James B. Francis, CFA, Managing Director of Securities Product and Research, CRB Monitor

As medical and recreational cannabis inch ever-closer toward US federal legalization/decriminalization, investors are increasingly seeing cannabis-linked securities as less of a novelty and more of a viable and attractive investment. We see cannabis making its way into our mainstream psyche, and stocks that provide exposure to the cannabis ecosystem have quietly been added to many investors’ portfolios as well as a number of publicly-traded funds (we will be writing about this in an upcoming blog post). With that said, investors in cannabis-linked securities are seeking new measures of investment risk that are not generic, but specific to the cannabis ecosystem.

This is why CRB Monitor is pleased to announce the creation and addition of our Cannabis-Linked Sector Classification System (CLS) to our global universe of 1,300+ publicly-traded issuers and their 1,500+ securities listed on six continents.

CRB Monitor Cannabis Linked Sectors

Below are the 22 Sectors into which CRB Monitor is categorizing all publicly-traded, cannabis-related issuers. Generally, the Sectors “Licensed CRB”, “Owner/Investor”, “ETF” and “Index” relate to Tier 1 CRBs, while the remainder relate to Tier 2 and Tier 3 CRBs. We plan to release more detailed documentation regarding the Sectors, including long-form definitions, but the following provides a high level summary.

|

CLS Sector |

# of Issuers |

CLS Sector |

# of Issuers |

|

|

40 |

101 |

|||

|

7 |

99 |

|||

|

7 |

18 |

|||

|

33 |

44 |

|||

|

21 |

539 |

|||

|

ETF - non-Cannabis Themed |

62 |

|

|

|

|

20 |

100 |

|||

|

53 |

139 |

|||

|

93 |

85 |

|||

|

48 |

23 |

|||

|

27 |

9 |

|||

|

23 |

20 |

CLS Classification Methodology

CRB Monitor developed its CLS sector classification system in response to the perceived inadequacies presented by the “standard” sector classification systems.

For the purposes of this article, we use the Global Industry Classification System [GICS] as a comparison to CLS.) The widely-used GICS system does not mention the word “cannabis” in its current methodology, in either its sectors (top level), industries, or sub-industries, and over-generalizes CRBs into incorrect or even irrelevant sectors. CRB Monitor’s Cannabis-Linked Sector classification methodology places every issuer in our CRB universe into the cannabis-specific sector that best defines its connection to the industry.

CRB Monitor’s Securities Research team performed the following due diligence in the development of the CLS Methodology:

- Closely reviewed the descriptions and operations of the 1,300+ issuers to develop ~50 potential “sectors” that would be a meaningful expression of the specific function of each business relative to the cannabis industry. This information is derived from the original research that CRB MOnitor performs as we identify and qualify issuers for inclusion in our cannabis-linked securities universe.

- Refined and distilled the initial ~50 potential “sectors” down to 22 that CRB Monitor feels could adequately and accurately be applied to all Tier 1 (aka “Direct”) and Tier 2 / Tier 3 (aka “Indirect”) CRBs.

- Composed and refined clear “cannabis-focused” definitions for each of the 22 sectors.

- Applied a CLS sector to each issuer based on the issuer’s cannabis-related activities and revenues, regardless of what the issuer's main and/or historical business line(s) may be.

CLS Sectors - Tier 1A & 1B CRBs

GICS tends to place all “Pure Play” CRBs into its Health Care sector, in spite of the fact that (A) many Pure Play CRBs are often a portion or largely “recreational” and (B) many CRBs have diverse, multi-industry risk exposure. Generally, “Health Care” is not remotely helpful for investors broadly, let alone cannabis-focused investors. CRB Monitor defines all “Direct” (generally “Pure Play”) CRBs as “Tier 1” and categorizes them into one of two sectors: Tier 1A issuers into the “Licensed CRB” sector and Tier 1Bs into the “Owner/Investor” sector. Cannabis-themed ETFs and indexes, which are also included on the CRB Monitor cannabis-linked securities data, are classified in the “ETF” and “Index” sectors, respectively.

