Amid the chaos of the COVID-19 pandemic — and the health and economic fallout that has touched so many aspects of our lives — we have come to accept some hard truths: the threat of a prolonged recession, double-digit unemployment, and, even worse, a public health crisis that will haunt us for the foreseeable future. Even more difficult to swallow is the open-endedness of this disaster, from both a health and economic perspective. We are not even sure that the gradual opening of certain businesses in various states will last, given the threat of a “second wave” of the virus.

Regulatory Filing Extensions, Closures, Layoffs, and Home Delivery

For investors, cannabis is an emerging market: it has its own ecosystem, industry classifications, and, of course, inherent risks that do not resemble any other sector (Is it Health Care? Consumer Discretionary? Agriculture?). Suffice it to say, and US-federal illegalities aside, Cannabis has carved out its own niche among investments, and investors still seem to crave it, despite its wild volatility.

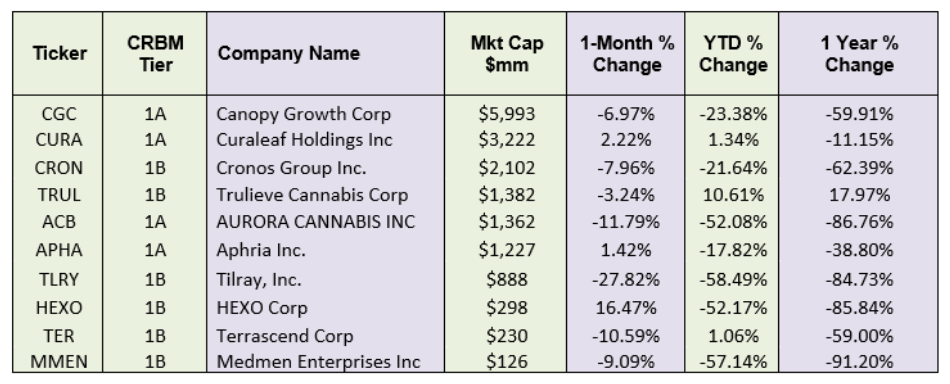

With all that said, Tier 1 North American Cannabis companies have been managing investors’ expectations during the crisis in various ways to head off a possible “flight to quality” (see our post on Defining “Cannabis-Related Businesses” to better understand what constitutes a “Tier 1” CRB). The top 10 Tier 1 cannabis companies by market cap are as follows. We’ll look at how each has been handling the impact of the COVID-19 pandemic and how their shares are returning this year.

CRB Monitor “Top 10 Pure Play” Cannabis Companies by Market Cap (6/30/2020)

Source: Sentieo, CRB Monitor

CRB Monitor “Top 10 Pure Play” - 1-Year Return (Equally Weighted) vs. SPY

Source: Sentieo, CRB Monitor

Company-Level Impacts of Covid-19 on Select CRBs

Below are some case studies on how some of the largest, publicly-traded CRBs are handling and/or being impacted by the Covid pandemic.

Canopy Growth (TSX: WEED, NYSE: CGC)

In the glory days of 2017/2018, Canopy Growth Corp. was so dominant in the medical and recreational cannabis space it might have been called the “Google of Cannabis”; however, more than 30% of Canopy Group’s share price was lost during 2019 amid chaos at the executive level of the company as well as other growing pains. With that said, Canopy’s size remains head-and-shoulders above the rest of the pure-play cannabis field, with a market capitalization of more than double any other player in the space at just under $6 billion. Furthermore, Canopy Growth has benefitted from a substantial buffer: beverage giant Constellation Brands (NYSE:STZ) has invested over $4 billion in Canopy and currently owns 38.6% of common shares (and up to 55.8% if all options are exercised).

Canopy’s response to COVID-19 has been defensive, as they announced the temporary closing of two corporate-owned Canadian retail chains – Tweed and Tokyo Smoke – until further notice. In addition, Canopy recently announced temporary layoffs of 285 workers and the temporary closure of two greenhouses.

