CRB Monitor Chart of the Month: 2023 Cannabis Equity Performance

James B. Francis, CFA, Chief Research Officer, CRB Monitor

It’s hard to believe that it has been a whole calendar year, but here we are, post-December 31, and arguably we are no closer than we were a year ago to the legalization of marijuana at the federal level. Chalk it up to political gridlock, or prioritization, or apathy, but cannabis businesses will need to accept the fact that state-by-state legalization is all they will see for the foreseeable future. With that said, the two frequently-discussed reforms, SAFER and Rescheduling, offer a glimmer of hope while they are still in progress.

Some disappointing results for some...

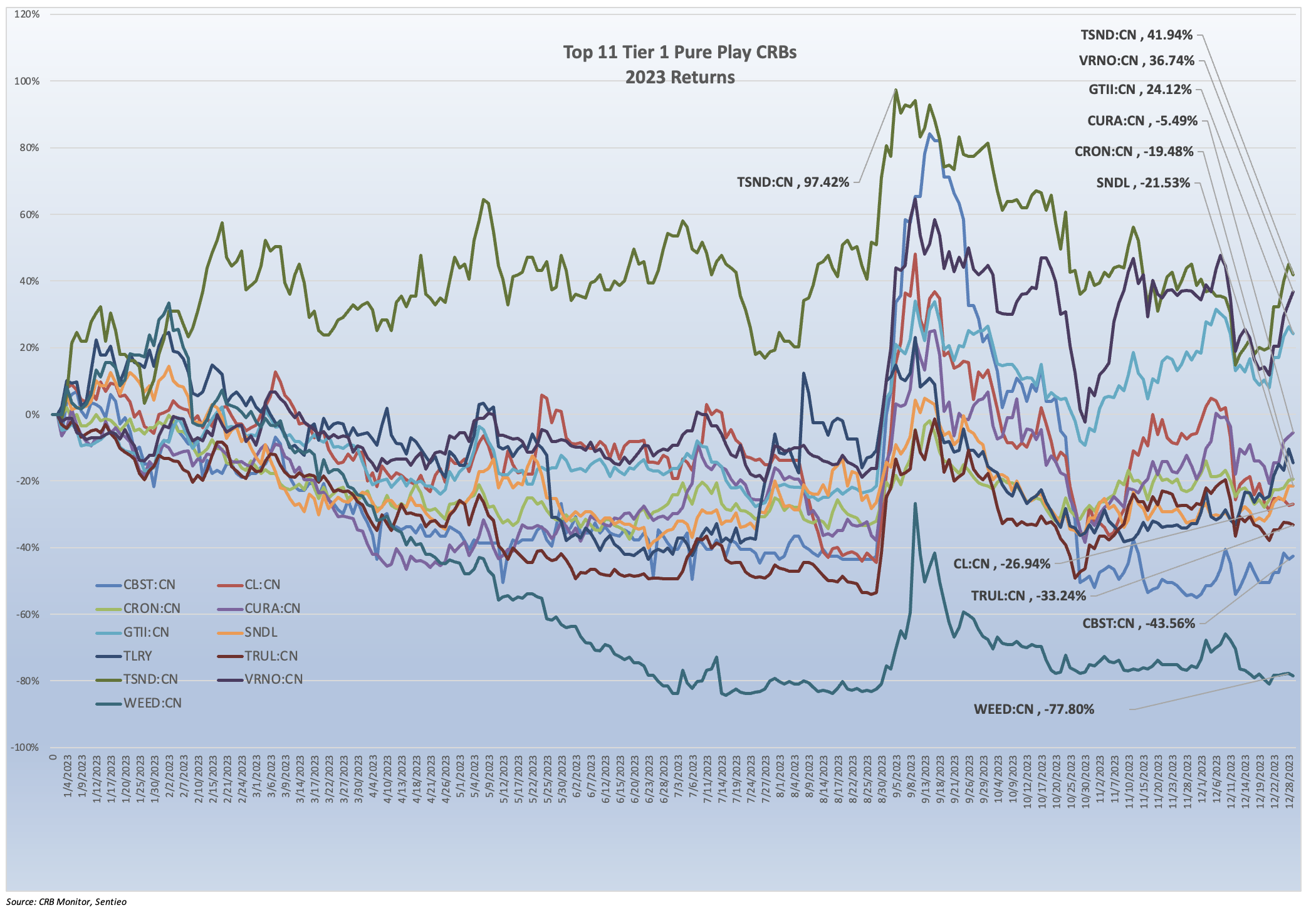

And because it is year end, we find it appropriate to take a look at the year that was for cannabis-related businesses, specifically the ones that we can buy shares of on the open market. The chart below is not an optical illusion, it really is a look at 2023 performance of the largest Tier 1 pure play CRBs. The double black diamond-like line at the bottom of the chart tracks the return of Canopy Growth Corporation (TSX: WEED) (-77.8%), a company that was once called “the Google of cannabis.”