Here is the breakdown, as of 4/30/2021:

Source: CRB Monitor

In addition to applying a “sector” to each Tier 1 CRB, for further granularity, CRB Monitor also includes cannabis licensing details for every Tier 1 CRB including: Type (Cultivation, Processing, Retail/Dispensary, etc.); Medical/Recreational/Hemp Classification, Cannabis License Status (Pending, Active, Inactive, etc.), and Jurisdiction (ie, the State/Province/Country as applicable). By combining the sector and underlying license details, the CLS classification system ensures that CRB Monitor subscribers are able to maximize and customize their utilization of the CRB Monitor database for their own specific compliance and investment use cases. CRB Monitor is the only data company in the world that can provide this information, given its underlying database of 45,000+ licensed CRBs and 86,000+ cannabis business licenses.

For example, here are ten of the largest “Pure Play” CRBs, which are all considered by GICS to be in the Health Care sector. By contrast, CRB Monitor’s breakdown by license type* indicates that their revenues are generated from a diverse set of cannabis-related business lines (including medical and recreational). For example, Canopy Growth Corporation (TSX: WEED), the largest pure play CRB by market cap, has subsidiaries whose licenses cover a broad swath of the cannabis ecosystem.

|

Company Name |

Ticker Symbol |

CRBM Tier |

GICS Sector |

CRB Monitor CLS Sector |

CRB Monitor License Type(s)* |

|

1A |

Health Care |

Licensed CRB |

Retail/Dispensary, Cultivation, Vertically Integrated, Owner/Investor, Manufacturer/Processor, Testing, Wholesale/Distribution, Research |

||

|

1A |

Health Care |

Licensed CRB |

Owner/Investor, Retail/Dispensary, Cultivation, CBD, Manufacturer/Processor, Vertically Integrated, Wholesale/Distribution, Research, Delivery/Transporter |

||

|

1B |

Health Care |

Owner/Investor |

Retail/Dispensary, Cultivation, Vertically Integrated, Manufacturer/Processor, Wholesale/Distribution |

||

|

1B |

Health Care |

Owner/Investor |

Retail/Dispensary, Cultivation, Manufacturer/Processor, Owner/Investor, Wholesale/Distribution, Vertically Integrated, Testing |

||

|

1A |

Health Care |

Licensed CRB |

CBD |

||

|

1B |

Health Care |

Owner/Investor |

Retail/Dispensary, Vertically Integrated, Manufacturer/Processor, Cultivation |

||

|

1A |

Health Care |

Licensed CRB |

Retail/Dispensary, Cultivation, Manufacturer/Processor, Vertically Integrated, Wholesale/Distribution, Owner/Investor, Testing |

||

|

1B |

Health Care |

Owner/Investor |

Cultivation, Vertically Integrated, Retail/Dispensary, Manufacturer/Processor, Wholesale/Distribution, Event Organizer |

||

|

1B |

Health Care |

Owner/Investor |

Retail/Dispensary, Cultivation, Manufacturer/Processor, Vertically Integrated, Owner/Investor, Testing, Wholesale/Distribution, Research, Event Organizer, Management Company |

||

|

1A |

Health Care |

Licensed CRB |

Retail/Dispensary, Cultivation, Manufacturer/Processor |

Source: CRB Monitor, * "License Type” includes all licenses that are issued to the parent company and/or all of its underlying subsidiaries.

CLS Sectors - Tier 2 & Tier 3 CRBs

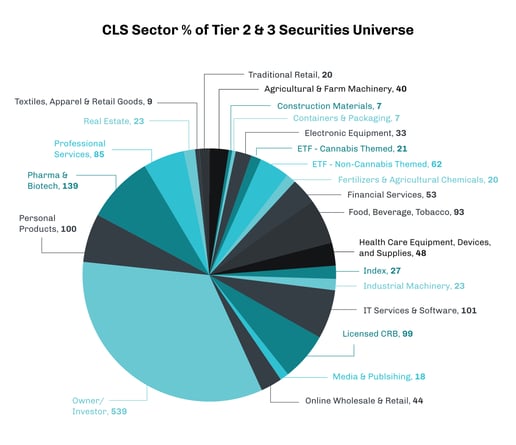

While four CLS sectors apply to Tier 1 CRBs, eighteen CLS sectors apply to Tier 2 and Tier 3 (aka “Indirect”) CRBs.