Cronos Group, Inc. (TSX: CRON, NYSE: CRON)

Cronos owns subsidiaries that are broadly diversified across the cannabis space, with licensed operations throughout North America and globally. Like other cannabis industry titans, Cronos rode the wave in 2017 and 2018, attracting a significant investment from tobacco giant Altria (NYSE:MO), which purchased a 45% ownership stake in early 2019, before things started to go south.

To date Cronos has not announced any closures or layoffs, and it can be said that CRON’s share price has largely weathered the storm, in spite of its negative 8% return for the month of June 2020. Quoting cannabis publication, The Motley Fool, “the company claims something that most marijuana stocks don't, namely a strong balance sheet.Thanks to Altria's investment, Cronos' cash stockpile totaled CA$1.5 billion at the end of 2019. That should be more than enough for the company to weather the storm caused by COVID-19.”

Curaleaf Holdings, Inc. (CSE: CURA)

Curaleaf is a well-known cannabis player headquartered in Wakefield, Massachusetts. By its own admission, Curaleaf operates in 14 states with 53 dispensaries, 15 cultivation sites, and 24 processing sites. Between June 2018 and May 2019, CURA shares were up nearly 50%, trading above CAD 15, before its precipitous fall that persisted through Q1 2020. The stock is now trading significantly lower, in the CAD 7.70 range.

Fortunately for Curaleaf, their dispensaries in the US have been deemed an essential service in many states where they operate. To quote a recent Curaleaf press release: “During the COVID-19 pandemic, Curaleaf dispensaries have been deemed an essential service in many states and continue to serve patients and customers while implementing heightened safety and hygienic measures including increased cleaning protocol, social distancing, new delivery options, curbside pickup, and dedicated hours for seniors and other at-risk populations.”

Tilray, Inc. (NAS: TLRY)

Tilray, Inc. is a global supplier of medical cannabis products to pharmaceutical distributors. The company is focused on cannabis research, cultivation, processing, and distribution of cannabis products worldwide. Tilray burst on the scene in the third quarter of 2018 with its IPO and Nasdaq listing. Within weeks, TLRY became the stuff of legends, as (due to its painfully short supply) it was one of the most in-demand and volatile stocks in the US. Tilray’s stock price rose from $24.15 on July 30, 2018 to more than $148 just a couple of months later, on October 8. TLRY plunged from that day forward, and now trades at about $8.00.

In March, when news of COVID-19 started to spread, Tilray said the following in a press release:

“Recently, the Wuhan coronavirus has spread across the world, and it may develop into a pandemic. We operate global manufacturing facilities, and have dispersed suppliers and customers…Our ability to compete and grow cannabis is dependent on us having access, at a reasonable cost and in a timely manner, to skilled labor, equipment, parts and components. No assurances can be given that we will be successful in maintaining our required supply of labor, equipment, parts and components.”

Trulieve Cannabis Corp. (CSE: TRUL)

Trulieve is a Canada-based, vertically integrated, seed-to-sale, medical cannabis company, with licensed marijuana operations in Massachusetts, California, Connecticut, and Florida. Trulieve’s geographic diversification and explosive growth have sustained them through difficult times, particularly the current pandemic.

Trulieve was quick to act, once Covid-19 was revealed as a threat. On April 2nd, the company issued a press release announcing how it was addressing, as a business, the coronavirus pandemic. The comprehensive measures included new procedures for delivery and pickup, social distancing, and special hours for the immunocompromised. “In addition to the above, we have increased cleaning and sanitation protocols at each of our stores as well as in our delivery vehicles. Trulieve is actively taking part in providing needed medical care to the large patient population that counts on us.”

As with its competitors in the space, the states’ “essential service” designation has been a lifeline, and despite the crisis Trulieve has expanded its reach as a leading provider of medical cannabis by opening a new dispensary in Daytona, Florida.

Are you an investor or financial institution seeking greater clarity on the cannabis industry and cannabis-related businesses (CRBs)?

Learn more about CRB Monitor’s “single source of truth” on relevant CRBs and Beneficial Owners that enables institutions to effectively reveal connections, evaluate risk and opportunity, and make decisions.

The information provided herein presents general information and should not be relied on as legal advice. If you have specific questions regarding a particular fact situation, please consult with competent legal counsel about the facts and laws that apply.