In 2024 it is safe to say that Canopy boasts a lot less “Googli-ness” than it used to, given its wild price swings and incredible shrinking market cap. In December 2023, Canopy Growth announced a 1 for 10 reverse split, which (of course) resulted in an automatic, significant price increase (this was short-lived). This move was more for self-preservation than anything else, as WEED was in danger of losing its exchange listing due to its falling price. And so the 1-10 split took care of this; however, investors initiated a sell-off that persisted for the entire year. We also know that Canopy Growth’s new minimalist operating strategy, while viewed as defensive, has not helped to stem the sell pressure.

The one moment of relief for Canopy Growth’s share price was the September spike, caused by the leaked memo by the HHS that recommended rescheduling marijuana to Schedule III from Schedule I. It is clear that, aside from the rescheduling spike in September (see the chart below), WEED had a dreadful year.

Also hitting the skids in 2024 was Tier 1A MSO The Cannabist Company Holdings Inc. (CBOE Canada: CBST) (-43.6%). The Cannabist, formerly known as Columbia Care, struggled, but survived following its failure to be acquired by larger Tier 1B Cresco Labs Inc. (CSE: CL) (-26.9%), which also had a rough year. This 18-month long adventure should serve as a cautionary tale to any CRB that is looking for a business combination in this heavily-regulated space, and we watched as the Cresco/Columbia Care deal collapsed as they raced to divest of cannabis subsidiaries to satisfy local authorities.

Tier 1B Trulieve Cannabis Corp. (CSE: TRUL) (-33.2%), famous for its sizable medical cannabis presence in the state of Florida, delivered significant losses to investors in 2023. Trulieve, whose stock price is now approximately 95% lower than it was just two years ago, was once considered a hot property by investors who were willing to take a flyer on the future legalization of US plant-touching marijuana. If legalization had come through, TRUL was in an excellent position to rally, having secured significant market share in Florida while moving into several other states. But their expansion was also their downfall. From a March 2023 article in The Motley Fool: “The company's $2.1 billion acquisition of Harvest Health & Recreation in 2021 made Trulieve the largest MSO in the country in terms of dispensaries, but that deal is the biggest reason Trulieve isn't profitable.” In an increasingly competitive market, where success depends not only on legalization at the federal level but legalization of adult-use marijuana in the state of their largest operational footprint, Florida.

And on the bright side, the others...

The best performing CRB in the basket in 2023 was Tier 1B TerrAscend Corp. (TSX: TSND) (+41.9%), but as we can see in the chart below that there is more to the story: TSND climbed to a +97% YTD return with the aforementioned September euphoria before losing more than 50% of its value by year end. With that said, Terrascend, with more than 100 active or pending cannabis licenses, had the distinction of remaining in positive territory throughout 2023, posting a YTD return of more than 40% by the date of their Q4 2022 earnings report (March 16), which spun a positive tale of significant increases in net revenue, profits, and cash flows from operations. And it is safe to say that even TerrAscend, with it’s impressive year-on-year financials, was and is just as vulnerable to the political environment as every other company in the Tier 1 basket. In fact, TSND has fallen more than 70% over the last two years.

Also closing out 2023 on a positive note was Tier 1B Verano Holdings Corp. (CSE: VRNO) (+36.7%), an MSO that has been widely known for its rapid expansion across the US over its 3-year history. Verano’s performance was largely negative for much of the first three quarters of 2023 (-17%), but the HHS recommendation for rescheduling turned VRNO’s year around, propelling it more than 50% over the last 100 days of 2023. And a mediocre Q3 earnings report in November notwithstanding, Verano’s financials were good enough for investors to prop up their share price, but in this volatile year these mostly sentiment-driven share prices can turn around quickly.

