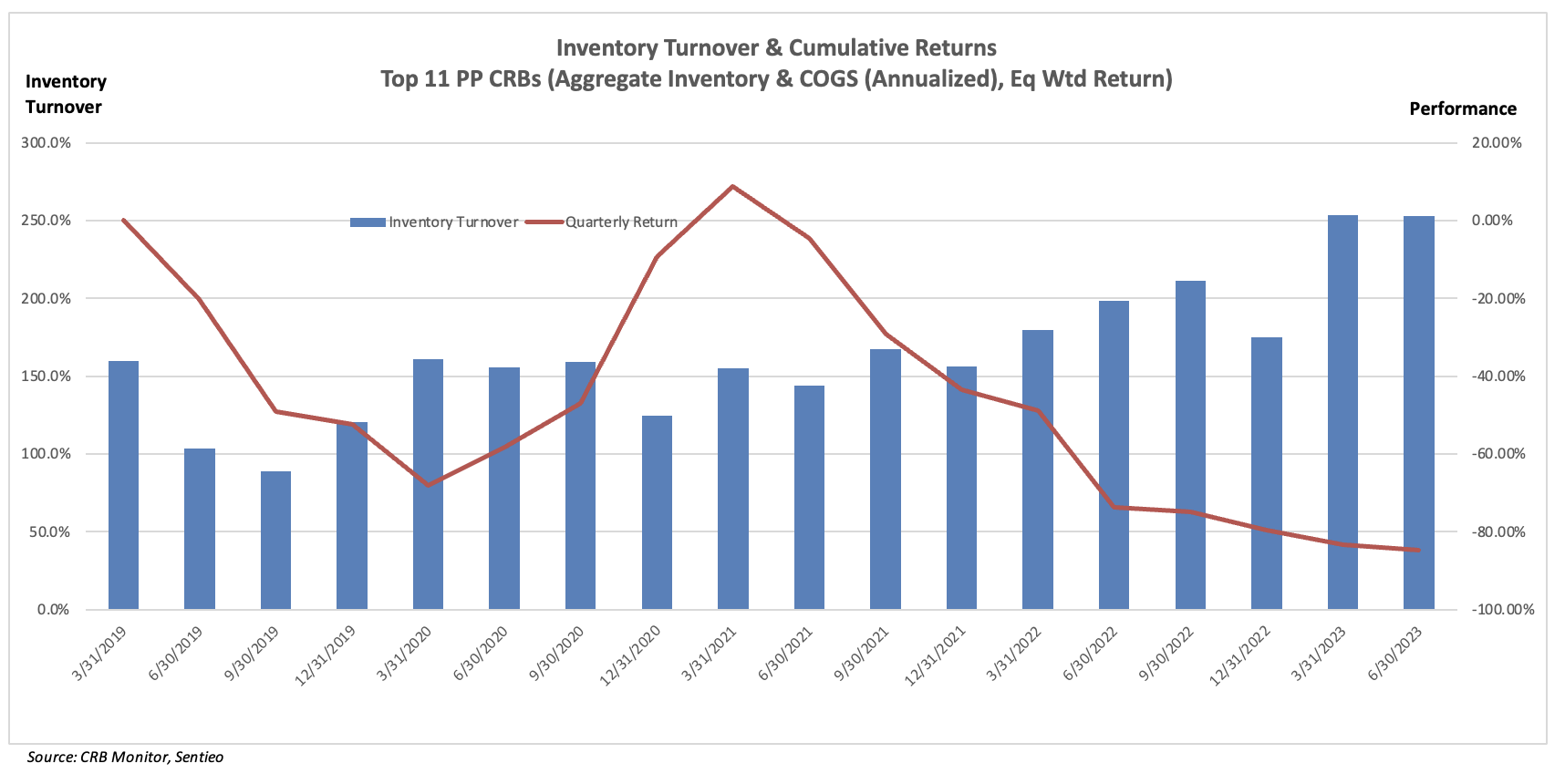

For this exercise, we summed the quarterly values in order to calculate the aggregate inventory for each period and COGS (annualized) for the top 11 pure play Tier 1 CRBs by market capitalization. Performance for this equally-weighted basket is the red line while the blue bars represent the aggregate inventory turnover ratio for the basket. While we do feel it’s useful to look at this data on a company-by-company basis, it also works to view it in the aggregate. Aggregating the data serves to smooth it out over the periods and we feel that the basket is so focused in its theme that combining the numbers into one total value is appropriate.

Now for the useful part of this exercise - what are we looking at here? It appears that, while Rome has been burning, cannabis has been selling - not spectacularly, but respectably (1.5 - 2.5X). Now don’t be fooled, this is not a pretty picture, particularly as we witness this breathtaking, downward spiral of the industry group. However, what we also see is these companies surviving via their ability to turn over their inventories.

While it is obvious that publicly-traded CRBs are far from out of the woods - let’s face it, nearly 90% of pure play Tier 1 market cap has evaporated over the last 30 months - the companies that continue to expand operations and are mindful of expenses will survive. And the fact that marijuana legalization and decriminalization is expanding to include (dare I say) red states, the cannabis industry has legs - and lots of new revenues, and jobs, and economic opportunities for struggling communities.

Another important fact that favors this industry is that the vast majority of cannabis licenses are not held by publicly-traded CRBs (either directly or through subsidiary businesses). Of the more than 200,000 cannabis licenses tracked globally by CRB Monitor, just over 10,000 (5%) are connected to publicly-traded Tier 1 companies. Hence, there is plenty of room for these companies to expand, particularly the multistate operators.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"