Here is the breakdown, as of 4/30/2021:

One interesting case is that of Tier 3 CRB Philip Morris International (NYSE: PM). While PM is widely known as a Consumer Staples (ie, tobacco) company, its connection to the cannabis space is via an investment in Syqe Medical, which has developed a metered-dose vaporizer. Given Philip Morris’s exposure to the cannabis industry is via the development of an electronic drug delivery device, we have assigned PM to the CLS sector “Electronic Equipment.” The following is a partial list of some of the largest Tier 2 and Tier 3 CRBs by market capitalization, with their GICS sector side-by-side with their CRB Monitor CLS sector:

|

Company Name |

Primary Symbol |

CRBM Tier |

GICS Sector |

CRB Monitor CLS Sector |

|

2 |

Real Estate |

Real Estate |

||

|

2 |

Industrials |

Agricultural & Farm Machinery |

||

|

2 |

Health Care |

Personal Products |

||

|

2 |

Health Care |

Pharma & Biotech |

||

|

2 |

Industrials |

Containers & Packaging |

||

|

2 |

Health Care |

Pharma & Biotech |

||

|

3 |

Consumer Discretionary |

Online Wholesale & Retail |

||

|

3 |

Health Care |

Pharma & Biotech |

||

|

3 |

Consumer Staples |

Pharma & Biotech |

||

|

3 |

Information Technology |

Online Wholesale & Retail |

||

|

3 |

Consumer Staples |

Personal Products |

||

|

3 |

Consumer Staples |

Electronic Equipment |

||

|

3 |

Consumer Staples |

Food, Beverage & Tobacco |

||

|

3 |

Health Care |

Pharma & Biotech |

||

|

3 |

Consumer Staples |

Personal Products |

||

|

3 |

Information Technology |

Financial Services |

||

|

3 |

Industrials |

Construction Materials |

Source: CRB Monitor

Conclusion

The global cannabis ecosystem is a complex, diverse space with vast growth potential for investors. And essential to the success of a cannabis investment strategy is an understanding of 1) the definition of a cannabis-related business; 2) validation for a company’s inclusion as a cannabis-related business, and 3) the degree to which each cannabis-related business is exposed to the cannabis industry. CRB Monitor’s addition of the CLS sector classification system provides a new degree of clarity into the connection between Tier 1, 2, and 3 CRBs and the cannabis ecosystem.

CRB Monitor – The Gold Standard in Cannabis Market Intelligence

As the CRB Monitor securities database has grown, so has the number of use cases for its data. Investment professionals are now utilizing CRB Monitor as a reliable source of universe of data for:

- Benchmarks/Indexing

- ESG/SRI Investment Policy

- Portfolio Construction

- Risk Modeling

- Portfolio Analytics

- Performance Attribution/Reporting

We provide front, middle, and back office professionals with critical details of cannabis-linked securities listed on six continents. CRB Monitor has become an essential source of information for financial institutions, including:

- Proprietary Cannabis Risk Tier

- Underlying Corporate Structure for Tier 1 CRBs, including plant-touching subsidiaries

- Underlying Cannabis License Classification (Medical, Recreational, Hemp)

- Underlying Cannabis License Type (Cultivation, Dispensary, Extraction, etc.)

- Geographic exposure for Tier 1 CRBs

- CUSIP/ISIN/CINS codes

- Primary, secondary, tertiary exchange listings and tickers

- Complete directory of ETFs and market indexes

- And now, Cannabis-Linked Sector (CLS) Classification

To always be updated on the latest cannabis market intelligence, please be sure to stay tuned to the CRB Monitor website.

Wondering what a Tier 1, Tier 2 or Tier 3 CRB is?

See our seminal ACAMS Today white paper Defining "Marijuana-Related Business" and its update Defining "Cannabis-Related Business"