The largest pure play Tier 1 CRB, Green Thumb Industries Inc. (CSE: GTII) (+24.1%) followed a similar pattern in as most of its peers in 2023, which featured a depressed share price that had fallen by more than 22% before the rescheduling spike in mid-September. That event triggered a rally that boosted GTII by more 50% by the end of 2023. On November 8th, Green Thumb reported its 3rd Quarter financials, which were respectable given that the company earned a profit and boasts a reasonably healthy balance sheet with $137 million in cash. But similar to the rest of the pure play cannabis space, the impact of the progress (and lack thereof) toward legalization in the US continues to overshadow the operating highlights. Green Thumb has had a decent run relative to the rest of the MSO basket, with a two-year return of minus 45%, which looks horrific but is actually far better than most of its peers in the cannabis space.

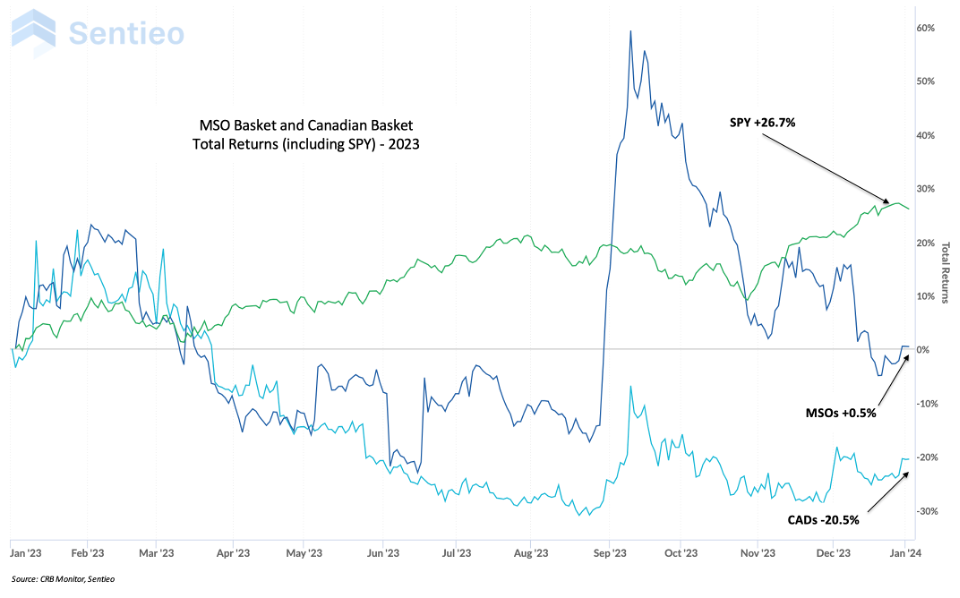

MSOs and CADs

Our last Chart of the Month featured the long-term performance of the MSO group vs. those CRBs with no US marijuana touch points. Since the returns of these baskets showed some significant divergence, we thought it would be useful to show how those two groups performed in 2023. Truth be told, the volatility has been off the charts, particularly as investors attempt to time this market, which features low share prices, weak volumes, and wide spreads. We would not be surprised for these two paths to cross (perhaps more than once) in 2024, as sentiment continues to shift with the evolving regulatory environment.

Multistate operators (MSOs) are CRBs that spread their revenue-generating, licensed cannabis operations (cultivation, manufacturing, distribution, etc.) across two or more states in the US. This model for doing business can be complicated and painful, but CRBs’ hands are tied while cannabis is still federally illegal and operating on a state-by-state basis (and internal to each state) is the only way to grow revenues within the US.

As such, MSOs face obstacles that can limit their ability to operate profitably in every state where they are licensed. Some notable hurdles include:

- Licensing requirements that seek to establish or restore social equity to CRB ownership

- Varying levels of state taxation

- Barriers to using mainstream banking services, such as payments, lending, and deposit accounts

- Varying degrees of participation by the illicit market which undermine the legal market

Given the above-mentioned headwinds, several large, publicly-traded multistate operators have closed their operations in one or more states. And we thought it might be interesting to take a look at this trend in the cannabis industry as it could be a reflection of companies’ need to survive while the politicians figure things out.

And we are quite sure that investors in cannabis equities are happy that 2023 is finally in the rear-view mirror.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"